Responses to the Audit

Use the links below to skip to the specific response you wish to view:

- Los Angeles County Office of Education

- Montebello Unified School District

- Los Angeles Regional Adult Education Consortium

Los Angeles County Office of Education

October 11, 2017

Elaine M. Howle, State Auditor

California State Auditor

621 Capitol Mall, Suite 1200

Sacramento, CA 95814

Re: California State Auditor's Report No. 2017-104

Dear Ms. Howle:

Attached is the response of the Los Angeles County Office of Education (LACOE) to the above-referenced California State Auditor (CSA) draft report titled Montebello Unified School District: County Intervention is Necessary to Address Its Weak Financial Management and Governance. We appreciate the work of the CSA audit team members in their development of the audit findings and recommendations. LACOE would like to thank the California State Auditor for the opportunity to respond to the draft report.

Sincerely,

Patricia Smith

Interim Chief Financial Officer

Business Services

PS/KDC

Attachment

cc: Debra Duardo, M.S.W., Ed.D., Superintendent of Schools

Keith D. Crafton, Director, Business Advisory Services

RESPONSE TO CALIFORNIA STATE AUDITOR'S REPORT NO. 2017-104

LOS ANGELES COUNTY OFFICE OF EDUCATION

MONTEBELLO UNIFIED SCHOOL DISTRICT:

COUNTY INTERVENTION IS NECESSARY TO ADDRESS ITS WEAK FINANCIAL

MANAGEMENT AND GOVERNANCE

Direct Montebello to submit a corrective action plan to address the issues identified in this report including balancing its budget, amending and adhering to its hiring procedures, and establishing adequate safeguards to ensure that policies related to bond proceeds, conflicts of interest, and the approval of expenditures are implemented and followed.

RESPONSE

The Los Angeles County Office of Education (LACOE) agrees with the recommendation. On October 5, 2017, the Montebello USD Board approved an updated budget and provided LACOE with a detailed Revised Fiscal Stabilization Plan (FSP) (attachment 1) for 2017-18. This plan addresses the issues mentioned in the above recommendation.

LOS ANGELES COUNTY SUPERINTENDENT RECOMMENDATION

Assist Montebello in developing a workforce plan to justify its size and cost in terms of its current and projected enrollment, including evaluating the necessity of staff levels and personnel costs.

RESPONSE

We concur with the recommendation. On October 5, 2017, the Montebello USD Board approved an updated budget and provided LACOE with a detailed Revised FSP (attachment 1) for 2017-18. This plan addresses the issues mentioned in the above recommendation.

LOS ANGELES COUNTY SUPERINTENDENT RECOMMENDATION

Evaluate the necessity of executive positions and adjust executives' salaries based on an analysis of the number and cost of executives in comparable districts.

RESPONSE

We concur with the recommendation. On October 5, 2017, the Montebello USD Board approved an updated budget and provided LACOE with a detailed Revised FSP (attachment 1) for 2017-18. This plan addresses the issues mentioned in the above recommendation.

LOS ANGELES COUNTY SUPERINTENDENT RECOMMENDATION

Ensure that the board and Montebello implement all of the recommendations detailed below.

RESPONSE

LACOE agrees with the recommendation. Assembly Bill (AB) 1200 provides the county superintendent of schools with the framework for the fiscal oversight of the school districts in his or her county. Under AB1200, the county superintendent reviews district budgets and interim reports to determine whether the district can meet its financial obligations. AB 1200 allows the county superintendent of schools to provide management assistance and progressive intervention to local school districts. As part of LACOE's AB 1200 oversight responsibilities, the county superintendent of schools has assigned a fiscal expert to the district for the remainder of the 2017-18 fiscal year. The County Superintendent will pay for the fiscal expert. The fiscal expert will provide fiscal and financial support to the District and will offer guidance to the District administration for implementation of the FSP during 2017-18. The fiscal expert will be required to provide FSP implementation progress reports to the District's Governing Board and to the County Superintendent.

MEMORANDUM ACTION

September 20, 2017

TO: Dr. Anthony J. Martinez, Ph.D., Interim Superintendent of Schools

FROM: Dr. Anthony J. Martinez, Ph.D., Interim Superintendent of Schools

SUBJECT: Approval of Revised Fiscal Stabilization Plan for 2017-18

The Los Angeles County Office of Education (LACOE) has requested that the Board adopt a Fiscal Stabilization Plan to accompany the 2017-18 Adopted Budget. This plan is due October 8, 2017. It restores and maintains reserves at the required statuary level.

We recommend adoption of the following motion:

That the Board of Education of the Montebello Unified School District approve the

Revised Fiscal Stabilization Plan for 2017-18 fiscal year.

The District Adopted Budget presents the required statutory reserves for the following Fiscal Years: 2017-18, 2018-19 and 2019-20. The District's change in financial position from June 29, 2017 is due to the commitment to the following actions to support the Budget assumptions:

- The 2017-18 Adopted Budget is projected based on employee costs of those employees on the District payroll as of September 12, 2017.

- All vacancies as of this time are either to be filled as an exchange of dollars elsewhere in the budget or as a compliant charge to a Federal or State grant or entitlement.

- Programs that are budgeted to encroach are not to incur more costs in 2017-18 than in 2016-17, with the exception of increases to step, column and statutory benefits.

- The only vacancies budgeted to unrestricted funds for being filled in 2017-18 are: 1) Superintendent, 2) Assistant Superintendent, Chief Financial Officer, 3) Assistant Superintendent, Facilities, 4) Accounting Leadership position, 5) Transportation Leadership position, and 6) Maintenance & Operations Leadership position.

- The District is to comply with the MTA settlement agreement, signed June 29, 2017. Twenty-nine (29) Montebello Teacher's Association (MTA) members are on the District payroll due to this settlement and are considered to be employed through September 30, 2017. The Adopted Budget discontinues funding for these employees as of October 1, 2017.

- $1.1 million is budgeted for MTA column movement for MTA employees not already advanced as of September 2017. These dollars are also available to accommodate immediate classroom staffing needs and to support traditional kindergarten.

- For 2017-18 and 2018=19, twelve (12) furlough days for certificated and classified management, and six (6) furlough days for classified supervisors and confidential management.

- A commitment to compliantly utilize the Educator Effectiveness and College Readiness awards to fund employee compensation previously paid from unrestricted funds.

- A commitment to monitor the Redevelopment Agency stream of income, reported in Fund 25, so that this funding source may repay all of the debt owed on the 2012 Certificates of Participation (COPs). The District currently has sufficient fund balance in Fund 25 to repay the debt for a minimum of three years, 2017-18 through 2018-19.

- The District will adopt a Board resolution within the next month to transfer the 2016-17 ending fund balance of $1,014,152 from the Deferred Maintenance fund to the General Fund of the District. The District will transfer the cash no later than December 31, 2017.

- The District will adopt a Board resolution within the next month to transfer the 2016-17 ending fund balance of $1,989,432.68 from the Adult Education fund to the General Fund of the District. The District will transfer the cash no later than December 31, 2017.

- The District will adopt a Board resolution within the next month to transfer

- $717,000 from the 2004 Measure M / 1998 Measure EE General Obligation Bond funds to the General Fund of the District. This transfer will reimburse the General Fund for 2004 Measure M / 1998 Measure EE compliant expenses that were incurred in 2016-17 for facilities – related costs. The District will transfer the cash no later than December 31, 2017.

- $2,990,942 from the 2004 Measure M / 1998 Measure EE General Obligation Bond funds to the General Fund of the District. This transfer will reimburse the General Fund for 2004 Measure M / 1998 Measure EE compliant expenses that were incurred in 2015-16 for facilities – related costs. The District will transfer the cash no later than December 31, 2017.

- $2,840,063 from the 2004 Measure M / 1998 Measure EE General Obligation Bond funds to the General Fund of the District. This transfer will reimburse the General Fund for 2004 Measure M / 1998 Measure EE compliant expenses that were incurred in 2016-17 for Information Technology (IT) infrastructure – related costs. The District will transfer the cash no later than December 31, 2017.

- The District will no longer fund facilities and IT infrastructure expenditures from the General Fund that are compliant with Bonds passed by the voters. The District will reconsider all 2017-18 costs in process and reclassify them per Board approval.

- The District will prioritize capital needs and spend the most restrictive funds first. Investment in facilities costs will be prioritized so that the following funds are expended in order of restriction and age:

- Measure M and Measure EE General Obligation Bonds

- Office Of Public School Construction (OPSC) Funds

- Measure GS General Obligation Bonds

- Capital Facilities, Fund 25 Developer Fees

- Redevelopment Agency Funds, Fund 25. Sufficient funds must remain available for retirement of 2012 COPS debt through 2029.

- The District will continue to research 2012-2013, 2013-14, 2014-15 and 2015-16 General Fund expenses for facilities and IT-infrastructure costs incurred by the General Fund that should have been the costs of one of the capital funds of the District. These transfers will be brought forward at one time for a reimbursement transfer. Since these items are not quantified at this time, the District has not included them in the Budget Adoption.

- The District is committed to suspending the purchase of textbook adoptions for the three projected years. The textbooks ordered in 2016-17 were not received as of June 30, 2017. Therefore the costs incurred in 2017-18 are for the 2016-17 order.

Approved for presentation to the

Board of Education: October 2, 2017

Anthony J. Martinez, Ph.D.

Interim Superintendent of Schools

Secretary to the Board

Comments

CALIFORNIA STATE AUDITOR’S COMMENTS ON THE RESPONSE FROM THE LOS ANGELES COUNTY OFFICE OF EDUCATION

To provide clarity and perspective, we are commenting on the Los Angeles County Office of Education's (LACOE) response to our audit. The numbers below correspond to the numbers we have placed in the margin of LACOE's response.

We disagree that the fiscal stabilization plan addresses our recommendations. Specifically, the plan does not address amending and adhering to Montebello's hiring processes, nor does it establish safeguards to ensure that policies related to bond proceeds, conflicts of interest, or the approval of expenditures are implemented and followed. Further, the plan does not address our recommendations that LACOE assist Montebello in developing a workforce plan and that LACOE evaluate the necessity of Montebello's executive positions.

Because the fiscal stabilization plan does not specifically address our recommendations, we look forward to LACOE's 60-day response to our audit report. The response should specifically describe and provide support for its actions to implement our recommendations, including assisting Montebello in implementing the recommendations we directed to the district.

Montebello did not provide us with this fiscal stabilization plan during our audit; therefore, we have not analyzed these items. However, we are concerned with Montebello's plan to transfer nearly $2 million in funds from the adult education fund to the general fund. As we state in the Audit Results, state law prohibits using the adult education fund for purposes other than adult education.

Montebello Unified School District

October 11, 2017

Ms. Elaine M. Howle

State Auditor

Bureau of State Audits

555 Capitol Mall, Suite 300

Sacramento, California 95814

Response to: Montebello Unified School District: County Intervention Is Necessary to Address Its Weak Financial Management and Governance

Dear Ms. Howle:

On behalf of the Montebello Unified School District (MUSD) Board of Education I would like to thank you for responding affirmatively to the District's request for a forensic audit of its policies, protocols, programs and operations. We believe the audit, coupled with the efforts the District has undertaken over the past year, will result in improved governance and an even stronger, more responsive and transparent District.

Our request for a forensic audit was embedded in the board's desire to improve the programs, services and operations of the district in the aftermath and departure of former administrative officials, and concerns expressed to Boardmembers by employees, parents and stakeholder alleging occurrences of fraud, corruption and misappropriation of funds and resources.

MUSD is pleased that after a thorough and exhaustive review by the Office of the California State Auditor, it appears these allegations were unsupported. In other words, the State Auditor found no widespread evidence of corruption, gross mismanagement, fraud, waste or maleficence at the District. This is an important finding the District would like to highlight to the Joint Legislative Audit Committee.

Although we agree with most of recommendations in the audit and have no concerns (principally because they are basically restatements of procedures the district already employs or was in the process of adopting as part of the comprehensive reforms the district has been implementing), we feel there are certain audit areas that merit further discussions because of serious factual errors and mischaracterizations.

Specifically, regarding the area of a viable and approved budget, it's important to point out that the MUSD Board of education has approved a revised multiyear budget and submitted it to the Los Angeles Office of Education where initial communications indicate a positive response from LACOE. The current budget does not reflect a negative nor does it indicate eminent danger to the District's ability to conduct its business.

Also, addressing the area of auditors' perceived erosion of public trust, public concerns over the future of District teachers and support personnel were expressed during budget discussions, particularly since the District had not experienced a substantial reduction in force since 1991. Given the emotional response by some District detractors, there were initial calls for radical change in our budget process and decisions, however these movements dissolved as teachers were returned to the classrooms, and communications regarding the state of the District increased and improved with employees, parents, students and stakeholders.

We have taken a close look at the areas that you reviewed during the audit and have already or rapidly undertaken steps to improve the particular processes and procedures contained in your recommendations in order to meet the goal of improved governance, financial stability, and a stronger, more responsive and transparent District.

RECOMMENDATIONS

1. To improve its current financial condition and ensure future viability, Montebello should do the following:

- Within 60 days, revise its fiscal stabilization plan and make the necessary cuts to fund its ongoing commitments. Create a robust budgeting process within 180 days using Government Finance Officers Association best practices that ensures Montebello's ability to meet its priorities while maintaining the legally required level of reserves that buffers Montebello from drastic cuts in times of economic instability.

- Implement an effective budget monitoring process with regular budget-to-actual comparisons. This process should include safeguards against spending in excess of budgeted expenditures and require advance board approval of such spending before it occurs. For example, Montebello should require the budget manager to perform monthly reviews of budget-to-actual figures and provide detailed explanations for any variances to the board.

Response: MUSD agrees with the recommendation. On October 5, 2017, the Board of Education approved a Fiscal Stabilization Plan and submitted to the Los Angeles County Office of Education (LACOE). As of October 2017, MUSD has implemented a process for reviewing budget-to actual figures on a monthly basis.

2. To ensure that Montebello hires the most qualified executive and management staff, Montebello should immediately adhere to its policies for hiring classified employees, including screening candidates to ensure that they meet the minimum qualifications. Montebello should also hold provisional employees to the same standards for minimum qualifications as its policy requires.

Response: MUSD agrees with the recommendation. As of October 2017, MUSD is adhering to hiring practices for executive and management classified employees. Furthermore, as of October 2017, MUSD requires that all employees being considered for provisional positions be held to the same minimum qualifications as the job description requires.

3.- To ensure that Montebello hires qualified classified employees, the personnel commission should, within 90 days, revise its policies to require the director of classified human resources to provide it with the education and work of any candidates on eligibility lists for high-ranking positions. It should also require the classified director to provide it with provisional appointments and information on how those employees meet the minimum qualifications.

Response: MUSD agrees with the recommendation. As of October 2017, the Director of Classified Human Resources will provide the personnel commission with a revised policy to provide it with the education and work experience of any candidates on eligibility lists for high-ranking positions. The Director of Classified Human Resources will also provide the personnel commission with supporting information on how employees being recommended for provisional appointments meet the minimum qualifications.

4. To ensure that it does not violate state law, Montebello should immediately adhere to its policies and ensure that provisional employees do not exceed the legal maximum number of days of service.

Response: MUSD agrees with the recommendation. MUSD has already addressed this recommendation. As of October 2016, MUSD has worked on ensuring that employees in a provisional assignment do not exceed the legal maximum number of days of service.

5. To ensure that Montebello hires executives that meet the minimum qualifications, prior to appointing them into a position of superintendent, deputy superintendent, associate superintendent, or assistant superintendent, it should verify that the individual holds both an administrative and teaching credential.

Response: MUSD agrees with the recommendation. MUSD has already addressed this recommendation. As of July 2017, the District has implemented a practice to ensure that all candidates for executive positions meet the minimum qualifications prior to appointing them into an executive position.

6. In order to rebuild trust with its community, Montebello should adhere to its policies for hiring certificated personnel and fill any vacant positions for executives through a competitive hiring process, including advertising the positions, screening, and interviewing to ensure that it hires and retains the most qualified and talented leaders.

Response: MUSD agrees with the recommendation. MUSD has already addressed this recommendation. As of July 2017, MUSD has implemented a hiring process which includes advertising the positions, screening, and interviewing to retain the most qualified and talented leaders.

7. To ensure that Montebello creates positions only when necessary, it should create a policy within 30 days that requires valid justification for why Montebello is creating a position. Additionally, in order to maintain transparency when creating new positions, Montebello should immediately begin to document its justifications.

Response: MUSD agrees with the recommendation. As of October 2017, MUSD has implemented the practice of requiring a valid justification on the personnel request form for all positions. The justification is included on the agenda items that are presented to the Board of Education for approval in order to maintain transparency.

8. To ensure that Montebello hires qualified certificated and classified employees, the board should, within 90 days, revise its policies to require the superintendent or his or her designee to provide information to the board about recruitments for high ranking employees. The board should consider this information when approving appointments. This information should include at a minimum:

- The number of initial applicants

- The number of candidates that passed the screening and interviewing steps

- The education and work experience of the final candidates recommended by the superintendent or designee

Response: MUSD agrees with the recommendation. MUSD has already addressed this recommendation. As of July 2017, MUSD provides the Board of Education with the number of initial applicants, the number of candidates who passed the screening, the number of candidates interviewed, as well as providing it with the education and work experience of the final candidates.

9. To ensure that Montebello is making hiring decisions free of bias or favoritism, it should strengthen its hiring policies within 90 days related to nepotism and conflict of interest for classified and certificated personnel to include the following restrictions on immediate family members being involved in the screening and interviewing processes, defining what types of personal relationships fall under the nepotism policy, which work relationships the nepotism policy applies to, and what factors to consider when evaluating the potential impact of a personal relationship.

Response: MUSD agrees with the recommendation. MUSD will strengthen its hiring policies within 90 days related to nepotism and conflict of interest for classified and certificated personnel incorporating industry standards and best practices.

10. To ensure that bond funds are spent appropriately, the district should immediately do the following:

- Ensure that its bond oversight committee meets at least once per year

- Ensure that the bond oversight committee member positions are filled

- Require its contracted project manager to provide detailed bond expenditure reports to the bond oversight committee at least quarterly for all relevant bonds

- Ensure that its contracted auditor delivers a timely bond audit and that Montebello addresses the auditor's concerns and recommendations

Response: MUSD agrees with the recommendation. MUSD has already addressed this recommendation. As of September 2017, as indicated in the by-laws the Citizens Bond Oversight Committee (CBOC) has already met once during this fiscal year and was provided with a detailed bond expenditure report. Furthermore, should there be a vacant position on the CBOC, MUSD will ensure that it advertises, recruits, and fills the vacant position in a timely manner. As of August 2017, the Board of Education approved an auditor to ensure that a bond audit is delivered in a timely manner. MUSD is committed to addressing the auditor's concerns and recommendations.

11. To ensure that the staff that make or influence district decisions are free from perceived or actual conflicts of interest, Montebello should do the following:

- Immediately identify all positions that make or influence district decisions and designate those not already identified in its conflict-of-interest policy

- Immediately require designated employees to file statements of economic interests and adhere to its conflict-of interest policy

- Expand its policy within 60 days to require all employees approving contracts or expenditures to file a statement of economic interests

Response: MUSD agrees with the recommendation. MUSD will expand its policy within 60 days to require all employees approving contracts or expenditures to file a statement of economic interests.

12. To ensure that Montebello spends its funds for allowable and reasonable purposes, we recommend that it do the following:

- Require employees whose salaries are funded by voter approved bond proceeds to fill out detailed timesheets to demonstrate they worked on bond related activities. It should only use bond proceeds to pay the portion of the salary that is supported by the timesheet.

- Implement an inventory tracking system that allows it to know where its equipment is located. Montebello should also periodically review its inventory listing to ensure that equipment is being properly used

- Close the adult education fund's revolving fund account

- Require all employees to obtain approval for overtime before performing overtime work and submit and explanation of tasks they completed during their overtime work when they submit their overtime timesheet for payment

- Follow its purchase card manual procedures including requiring employees to submit receipts for all purchases made with the card and not making payments until appropriate officials have reviewed all required documentation

Response: MUSD agrees with the recommendation. By November 2017, MUSD will require employees whose salaries are funded by voter approved bond proceeds to fill out a detailed timesheet demonstrating the work associated with bond related activities. By November 2017, MUSD will initiate the process of evaluating inventory tracking systems to account for its equipment and intends to implement it by January 2018.

MUSD will also engage in implementing periodic reviews of its inventory to ensure that it is being properly used and to identify any obsolete equipment that may need to be replaced. As of October 2017, the adult education fund's revolving fund account has been closed. As of July 2017, all overtime assignments appear on the Board agenda for prior approval including a description of services to be performed and not to exceed hours. By November 2017, MUSD will implement its overtime policy and require that all employees obtain prior approval before performing overtime work.

By November 2017, MUSD will initiate an Administrative Regulation requiring all employees using a purchase card to submit receipts for all purchases, and payments will not be made until approved by an appropriate official.

13. To ensure that state adult education expenditures are reasonable and justified, the board should do the following by November 4, 2018:

- Develop a policy that requires adult education classes to meet specific class size minimum thresholds. If classes do not meet these thresholds, the Montebello adult education program must cancel the class

- Require the Montebello adult education program to annually report to the consortium and to the board on the number of students in each class, the number of hours taught, and the cost of the class per student

Response: MUSD agrees with the recommendation. By November 2017, a policy will be submitted to the Board of Education requiring adult education classes to meet specific class size minimum thresholds. If classes do not meet the minimum threshold, they will be closed. MUSD will submit an annual report to the consortium and Board of Education on the number of students in each class, the number of hours taught, and the cost of the class per student.

14. To improve the cash collection process, Montebello should ensure that the adult education program has adequate safeguards in place to minimize the misuse of funds including the following:

- Implementing policies and procedures by January 5, 2018, that align with best practices for cash collection and cash deposits that include robust safeguards such as ensuring separation of duties in the cash collection process

Response: MUSD agrees with the recommendation. As of October 2017, MUSD adult school has implemented a cash receipt policy and a new enrollment system that allows students extended payment options for their tuition and fees, including credit or debit cards.

As the Montebello Unified School District moves forward in drafting and implementing a corrective action plan, it is our intent to cooperate with the State Auditor to bring about improved governance and financial stability, but to also further clarify items contained in the report, including any mischaracterizations, inaccuracies and unsupported items. Furthermore, the District will address each topic within the report to provide a timeline for the ongoing tasks to be undertaken in the furtherance of the goal to achieve improved policies, protocols and procedures.

If you'd like to discuss the Districts response to the audit, please feel free to contact me at (323) 887-7900.

Sincerely,

Anthony J. Martinez, Ph.D.

Interim Superintendent of Schools

Comments

California State Auditor's Comments on the Response From the Montebello Unified School District

To provide clarity and perspective, we are commenting on the Montebello Unified School District's (Montebello) response to our audit. The numbers below correspond to the numbers we have placed in the margin of Montebello's response.

We performed this audit at the request of the Joint Legislative Audit Committee (Audit Committee), not Montebello.

Montebello is confused about the type of audit we performed. We conducted a performance audit in accordance with generally accepted government auditing standards based on audit objectives approved by the Audit Committee. The audit objectives focused on Montebello's financial practices, hiring processes, compensation, and related issues. In contrast, forensic accounting services generally involve applying specialized knowledge and investigative skills, and interpreting and communicating findings in the courtroom or in other legal or administrative venues.

Montebello mischaracterizes our findings. As we state for Objective 2 in Table 1, the former superintendent and chief financial and operations officer recently filed a complaint alleging, among other things, that the board and former chief business officer violated various state laws when awarding certain contracts, such as competitive bidding laws and laws governing the disposal of school property. The litigation is pending. Because audit standards prohibit us from auditing or reporting in a manner that could interfere with pending legal proceedings, we are not reporting on these matters. However, we found several areas indicative of Montebello's poor governance and financial management, which we discuss throughout this report.

Montebello's assertion is misleading. Throughout our report, we highlight instances in which Montebello either lacked sufficient policies and procedures or failed to follow them. Accordingly, we make multiple recommendations to Montebello to correct these deficiencies.

We disagree with, and are puzzled by, Montebello's assertion that our report contains factual errors and mischaracterizations. In particular, Montebello does not provide any specifics about the aspects of our report with which it disagrees with either the accuracy or the characterization. Further, Montebello indicates that it agrees with all of our recommendations. Finally, because we conducted this audit in accordance with generally accepted government auditing standards, which requires us to obtain sufficient and appropriate audit evidence to support our conclusions and recommendations, we stand behind those conclusions.

As stated in the Audit Results, Montebello has continually ignored warnings from LACOE to curtail its deficit spending. We also note in the Audit Results that Montebello has not followed through with the cost reductions in its previous fiscal stabilization plan. Given its history, it is important that Montebello implement our recommendations to improve its financial condition.

Some of the reasons the Audit Committee approved this audit were public concerns expressed regarding the qualifications of administrators hired by Montebello and the potential for conflicts of interest. We believe such public concerns are an exposition of an erosion of the public's trust in the district.

We are pleased that Montebello agrees with our recommendations and asserts that it has either already implemented or has begun implementing them. We look forward to its 60-day response to our audit report, which should include documentation demonstrating the actions Montebello has taken in implementing each recommendation.

Los Angeles Regional Adult Education Consortium

October 11, 2017

Ms. Elaine M. Howle, State Auditor

California State Auditor

621 Capitol Mall, Suite 1200

Sacramento, CA 95814

Dear Ms. Howle,

The Los Angeles Regional Adult Education Consortium (LARAEC) submits this letter in response to the California State Auditor (CSA) confidential draft audit report for Montebello's California State Audit, LARAEC portion. We appreciate the time and effort the CSA office has invested in this process and the recommendations offered.

LARAEC has and will continue to adhere to state law (AB 104). LARAEC's response to the report is as follows:

Figure 5 caption

"The Montebello Adult Education Program is Overseen and Funded by the Los Angeles Regional Adult Education Consortium (Fiscal Year 2015-16)"

Response:

Page 3

Response:

LARAEC objects to this statement as it is inaccurate and misrepresents the allocation process.

Page 4

Response:

This sentence misrepresents how LARAEC determined the distribution of funds. The distribution of funds was not based on a formula that included student enrollment.

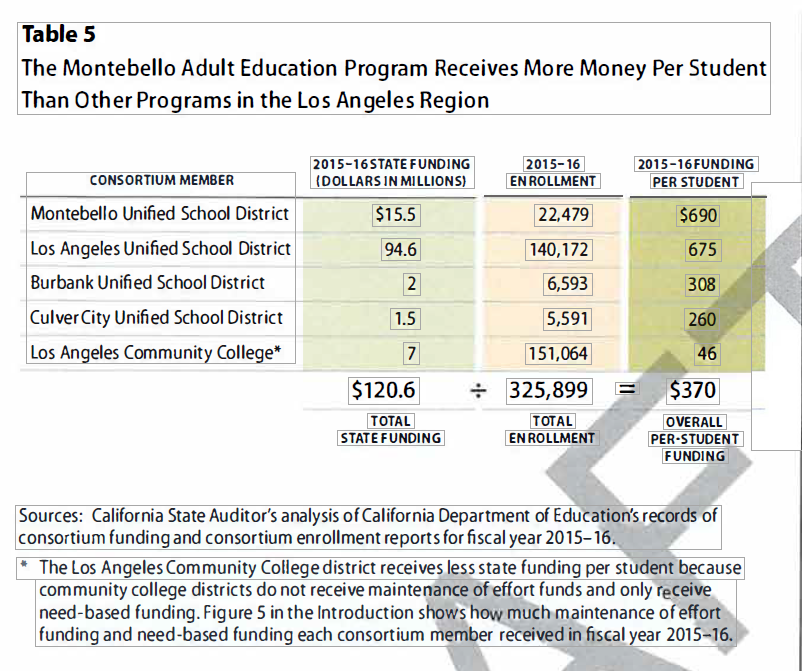

Table 5

Response:

Page 5

Response:

While enrollment was discussed, it was not a factor in determining final allocations.

Page 7

Response:

The word "difficult" must be changed to "impossible". The consortium members deem it impossible to "exert oversight without a specific mandate from the Legislature…".

Page 7

Response:

The state has not provided specific guidance to determine what constitutes "ineffectiveness in providing services;" without appropriate state guidance LARAEC cannot unilaterally make an independent determination of "effectiveness".

Page 8

- "Complete an assessment of Montebello's ability to meet the requirements of its adult education plan to determine whether its use of state funds was effective. If Montebello is found to be ineffective, the consortium should immediately recalculate the program's fund allocation going forward."

Response:

Page 9

- "Develop policies and procedures to ensure the proper collection and reporting of enrollment, attendance, and expenditure data among consortium members. Periodically review enrollment, attendance, and expenditure data to ensure their accuracy."

Response:

LARAEC, once again, reaffirms that it will continue to adhere to state law (AB 104) and will comply with the implementation of state-developed guidelines as released.

Respectfully,

Lanzi Asturias

LARAEC Project Director

Comments

California State Auditor's Comments on the Response From the Los Angeles Regional Adult Education Consortium

To provide clarity and perspective, we are commenting on the Los Angeles Regional Adult Education Consortium's (consortium) response to our audit. The numbers below correspond to the numbers we have placed in the margin of the consortium's response.

We disagree. The consortium has oversight responsibilities. For example, as we describe in the Introduction of the report, state law requires the consortium to decide how to allocate funds. Further, in the Introduction we describe that state law allows the consortium to reduce funding if it finds that, among other things, a consortium member has been consistently ineffective in providing service and intervention has not resulted in improvement. These actions constitute oversight responsibilities.

While preparing our draft report for publication, some page numbers shifted. Therefore, the page numbers on the consortium's redacted draft copy of the audit report do not correspond to the page numbers of the final audit report.

The statement in our report is accurate. As we show in Table 5, Montebello received more funds based on enrollment than the other districts in the consortium.

The consortium's response ignores information we included in the report and contradicts earlier statements from the consortium's staff. We acknowledge in the Audit Results that the consortium determined its need-based funding via extensive negotiations among its members that included several factors. In the Audit Results, we quote the project manager for the consortium as stating that the 2015–16 need‑based funding was loosely based, in part, on district enrollment. Finally, as we also state on that page, it is difficult to determine how the consortium used various criteria to allocate its funding.

In completing our quality control process, we revised the title and a heading for Table 5, and added a footnote.

Table 5 is an accurate representation of the funds each district received based on enrollment. Presenting school funding based on enrollment allows for comparisons across districts of disparate sizes.

As we describe in the Introduction and Comment 1, state law already provides the consortium with the authority to make findings related to its members' provision of adult education services and does not require the consortium to seek an additional mandate from the State. Further, state law establishes certain measures for determining effectiveness such as the number of adults served, job placements, and improved wages. State law further authorizes the California Community College Chancellor's Office and the California Department of Education to identify additional measures for effectiveness, and guidance is being provided through this partnership. Based on the consortium's response, we are concerned that it will not take the necessary actions to ensure that Montebello's adult education program receives an appropriate amount of state funding.

The consortium's response is disingenuous. As we describe in the Audit Results, state law allows the consortium to evaluate the effectiveness of a member in providing services addressing the needs identified in the adult education plan. Further, as we note in Comment 7, state law outlines some measures of effectiveness and state guidance is being provided.