Introduction

Background

Medicaid is a jointly funded, federal-state health insurance program for low-income and needy individuals. It covers children; the aged, blind, or disabled; and other individuals who are eligible to receive federally assisted income maintenance payments. The Centers for Medicare and Medicaid Services (CMS), part of the U.S. Department of Health and Human Services, administers the Medicaid program at the federal level. According to CMS, the school setting provides a unique opportunity to enroll eligible children in Medicaid and to assist children who are already enrolled in Medicaid to access the benefits available to them.

Federal law requires states to identify a single state agency to administer the Medicaid program. While many organizations are involved in administering the Medicaid program in California, which is called Medi-Cal, the California Department of Health Care Services (Health Care Services) is the single state agency responsible. To assist eligible children in their school settings, Health Care Services uses separate organizational structures to operate two school-based programs: the School-Based Medi-Cal Administrative Activities program (administrative activities program) and the Local Educational Agency Medi-Cal Billing Option Program (billing option program). For the administrative activities program, Health Care Services contracts with local educational consortia and local governmental agencies to perform many functions, such as contracting with claiming units, coordinating and submitting Medi-Cal administrative activities reimbursement claims that claiming units file, and overseeing claiming unit activities.3,4 State law currently requires each claiming unit participating in the administrative activities program to submit reimbursement claims through either its local educational consortium or its local governmental agency. Claiming units can contract with the local educational consortium or local governmental agency in whose jurisdiction they reside. Figure 1 shows California’s 11 local educational consortia and the eight local governmental agencies that were participating in the administrative activities program as of January 2015.

Figure 1

Geographic Areas Served by Local Educational Consortia and Local Governmental Agencies Participating in the School-Based Medi-Cal Administrative Activities Program as of January 2015

Medi-Cal Administrative Activities in the School Setting That Are Eligible for Federal Reimbursement

Under federal and state laws, activities necessary for the efficient administration of Medi-Cal are reimbursable. Federal and state policies specify that the following Medi-Cal administrative activities are eligible for reimbursement in a school setting:

- Medi-Cal outreach.

- Facilitating the applications for Medi-Cal.

- Referral, coordination, and monitoring of Medi-Cal services.

- Arranging transportation to support Medi-Cal services.

- Translation of documents related to Medi-Cal services.

- Program planning, policy development, and interagency coordination related to Medi-Cal services.

- Medi-Cal claims administration, coordination, and training.

Sources: Title 42, United States Code, Section 1396b; Title 42, Code of Federal Regulations, Section 433.15; U.S. Department of Health and Human Services’ Centers for Medicare and Medicaid Services’ Medicaid School-Based Administrative Claiming Guide (2003); California Welfare and Institutions Code, Section 14132.47; and California Department of Health Care Services’ California School-Based Medi-Cal Administrative Activities Manual (June 2014).

Note: An additional category of reimbursable activities exists that includes the following: general administration, completing the Medi-Cal administrative activities time survey form, and paid time off. Costs in this category are to be reallocated across other activities on a pro rata basis.

Through the administrative activities program, Health Care Services allows claiming units to file claims for federal reimbursement for 50 percent of the cost for certain types of administrative activities related to Medi-Cal that are eligible for reimbursement. See the text box for a list of the allowable types of administrative activities. To be reimbursed for the time that the claiming units’ staff spend performing administrative activities, federal requirements require documentation such as personnel activities reports that account for all time spent or substitute systems such as time studies that use sampling methods. Types of time studies include worker log and random moment time surveys, both of which we describe in more detail later. Claiming units then submit completed reimbursement claims to their local educational consortium or local governmental agency for review and approval.

After approving these claims, the local educational consortium or local governmental agency prepares and submits a summary invoice to Health Care Services, which performs a final review of the claims. If Health Care Services approves the claims, it includes them as part of a quarterly Medicaid expenditure report, which it submits to CMS at the end of each federal quarter. Health Care Services also schedules the claims for payment via the California State Controller’s Office (state controller) and draws the federal funds for payment. If Health Care Services does not approve a claim, it requests a revised claim from the local educational consortium or local governmental agency that forwarded it.

Local educational agencies may also claim federal reimbursement under the billing option program for up to 50 percent of the cost of certain types of direct medical services, or health-related services provided in school settings, to students eligible for Medi-Cal. See the text box for a summary of the allowable types of direct services that are eligible for reimbursement under the billing option program. However, if a Medi-Cal-eligible student needs any medically necessary services, Medicaid’s early and periodic screening, diagnostic, and treatment (EPSDT) services provisions require states to provide those services, whether or not the services are covered under the state plan. Medicaid’s EPSDT provisions state that covered services include any necessary health care, diagnostic services, treatments, or other measures described in federal law to correct or ameliorate defects and physical and mental illnesses and conditions discovered through screening.

Medical Services Under the Local Educational Agency Medi-Cal Billing Option Program That Are Eligible for Federal Reimbursement

State law and California’s Medicaid State Plan identify the following direct services as allowable and reimbursable through the Local Educational Agency Medi-Cal Billing Option Program:

- Health and mental health evaluations and education.

- Physical therapy.

- Occupational therapy.

- Speech pathology and audiology services.

- Physician services.

- Mental health and counseling services.

- Nursing services.

- School health aide services.

- Medical transportation.

Sources: California Welfare and Institutions Code, Section 14132.06, and California’s Medicaid State Plan.

Unlike the administrative activities program, local educational agencies participating in the billing option program do not file reimbursement claims with local educational consortia or local government agencies; instead, they file claims using the traditional Medi-Cal fee-for-service system through Health Care Services’ fiscal intermediary, Xerox State Healthcare (Xerox). Health Care Services contracts with Xerox to perform services such as reviewing and then approving or denying provider claims. After local educational agencies send their claims to Xerox, it reviews and approves or denies the claims for payment. If Xerox approves the claims, it submits payment files to the state controller for the issuance of warrants to providers. According to the chief of Health Care Services’ Medi-Cal Administrative Claiming Section, Xerox submits a report of paid claims to Health Care Services’ accounting department, which then prepares the quarterly Medicaid expenditure report to obtain reimbursement from the federal government.

A Federal Financial Management Review Triggered Changes to the Administrative Activities Program

In 2012 CMS completed its fieldwork on a financial management review of expenditures for Health Care Services’ administrative activities program, leading to changes in how claims for the administrative activities programs are reviewed and in the type of time studies used in the State. At the time of the CMS review, Health Care Services required claiming units to use a time study methodology known as worker log. Using the worker log, claiming unit staff tracked the amounts of time they spent during five consecutive workdays each quarter on different types of activities—both related and unrelated to the administrative activities program. Claiming units applied the time survey results from this week to the entire quarter to calculate their administrative activities claims.

In November 2013 CMS issued its final report based on the results of its financial management review. However, from its review of the reimbursement claims paid to three California claiming units, CMS made decisions and issued directives to Health Care Services even before it issued the final report. For instance, in June 2012 CMS required Health Care Services to revise its time study methodology to comply with federal requirements. Also in June 2012, CMS began deferring the payment of reimbursement claims pertaining to administrative activities performed as far back as fiscal year 2009–10.

In its review, CMS found that two out of the three claiming units it reviewed submitted claims for reimbursement that did not comply with federal requirements. CMS found that staff at both the Turlock Unified School District and the Tulare County Office of Education–Special Services were directed to perform activities during the survey period that were outside their normal job duties to maximize federal reimbursement. CMS concluded that these additional activities resulted in an overallocation of claiming unit costs to the Medicaid program.

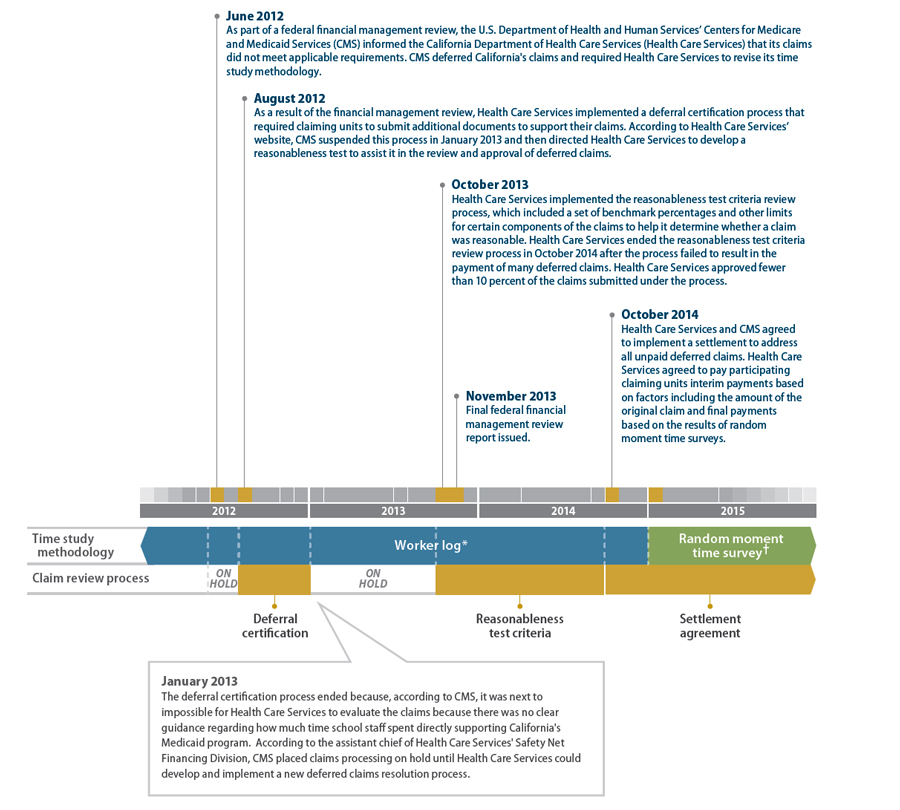

CMS also reported that neither Health Care Services nor the respective local educational consortium or local governmental agency for each of the two claiming units questioned the reimbursement claims because their oversight reviews did not include an assessment of the reasonableness of the claims’ information. One CMS finding noted that the State lacked appropriate internal controls to ensure compliance with federal requirements. CMS also found that instead of providing consistent oversight and monitoring guidance to claiming units, local educational consortia, and local governmental agencies, Health Care Services allowed the latter two entities to either establish their own standards or perform a very cursory review of the claiming units’ claims. Consequently, CMS stated that Health Care Services must implement a reasonableness review of reimbursement claims to ensure that the time studies and invoices were reasonable and allocable, and that Health Care Services must implement internal controls to ensure compliance with federal regulations and guidelines.5 Figure 2 summarizes the evolution of the time study methodologies and claims review processes that Health Care Services has used for the administrative activities program. We describe Health Care Services’ efforts to resolve deferred claims using the deferral certification and reasonableness test criteria review process in the Appendix. We describe Health Care Services’ efforts to resolve deferred claims under the terms of its settlement agreement with CMS in the next section.

Figure 2

California Department of Health Care Services’ Time Study Methodologies and Claim Review Processes for the School-Based Medi-Cal Administrative Activities Program

* Health Care Services used its worker log time study methodology for more than a decade until replacing it with a new time study methodology— the random moment time survey—in January 2015.

† According to Health Care Services’ June 2014 California School-Based Medi-Cal Administrative Activities Manual, the random moment time survey methodology polls selected staff from the claiming unit individually to determine what they were doing at randomly selected minutes during the quarter being surveyed, and then it totals the results to identify the proportion of time spent on allowable administrative activities for the entire population of time survey participants.Health Care Services Agreed to Resolve Deferred Claims by Making Interim and Final Reimbursement Payments to Claiming Units

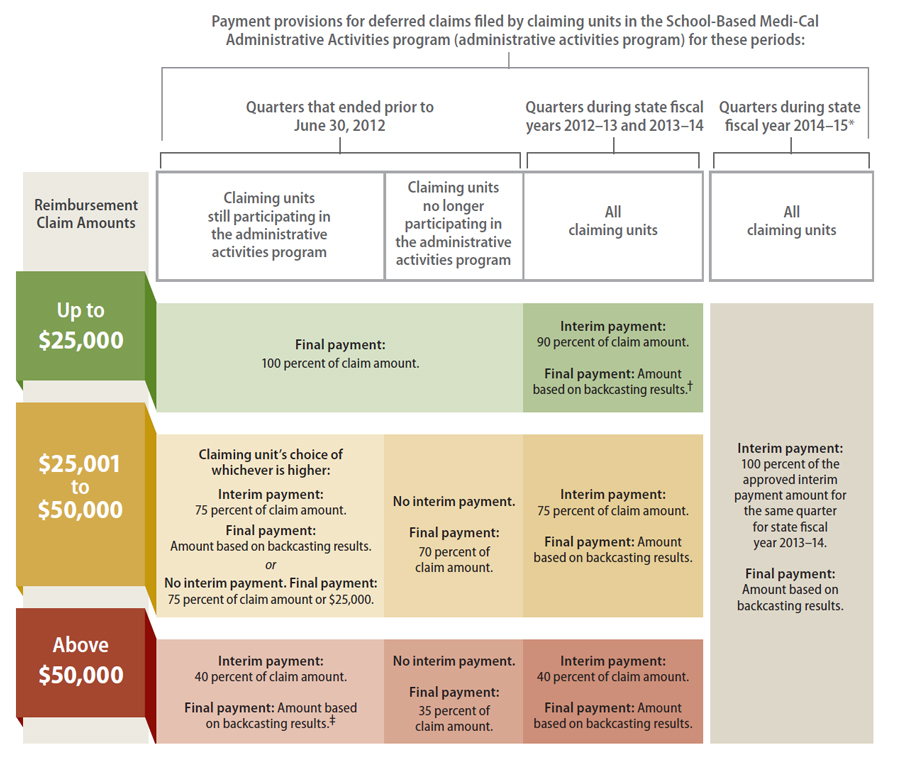

When the reasonableness test criteria review process failed to result in the payment of many of the deferred claims, Health Care Services and CMS entered into an agreement in October 2014 to implement a third process. Under the terms of the settlement agreement, Health Care Services would make initial interim reimbursement payments to claiming units, followed later by final payments, all of which would resolve the deferred claims. Figure 3 on the following page summarizes the payment terms of the settlement agreement. Health Care Services could make interim payments ranging from 25 percent to 100 percent of the claim amounts depending on the size of the reimbursement claim and the fiscal year that the claiming unit provided the services. For those claiming units no longer participating in the administrative activities program, Health Care Services would calculate a single amount as payment in full based on a percentage of the original deferred claim ranging from 35 percent to 100 percent depending on the size of the deferred invoice. As of July 2015 Health Care Services was making interim payments to local educational consortia and local governmental agencies for their claiming units.

Under the terms of the settlement agreement, Health Care Services is to calculate the final payments and pay the unpaid balances of the remaining claims through a process it and CMS call backcasting, which relies on the results of the new time study methodology that Health Care Services implemented in January 2015. According to Health Care Services’ June 2015 proposed backcasting methodology, CMS requires Health Care Services to collect data from the results of four quarterly surveys conducted under the new random moment time survey methodology that we discuss later in this report.6 The methodology states that these data will be used to determine the final reimbursement amount for all deferred claims. Local educational consortia and local governmental agencies will calculate an average of the administrative activities percentages for each quarter. The results will be combined and averaged to produce a single set of summary percentages for each administrative unit for each quarter, after which an overall average will be calculated for each administrative unit from the four quarters of data.7 This final set of summary percentages will replace the worker log summary percentages in all claims subject to backcasting. Per the methodology, a final claim amount will be determined based on the survey results for all claims subject to backcasting and compared to the interim payments made. If the comparison results in a balance due to the claiming unit, Health Care Services will issue the payment. If the comparison results in a balance due to Health Care Services, the claiming unit will issue payment through their local educational consortium or local governmental agency to Health Care Services.

Figure 3

Payment Provisions of the October 2014 Settlement Agreement Between the Centers for Medicare and Medicaid Services and the California Department of Health Care Services

Sources: October 2014 letter from the U.S. Department of Health and Human Services’ Centers for Medicare and Medicaid Services (CMS) to the California Department of Health Care Services (Health Care Services) regarding the settlement agreement, Health Care Services’ January 2015 letter to claiming units about implementation of the random moment time survey, and Health Care Services’ April 2015 backcasting methodology.

* Health Care Services used this process only for the two quarters from July 1, 2014, through December 31, 2014. Health Care Services started using random moment time surveys beginning January 1, 2015.

† Backcasting is a process that takes time survey percentages computed from the average of results from the first several quarters of the new time surveys and applies the percentages to the deferred claims.

‡ CMS had a single exception to this provision; it would approve an interim payment of 25 percent of the claim amount for the Turlock Unified School District (Turlock Unified) and then backcast to calculate its final payment. The reduced percentage is based on the results of CMS’s review of Turlock Unified’s claims and the revised invoices that Turlock Unified submitted to Health Care Services.

Claiming units may not receive some final payments to resolve deferred claims until 2019. Health Care Services’ June 2015 proposed backcasting methodology states that local educational consortia and local governmental agencies will submit recalculated claims for deferred claims greater than $25,000 according to the following schedule:

- State fiscal years 2009–10 and 2010–11 by June 30, 2017

- State fiscal years 2011–12 and 2012–13 by December 31, 2017

- State fiscal years 2013–14 and 2014–15 by June 30, 2018

The proposed backcasting methodology also states that the reconciliation of all deferred claims must be completed by April 1, 2019, and that any deferred claims not finalized by Health Care Services by June 2019 will be forfeited.

Scope and Methodology

The Joint Legislative Audit Committee (audit committee) directed the California State Auditor to audit the administrative activities and billing option programs. Table 1 lists the audit committee’s objectives and the methods we used to address them.

Table1

Audit Objectives and the Methods Used to Address Them

| AUDIT OBJECTIVE | METHOD | |

|---|---|---|

| 1 | Review and evaluate the laws, rules, and regulations significant to the audit objectives. |

|

| 2 | Research the oversight and administrative structure of similar Medicaid programs in other states. To the extent possible, identify best practices for the administration of these programs. | To identify states with similar school-based Medicaid programs, we gathered data about all For purposes of this report, we identified practices used by other states that we believe could |

| 3 | Compare California’s structure, including the use of local educational consortia and local governmental agencies, to the structures implemented by other states. To the extent possible, determine how California’s program structure compares to those of other states in the areas of cost-effectiveness, transparency of fiscal reporting, the extent to which state reporting requirements allow for tracking of student outcomes, clarity and effectiveness of program communication, stakeholder engagement processes, and the potential for conflicts of interest. | To identify the structure of California’s administrative activities and billing option programs, we We then reviewed documentation and interviewed staff from the Illinois, Michigan, and |

| 4 | Determine whether Health Care Services maximizes the amount of federal funding available to California under the administrative activities and billing option programs. For increases in federal reimbursement rates since 2010, determine how Health Care Services distributed increased funding between state and local agencies. | We defined the verb maximize in this context as “to ensure that California receives the maximum

To determine whether Health Care Services ensured that claiming units participating in the To determine whether Health Care Services exerted sufficient efforts to increase the number of To determine whether Health Care Services accurately reimbursed local educational agencies |

| 5 |

Related to Health Care Services’ reasonableness test criteria review process: a. Review the design of the reasonableness test criteria review process and determine whether the benchmarks for reimbursements are reasonable given the wide range of sizes and types of local educational agencies statewide. To the extent possible, determine whether reimbursement criteria are consistently applied across all local educational agencies and whether there are areas where the criteria are more restrictive than federal guidelines. |

|

b. Review a selection of claims subject to the reasonableness test criteria to determine whether Health Care Services has effective fiscal and administrative controls over the reimbursement process to ensure that local educational agencies receive consistent, appropriate, and timely reimbursements. To the extent possible, determine whether the process for reimbursements is consistently applied across all local educational agencies. |

|

|

c.

To the extent possible, determine whether Health Care Services’ direction to local educational consortia and local governmental agencies about the reasonableness test criteria review process maximizes federal reimbursements and whether the criteria used in determining allowable staff costs is reasonable and consistent with allowable federal guidelines. |

To determine whether the reasonableness test criteria maximized federal reimbursements and were reasonable and consistent with federal guidelines, we interviewed staff from CMS and Health Care Services, and we reviewed relevant documentation for the reasonableness test criteria—including policy letters, guidance materials, and CMS’s approval of the process that used the reasonableness test criteria—and federal regulations and requirements, such as the Office of Management and Budget Circular A-87. | |

d.

Determine whether Health Care Services has clearly communicated the criteria for approving or rejecting a reimbursement claim to local educational agencies and whether it has an adequate appeals process for denied claims under the reasonableness test criteria review process. |

|

|

e.

Determine the approval rate of reimbursement claims by local educational consortium or local governmental agency by region and statewide. |

Using Health Care Services’ claims database, we calculated the approval rates of reimbursement claims statewide and for each local educational consortium and local governmental agency. | |

| 6 | Determine what Health Care Services has done to comply with the administrative and reporting requirements of Welfare and Institutions Code, Section 14115.8(f), and to the extent possible, determine whether a reasonable process is in place for local educational agencies to be compensated for withheld reimbursements. | To assess Health Care Services’ compliance with the administrative and reporting requirements in Section 14115.8(f) of the Welfare and Institutions Code, which apply only to the billing option program, we did the following:

To determine whether a reasonable process existed for claiming units to be compensated for withheld reimbursements, we examined communication between Health Care Services and CMS regarding the deferral resolution methodologies Health Care Services used through June 2015. |

| 7 | Review and assess any other issues that are significant to the structure of the administrative activities and billing option programs and Health Care Services’ implementation of the reasonableness test criteria review process. | Because Health Care Services replaced the reimbursement process that used reasonableness test criteria with another process in October 2014, we interviewed staff at CMS and Health Care Services, and we reviewed relevant documents to examine the replacement process. At the beginning of our audit, we received several stakeholder concerns about Health Care Services’ administration of the random moment time surveys. Many concerns fell into two categories: lack of new contracts between the local educational consortia or the local governmental agencies and their claiming units, and claiming units’ inability to provide in a timely manner the participation lists to the local educational consortia or the local governmental agencies. Our discussions with local educational consortia and local governmental agencies did not disclose any problems with contracts or participant lists that were serious enough to prevent the claiming units from participating in the first random moment time survey quarter, which Health Care Services implemented January 2015 through March 2015. |

Sources: California State Auditor’s analysis of the Joint Legislative Audit Committee’s audit request 2014-130, our planning documents, and our analysis of information and documentation identified in the column titled Method.

Assessment of Data Reliability

In performing this audit, we relied on various electronic data files extracted from the information systems listed in Table 2. The U.S. Government Accountability Office, whose standards we are statutorily required to follow, requires us to assess the sufficiency and appropriateness of computer-processed information that we use to support findings, conclusions, or recommendations. Table 2 describes the analyses we conducted using data from these information systems, our methodology for testing them, and the limitations we identified in the data. Although we recognize that these limitations may affect the precision of the numbers we present, there is sufficient evidence in total to support our audit findings, conclusions, and recommendations.

Table 2

Methods Used to Assess Data Reliability

| INFORMATION SYSTEM | PURPOSE | METHOD AND RESULT | CONCLUSION |

|---|---|---|---|

California Department of Health Care Services (Health Care Services) The Administrative Claiming Local and School Services Branch’s Medi-Cal Administrative Activities Invoice Database (invoice database) Data as of February 2015 for the period from July 2008 through June 2014 |

To select claims for in-depth testing and to calculate estimates based on claim statistics. |

|

Sufficiently reliable for the purposes of this audit. |

California Department of Education (Education) California Longitudinal Pupil Achievement Data System (achievement data system) Enrollment data for academic year 2011–12 |

To determine the universe of California local educational agencies and their enrollments for estimating lost reimbursement amounts due to nonparticipation in the School-Based Medi-Cal Administrative Activities program. We created a ratio of enrollment in nonparticipating local educational agencies to enrollment in participating local educational agencies to aid in the creation of this estimate. |

We did not perform data reliability testing for the enrollment data within the achievement data system because source documents are located throughout the State, making such testing cost-prohibitive. |

Undetermined reliability for the purposes of this audit. Although this determination may affect the precision of the numbers we present, there is sufficient evidence in total to support our audit findings, conclusions, and recommendations. |

Health Care Services Management Information System/Decision Support System (MIS/DSS) Service invoice payment data for September 2011 |

To determine whether the Local Educational Agency Medi-Cal Billing Option Program received increased federal reimbursements during the time the American Recovery and Reinvestment Act was in effect. |

We did not perform data reliability testing for the MIS/DSS because we used these data only to confirm the accuracy of other evidence. Additionally, this database is a mix of paperless and paper claims, and any source documents are located at local educational agencies throughout the State, making such testing cost-prohibitive. |

Undetermined reliability for the purposes of this audit. Although this determination may affect the precision of the numbers we present, there is sufficient evidence in total to support our audit findings and conclusions. |

Health Care Services School-Based Medi-Cal Administrative Activities Interim Claiming and Reasonableness Test Criteria Tracker Database Data for tracking claims processed using the reasonableness test criteria Claims received under the reasonableness test criteria review process for the period from July 2009 through June 2013 |

To determine the number and dollar value of claims received and approved using the reasonableness test criteria for each local educational consortium and local governmental agency. |

To test the accuracy of the data, we randomly selected 29 claims and attempted to verify that key data elements matched another data set that we had previously determined was sufficiently reliable for our purposes. After testing 14 claims, we found four material exceptions. Based on this information, we discontinued our data reliability testing for these data. |

Not sufficiently reliable for the purposes of this audit. Although this determination may affect the precision of the numbers we present, there is sufficient evidence in total to support our audit findings and conclusions. |

Sources: California State Auditor’s analysis of various documents, interviews, and data obtained from Health Care Services, and our analysis of data obtained from Education.

Footnotes

3 A local educational consortium is one of the 11 service regions of the California County Superintendents Educational Services Association. Each consortium is led by a county education office within the region. A local governmental agency is an agency of either a county or chartered city, or a Native American Indian tribe, tribal organization, or subgroup of a Native American Indian tribe or tribal organization.Go back to text

4According to CMS, a claiming unit is typically a school district or program within a district. California has claiming units that are as diverse as county offices of education, special education local plan areas, local school districts, community colleges, and Healthy Start programs.Go back to text

5 According to federal regulations, a cost is allocable to a particular federal award if, among other things, the goods or services involved are chargeable or assignable to that federal award in accordance with benefits received.Go back to text

6 The four quarters used for backcasting may not be consecutive. According to the June 2015 proposed backcasting methodology, data for backcasting can come from four of the five quarters from January 2015 through March 2016. The proposed methodology states that if Health Care Services determines that the data from January through March 2015 are not comparable to the data from the following three quarters, then data from January through March 2016 can be used in their place.Go back to text

7 Health Care Services’ June 2015 proposed backcasting plan describes an administrative unit as one of the eight survey entities that generate random moments in California, not including the Los Angeles Unified School District, which conducts its own quarterly time survey.Go back to text