Response to the Audit

City of Irwindale

November 8, 2016

Ms. Elaine M. Howle

California State Auditor

621 Capitol Mall, Suite 1200

Sacramento, CA 95814

Re: Audit of the City of Irwindale

Dear Ms. Howle,

On behalf of the City Council of the City of Irwindale (“City” or “Irwindale”), this letter is Irwindale’s response to the November 2, 2016 draft of the California State Auditor’s (“CSA”) Report entitled, “City of Irwindale: It Must Exercise More Fiscal Responsibility Over Its Spending so That It Can Continue to Provide Core Services to Residents,” as such draft is amended by the November 4, 2016 email from Jordan Wright to Irwindale Finance Director Eva Carreon (“Report”). We understand and expect that this letter will be made public as a part of the Report.

Irwindale prides itself on its commitment to being transparent and following best practices that meet or exceed industry standards. We welcome any suggestions to improve Irwindale’s operations; provided the suggestions are constructive and based on accurate facts. Regrettably, many suggestions in the Report are based on incorrect statements of fact, state law, and, as such, much of it fails to yield constructive advice beyond the generic statements in the Recommendation section of the Report.

The Report identifies 11 objectives, with one catch-all objective. We note that through the extensive review of Irwindale’s files, electronic and hard copies, the Report does not find that Irwindale violated any law. Nor does the Report find any mismanagement or fraud as to any part of the City’s operations. It also does not find any issue with the City’s governance structure. Instead, it predominately criticizes and disagrees with spending priorities of the City, a role that is beyond the CSA’s assigned objectives. As explained below, the main conclusion of the Report, which forms the title of the Report, is flawed and renders the audit undertaken by the CSA, at California taxpayer expense, of questionable value.

Recommendations in Report:

The Report includes 11 recommendations, 3 of which are specifically focused on a perceived budget crisis that the CSA argues Irwindale has not adequately addressed. Although Irwindale generally accepts most of the Recommendations of the Report, as explained below, those Recommendations do not match many of the Report’s unfounded criticisms.

Recommendation No. 1:

The Report makes the following recommendation related to the City’s financial situation:

“To address the structural deficit in its general fund, the city should seek long-term solutions to balance its budget so that its expenditures do not exceed its revenues. The city should document its approach in a long-term plan.”

By itself, the recommendation is welcomed and Irwindale does not take issue with its wording. In fact, well before the draft Report was presented, the City Council had already directed the City Manager to “[r]efine and finalize a five-year financial model for effective budget planning” as part of his employment contract amendment approved on September 14, 2016.

The Report, however, goes on to paint a contorted picture of Irwindale being fiscally irresponsible. Irwindale is proud of - and indeed believes it should be commended for - having weathered the Great Recession, commencing in 2008, which still has lagging effects on municipalities nationwide. Irwindale did so by prudently putting money away in its general fund reserves for many years before 2008.

Irwindale experienced positive operating revenues before the Great Recession and has realized the return of this trend as of Fiscal Year 2015-16, and going forward into Fiscal Year 2016-17 and beyond. This will be demonstrated in the City’s audited financial statements expected to be completed this month. Indeed, the City’s Finance Director provided the CSA with the chart enclosed as Exhibit A from the City’s auditors, Lance, Soll & Lunghard, LLP demonstrating that the City expects to enjoy an operating surplus in the current year just ended Fiscal Year 2015-16.

The CSA has refused to acknowledge that Irwindale expects positive operating revenues, which started Fiscal Year 2015-16 because the audited financial statements have yet to be finalized to prove these representations. However, the CSA refused to wait another two weeks to finalize the Report to allow Irwindale’s audited financial statements to be finalized. We question what the CSA’s motivation is to rush the Report, other than to avoid the discredit of having spent over 7 months and hundreds of thousands of California taxpayer dollars on a report that had little to criticize beyond making general statements applicable to any municipality in this State.

Irwindale was able to develop significant general fund reserves to be available for tough economic times by undertaking several difficult, yet innovative measures. It adopted special and general taxes on Irwindale’s abundant mining, processing and recycling operations to pay for the repair and upkeep of the City’s infrastructure impacted by such operations, as well as medical prescription care for its residents directly impacted by the dust, emissions, noise and other pollution from such operations. Irwindale further aggressively pursued redevelopment projects to transform unproductive land to beneficial uses, including the award-winning 2.2 million square foot Irwindale Business Center, a former mining operation turned commercial and industrial complex. Moreover, Irwindale purchased former mining quarries, which has allowed it to yield both one-time sales revenues as well as mining taxes and royalties for the next 20 years. These prudent actions allowed Irwindale to operate during the Great Recession, without interruption to resident services, cutting resident programs or benefits, laying off any of its labor force, or allowing its infrastructure to deteriorate.

Curiously, the Report not only fails to recognize Irwindale for such innovative, prudent, well-planned actions, but instead criticizes Irwindale for not doing more and not having a long term financial plan. Certainly, the actions that protected the City from having to implement drastic cuts following the Great Recession seem to be a far more valuable investment of City resources than the creation of a plan, as if such plan would prove to be a panacea in avoiding the unprecedented impacts on Irwindale (along with other municipalities nation-wide) during the Great Recession. The CSA is no doubt aware that, unlike Irwindale, many other municipalities had to implement drastic cuts, layoffs, bankruptcy protection and other measures with devastating effects on the lives of those impacted.

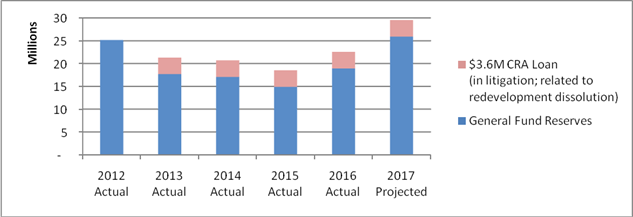

Irwindale recognizes that it faced several years of deficits in its general fund operations, beginning immediately after the Great Recession. However, and despite those deficit years, Irwindale still enjoys a $18.9 million General Fund Reserve, representing 97% of the annual operating expenses for Fiscal Year 2015-16. We suspect many cities would be envious of Irwindale’s ability to achieve this result, while avoiding any painful cuts to resident services or staffing. Furthermore, in the current Fiscal Year 2016-17, the City has already finalized transactions which will realize one-time financial gains of $7 million, effectively increasing its General Fund Reserves to $25.9 million and surpassing its pre-recession levels. See the chart below showing these projected General Fund Reserves, which presents a vast contrast to the dire picture portrayed in Figure 5 of the Report:

Recommendation No. 2.

The Report irresponsibly suggests Irwindale is overly generous to its employees in the following recommendation:

“Considering the city’s retirement benefits are more generous than those of most comparable cities, and in light of its financial situation, the city should reduce its employee benefits costs by negotiating with employee bargaining groups and key management employees.”

In the abstract, this recommendation would seem reasonable if it were not that Irwindale currently pays salaries that are in the lower range of comparable cities, as the Report recognizes (See Report, at Table 4, entitled “City of Irwindale’s Salaries for Key Management Rank Mostly in the Middle to Low Ranges Among the Generally High Salaries for Comparable Cities’ Management Positions, Calendar Year 2015”). The Report should be more balanced in making a total comparison of employee compensation. Certainly, the City should be able to offer competitive benefits to offset these lower salaries so that overall compensation to its employees remains sufficient to retain and attract experienced personnel. The failure of the Report to acknowledge this should make readers suspicious of the Report’s genuineness and value.

Irwindale further questions the Report’s conclusion that its employee benefits are generous. Such a statement must be made in terms of benefits relative to surrounding cities. For example, the Report criticizes the City’s payment of an in-lieu fee of $309 to employees who opt out of medical benefits, which in-lieu fee represents one-half of the average monthly cost of single-employee medical insurance. However, the Report then compares these payments to those paid by the State to its employees. A more candid comparison should be to that of comparable cities. That comparison, to the contrary, confirms that Irwindale actually pays in-lieu benefits at the lowest range of comparable cities. In fact, Irwindale’s in-lieu medical cash benefit is the second-to-lowest out of 13 nearby cities, as demonstrated in the table below.

Again, the Report’s misleading and dishonest comparisons put in question its overall value.

| CITY | CASH IN LIEU BENEFIT | RANK |

|---|---|---|

| Irwindale | $309 | 12 |

| Azusa | $823* | 7 |

| Baldwin Park | $1,325* | 2 |

| Claremont | $1,154* | 6 |

| Covina | $483* | 9 |

| Glendora | $1,275* | 3 |

| Monrovia | $448* | 10 |

| San Gabriel | $1,568 | 1 |

| Diamond Bar | $1,235* | 4 |

| Duarte | $406* | 11 |

| Montclair | Not Available | - |

| San Fernando | $769* | 8 |

| South El Monte | $100 | 13 |

| Arcadia | $1,226* | 5 |

Sources: Other cities’ most current, publicly available management employment agreements; other cities’ most current benefit data available on cities website

Note: Some data in table may not be current as it is based on the most recent publicly available information for each City

*Average amount as cash in lieu varies by classification and/or hire date

Moreover, the Report criticizes Irwindale for failing to reign in retirement expenditures for its work force. It takes issue with Irwindale’s payment of a California Public Employee’s Retirement System (“CalPERS”) pension of 2% at age 55 and a Retirement Enhancement Plan supplement from Public Agency Retirement Services (“PARS”) of 1% at age 55, for a 3% total pension at age 55. The Report acknowledges that the PARS is only available for those hired before January 1, 2013. What the Report fails to acknowledge, despite the repeated efforts of Irwindale staff and City Attorney to point out, is that the Irwindale City Council proactively eliminated the PARS benefit. Instead, it argues that Irwindale only did so when facing State legislation to eliminate this benefit. This is simply disingenuous. Even before the introduction of the California Public Employees' Pension Reform Act of 2013 (“PEPRA”) in 2011, and by July 1, 2010, following lengthy employee negotiations, Irwindale employees were required to begin contributing toward this benefit. New employees hired after July 1, 2010, were required to contribute 50% toward this benefit.

As for the PERS contributions, the Irwindale City Council negotiated and implemented the following costs savings: All new employees hired after July 1, 2010 were required to pay the full employee contribution. Additionally, effective November, 2010 current employees were required to pay 1% of employee contribution, by July 1, 2011, that increased to 2% of employee contribution, by July 1, 2014, that again increased to 4% of employee contribution and finally, by July 1, 2015 current employees pay the full 7% of employee contribution. This demonstrates the Irwindale City Council’s initiative in aggressively reigning in these retirement benefits.

Recommendation No. 3.

The Report attempts to sound alarm bells by suggesting Irwindale will somehow deplete its reserves in paying employee leave balances in the following recommendation:

“To ensure it does not deplete its reserves to reduce long-term liabilities, the city should annually determine whether it has sufficient funding to cash out employee leave balances. Additionally, in future labor negotiations, the city should explore the possibility of eliminating or reducing voluntary leave balance cash outs by employees, and eliminate sick leave cash outs altogether.”

Irwindale does not take issue with any suggestion that the City Council should continue to negotiate with its employee associations with the City’s budget in mind. To this end, the Council habitually reviews its reserves and encourages cash outs so that leave balances do not grow to be too large and cashed out at higher amounts in future years when employee salaries grow over time. This further reduces the City’s future long-term liabilities.

Additionally, the Report fails to mention that cash-outs of sick leave time has become a common negotiated benefit amongst cities. In fact, 9 out of the 13 cities surveyed by the CSA itself provide for sick leave cash out payments. In 2009, the City Council further restricted the maximum amount of hours that can be cashed out in any given fiscal year to 100 hours total. Sick leave hours are not cashed out at 100%, rather the employees can cash out sick leave at the following percentage of their basic rate of pay:

25% over 100 days

50% 61-100 days

75% 1st 60 days

This demonstrates that Irwindale is implementing appropriate restrictions and follows practices common to the majority of the cities surveyed by the CSA. Why the CSA fails to disclose that this is a common benefit paid to municipal employees remains a mystery. The Report should instead be objective and hold Irwindale to the same standards as other cities, especially the very ones the CSA surveyed.

Recommendation No. 4.

As to Irwindale’s resident benefit program, the Report recommends that:

“To reduce the cost of its prescription drug benefit program, the city should enact limits on the number or dollar amount of prescriptions an individual can receive each year.”

Irwindale accepts this recommendation and notes that the Report acknowledges the City Council has made significant strides at reducing the resident benefit program costs as recently as this year. The Report correctly explains that the Irwindale City Council hired a consultant in August 2014 to review the program and propose cost-reducing measures to extend the life of the program. That effort resulted in an approximately 10% annual savings in the program.

The Report nevertheless criticizes Irwindale for providing its residents with generous prescription care benefits and suggests it should implement a generic benefit discount program, such as the one provided through the California League of Cities and available to all cities in the State. This policy opinion ignores impacts Irwindale residents endured from the effects of mining, beginning before its incorporation and for over a century. Those very mining operations were the source of the vast majority of crushed rock and gravel used to develop Los Angeles County’s freeways and other thoroughfares. While Los Angeles benefitted from the mining activities, Irwindale residents did not. They experienced only the negative health benefits of hosting the dust, pollution and noise attendant with such mining operations.

The decision to repay its residents with more than generic benefits available to anyone in California is not within the objectives assigned to CSA, nor is its role to second guess the policy makers of Irwindale or question whether Irwindale can produce reports directly linking such mining operations to health impacts of its residents. The catch all objective of the Report to “Review and assess any other issues that are significant to the audit” should not be used as a ruse by the CSA to delve into matters of policy entrusted to the Irwindale City Council, especially given the City’s Charter recognizing the ongoing effects of mining to its residents. Indeed, if Irwindale spent that money to bolster other programs for its residents, such as improved recreational facilities, an enhanced library or other services or programs the CSA values as more traditional for a municipality, there would not be such criticism.

Despite the Report’s criticism, the Irwindale City Council remains committed to continuing its efforts to further reduce the costs of its resident benefit program. Irwindale staff remains vigilant in reviewing options for the program to be more cost effective, without compromising Irwindale’s mission of repaying its residents for the years of exposure to the effects of mining.

Recommendation No. 5.

The Report takes issue with the City’s distribution of overtime pay to its officers in the following recommendation:

“To promote public safety and equity among police officers, the city should implement a rotational order for scheduled overtime pay to prevent some officers from working excessive shifts.”

The body of the Report goes further to criticize Irwindale for not hiring more police officers to reduce the cost of overtime pay. Irwindale generally accepts the recommendation that it try to reduce the cost of overtime pay to its police personnel. However, the Report ignores some key facts.

First, as the response from Irwindale’s Finance Director enclosed herewith as Exhibit B demonstrates, the majority of police overtime is attributed to multiple police officers being out on medical leave. To control spending, Irwindale has not hired additional officers to cover these leaves due to a hiring freeze, a measure imposed by the City Council to address the City’s deficit spending. Although several officers may be out on medical leave at any given time, they must legally remain on the City’s payroll. If the City hired additional officers to cover temporary leaves, it would then be overstaffed and extremely over budget.

The majority of the officer vacancies leading to overtime pay expenditures is due to approximately 5 vacancies that were filled in the last 2 years, for which new recruits had to undergo a 3 month training process. Although the Irwindale Police Department does not often experience vacancies, when they occur, the recruitment process, background checks, and 3 month training, takes several months before a new officer can be fully utilized on the force. This vacancy time also needs to be covered by overtime in addition to the officers out on medical leave.

A cost analysis performed by the City confirms that paying overtime is significantly more cost effective than hiring additional officers. This analysis compares the fully-burdened cost of an officer on the force, which includes all compensation and benefits costs against the overtime rate. The analysis demonstrates that paying the overtime rate would cost significantly less than the fully-burdened cost of hiring a new officer. For example, the fully burdened cost of a newly-hired officer at a lower salary step is $61.08 per hour. The overtime pay for an officer at the same salary step is $51.45 per hour. The overtime rate is paid at “time and a half” and is derived based on the officer’s hourly wage, plus additional factors, including certificates, special assignment pay, bilingual pay, etc., which vary per officer. Thus, the fully-burdened hourly rate of a full-time officer, even a newly hired officer, is about 19% higher than the overtime rate of an existing officer at the same salary range.

Additionally, the overtime shifts and maximum allowable work hours were created through negotiations between the City and Irwindale Police Officers Association and are reflected in an approved memorandum of understanding between the parties. They are based on a policy created to maintain officer safety levels and wellness per the Lexipol policy and procedure manual, which is adopted by 1,400 agencies, representing 81,000 law enforcement and fire personnel nationwide. As such, the overtime hours worked do not exceed the amounts that have been studied and fully vetted as being within safe levels. Thus, the Report’s conclusion to the contrary, and that these shifts are “excessive,” is unsupported.

Recommendation No. 6.

The Report then takes issue with the City’s purchasing policy exempting professional services from strict bidding requirements stating:

“To help ensure it receives the best value for contracts it exempts from competitive bidding, the city should revise its purchasing policy to require its staff to document in the contract file evidence that the price is fair and reasonable.”

The practice of exempting professional services from the bidding requirements aimed at awarding bids to the lowest-responsible bidder is based on the need to assure the City secures professionals with appropriate qualifications. Further, there is no evidence whatsoever provided by the Report that Irwindale pays anything other than competitive rates in its award of bids. As Irwindale staff has explained to the CSA repeatedly, purchasing policies such as Irwindale’s exempting professional services are adopted by the majority of public agencies in California and for good reason. Irwindale, for example, must hire engineering firms with demonstrated expertise to oversee the appropriate method to reclaim former mining quarries, which are often hundreds of feet deep, and convert them to productive end uses. Few firms have this expertise and, as such, considerations other than price are tantamount.

Nevertheless, despite the need to find experienced professionals to best advise the City, the City still negotiates with successful bidders to assure the applicable compensation is equal to that of the low bidder. Irwindale staff has provided the CSA with this explanation in the context of the geologic engineering contract services that the Report criticizes. (See Exhibit C) The CSA refused to acknowledge this response in its Report. The City will nevertheless consider revisions to its Purchasing Policy to reflect the practice described in Exhibit C; namely that the responsible staff member securing proposals for professional services be required to negotiate a fair price with the selected firm, which price can be based on any lower cost proposals received, survey of the market for such services or other applicable pricing structures.

Recommendation No. 7.

The Report makes the following recommendation as to the Irwindale Housing Authority’s low-income housing programs:

“The Housing Authority should consider options to provide low-income housing opportunities to more people. Additionally, if the Housing Authority intends to continue providing low-income housing opportunities in the future, the city should examine the available funding mechanisms available to continue providing low-income housing before it exhausts its Housing Authority fund balance.”

As discussed below, Irwindale takes issue with the first statement in this recommendation insofar as the Report criticizes Irwindale’s decision to give long-term residents - who are able to qualify for a loan under its First Time Homebuyer Programs - greater priority in purchasing low-income housing produced using Housing Authority funding. Insofar as this recommendation suggests that Irwindale is not doing enough to create more opportunities for low-income housing programs, Irwindale has continuously developed low-income housing in such large numbers so as to allow it to meet or exceed its State-mandated Regional Housing Needs Assessment (“RHNA”) for all income levels, ranging from extremely low to moderate income – an accomplishment most jurisdictions in California cannot claim. As explained to CSA staff by the City Attorney and is demonstrated in various closed session agendas, the Housing Authority tries to purchase any available land for development or existing homes to rehabilitate using Housing Funds whenever Housing Authority staff learns of the availability of residential properties for sale.

The second part of this recommendation, suggesting the Housing Authority preserve its funding is well taken, with some caveats. Namely, given Irwindale’s prudent investments of its Housing Fund, Irwindale has sufficient funding to continue to offer low income housing programs for approximately 20 more years, as the report acknowledges. We suspect few housing authorities in the State are so well situated to continue to provide for the needs of its low-income families, let alone meet or exceed its RHNA allocation through its own efforts and funding.

Recommendation No. 8.

The Report then again delves into policy issues entrusted solely to the Irwindale Housing Authority Board:

“To ensure that all residents have an equal chance to participate in the housing authority’s housing programs, the city should remove the long-term residency priorities from any future housing programs.”

It is unfortunate the CSA finds the need to interject itself into how Irwindale should structure its housing programs, a policy decision that is completely outside the stated mission of the CSA. Since the Report finds no violation of law, there is no other explanation for the CSA expressing opinions in this regard.

The Report suggests that State law is not a good practice for Irwindale to follow by recommending Irwindale follow federal law in implementing its housing programs. Federal law, it argues, does not allow preferential treatment to area residents. The CSA should perhaps take this issue up with the State legislature rather than suggest that State law is not a best practice. Indeed, there is nothing nefarious in granting residents priority in receiving municipal services and benefits, as has been confirmed by the United States Supreme Court, California Courts of Appeal and California Attorney General Opinions.1

Throughout Irwindale’s history of providing low-income housing programs, there has never been a single claim that Irwindale’s policy of prioritizing its residents, regardless of the length of residency imposed by its Housing Authority, somehow discriminates on the basis of race, religion, or other protected class. Any long-term resident of Irwindale, regardless of such protected class, will receive the first priority in securing a subsidized home. Shorter-term residents, again regardless of their membership in any protected class, will receive the next priority. If the interested residents are unable to ultimately qualify for a loan to purchase the home, non-residents have opportunities to purchase a home, as has been the case in virtually every housing program developed by the Irwindale Housing Authority. In the Olson First Time Homebuyer Program, for example, over 12% of the successful applicants were non-residents.

Irwindale does not take issue with the remaining three recommendations that it update its expense reimbursement policy, implement a fraud policy and implement a debt management policy. Indeed, Irwindale City Council will consider adopting a fraud policy at its regular Council meeting of November 9, 2016. Staff is working with its City Attorney to update its expense reimbursement policy and develop a debt management policy, and anticipates presenting these to the City Council before the end of the present fiscal year.

Conclusion:

We hope this response is accepted by the CSA and produces appropriate changes in the Report. Irwindale remains open and willing to further discuss the Report and corrections pointed out in this response. Please feel free to contact the undersigned should you wish to discuss this further.

Sincerely,

John Davidson, City Manager

Enclosures

cc: Irwindale City Council

1A representative sampling of such cases are:

Califano v. Torres, (1978) 435 U.S. 1, 5, where various old age and disability benefits under the Supplemental Security Income Act were payable only while the claimant resided in one of the 50 states or the District of Columbia. In response to an Equal Protection challenge, the court concluded that laws providing for governmental payments of monetary benefits are entitled to a strong presumption of constitutionality. “So long as its judgments are rational, and not invidious, the legislature's efforts to tackle the problems of the poor and the needy are not subject to a constitutional straitjacket.”

McClain v. City of South Pasadena, (1957) 155 Cal.App.2d 423, where the court upheld a municipal regulation restricting use of a public pool to residents of the city. The court there explained that such a distinction is reasonable where (1) the pool is maintained with the use of city taxpayer funds, (2) the pool is of such size and capacity that there was a need to assure the orderly use of the pool for maximum usefulness during the high season, and (3) the regulation excludes all nonresidents regardless or race, color or creed or similar illegal bases.

41 Ops. Cal. Atty. Gen. 39 (1963), where the California Attorney General’s Office upheld a city’s rule prohibiting access to some portions of its beaches in front of private residences. The Attorney General explained that so long as the larger beaches and areas at the end of public streets are kept open, the public was provided adequate alternative access to the beaches and ocean. As such, it was reasonable to prohibit the use of beaches in front of private residences or to charge non-residents a fee to use same. Go back to text

Comments

CALIFORNIA STATE AUDITOR’S COMMENTS ON THE RESPONSE FROM THE CITY OF IRWINDALE

To provide clarity and perspective, we are commenting on the city of Irwindale’s (Irwindale) response to the audit. The numbers below correspond to the numbers we have placed in the margin of Irwindale’s response.

Subsequent to sending Irwindale the draft copy of our report, we had two lengthy conference calls with city officials during which we agreed to make certain changes to our report to add their perspective on certain issues. Unfortunately, notwithstanding our efforts to address the city’s concerns, it has chosen to repeat these concerns in its response.

We conducted this audit according to generally accepted government auditing standards and the California State Auditor’s thorough quality control process. In following audit standards, we are required to obtain sufficient and appropriate evidence to support our conclusions and recommendations. Thus, we stand behind our conclusions and recommendations, which are based on clear and convincing evidence.

This paragraph references the following areas in the response from the City of Irwindale: 2a 2b

We are troubled by Irwindale’s suggestion that the decisions of its city council are somehow not to be questioned and beyond the scope of this audit. On the contrary, we believe the purposes for which Irwindale uses taxpayer funds, whether from residents or businesses, require diligent scrutiny. In fact, Irwindale’s spending priorities were of such concern to the Joint Legislative Audit Committee (Audit Committee) that it directed us to address three separate audit objectives—audit objectives 4, 5, and 6 shown in Table 1—that required us to examine Irwindale’s spending practices.

This paragraph references the following areas in the response from the City of Irwindale: 3a 3b

We follow generally accepted government auditing standards in conducting our work. In following audit standards, we are required to obtain sufficient and appropriate evidence to support our conclusions and recommendations. As is our standard practice, we engaged in extensive research and analysis for this audit to ensure that we could present a thorough and accurate representation of the facts. Facts led us to our conclusion that Irwindale must exercise more fiscal responsibility over its spending so that it can continue to provide core services to residents. Thus we stand by the report’s title, which is based on clear and convincing evidence. We are also disappointed that the city fails to recognize that our recommendations could lead to significant cost savings for the city. For example, if Irwindale implements our recommendation to replace its expensive prescription drug benefit program with the discount program offered by the League of California Cities, the city could save nearly $1 million each year.

Our report contains more than 11 recommendations, but Irwindale did not respond to all of them. We look forward to receiving Irwindale’s 60‑day response, which should describe its actions to address all of our recommendations.

Irwindale fails to acknowledge in its response that for each of the last six fiscal years, Irwindale’s city council has approved annual budgets that contained structural deficits (budgeted expenditures that exceed budgeted revenues). We do not consider this to be a “perceived” budget crisis, but rather an actual and lengthy budget crisis. As Table 3 shows on page 20, Irwindale overspent both its budgeted and actual revenue. Notwithstanding these ongoing structural deficits, the city has not developed a long‑term financial plan for balancing its budget, which should include projecting revenues and expenditures over a long‑term period, using assumptions about economic conditions, future spending scenarios, and other salient variables. In addition, the city council did not direct the city manager to prepare a five‑year financial model until the end of our audit—months after we began discussing these issues with the city.

This paragraph references the following areas in the response from the City of Irwindale: 6a 6b

Our conclusions and recommendations are based on sufficient and appropriate evidence in accordance with audit standards. Therefore, we find it perplexing that Irwindale generally accepts our recommendations and yet asserts that our report includes unfounded criticisms.

As is our standard practice, we provided Irwindale five business days to review our draft report and prepare a response. However, as is also our standard practice, we met with Irwindale representatives on multiple occasions to share our conclusions and recommendations and showed them most of the report’s text at our exit conference prior to sending the city our draft report.

Irwindale’s city council approved annual budgets that for each of the last six fiscal years contained structural deficits, which we believe was fiscally irresponsible. As a result of those deficits, the city has had to rely on its general fund reserves, which have declined significantly. As we describe here in our report, if the city continues to use its general fund reserves to finance its deficits, it will no longer be able to use those funds for their intended purposes, such as funding its $11.8 million outstanding liability for retiree health benefits.

As we discussed with city officials previously, we describe the one‑time gains and other revenue that the city realized in fiscal year 2015–16 and 2016–17 here in our report. In addition, we included the finance director’s assertion that the city’s general fund reserves will increase by $4 million by the end of fiscal year 2015–16. Nevertheless, the city has not developed a long‑term financial plan that describes how it will use these one‑time gains and revenue to fund its ongoing expenses and eliminate future structural deficits.

The exhibits referenced in the city’s response are available upon request from the California State Auditor.

This paragraph references the following areas in the response from the City of Irwindale: 11a 11b 11c

Irwindale is mistaken in its assertion that we did not acknowledge its recent positive operating revenues. As we discussed with city officials previously, we describe the one‑time gains and other revenue that the city realized in fiscal year 2015–16 and 2016–17 here in our report. We also note here that the $1.8 million in new mining revenue helped to cover the nearly $1 million gap between fiscal year 2015–16 revenue and expenditures. In addition, we included the finance director’s assertion that the city’s general fund reserves will increase by $4 million by the end of fiscal year 2015–16. Nevertheless, the city has not developed a long‑term financial plan that describes how it will use these one‑time gains and revenue to fund its ongoing expenses and eliminate future structural deficits.

Our report contains numerous findings that support our overall conclusion that Irwindale should exercise more fiscal responsibility over its spending so that it can continue to provide core services to residents. Further, our findings are not “general statements applicable to any municipality in the state” as the city contends. For example, it is highly doubtful that all other municipalities in the state carry budget deficits for years without creating any kind of a long‑term plan for balancing such budgets. We are also disappointed that the city fails to recognize that our recommendations could lead to significant cost savings for the city. For example, if Irwindale implements our recommendation to replace its expensive prescription drug benefit program with the discount program offered by the League of California Cities, the city could save nearly $1 million each year.

We are troubled that city officials do not see the obvious benefit in developing a long‑term financial plan for balancing Irwindale’s budget. Irwindale’s city council approved annual budgets for each of the last six fiscal years, that contained structural deficits, which we believe was fiscally irresponsible. As a result of not taking appropriate actions to balance its budgets, the city has had to rely on its general fund reserves, which have declined significantly. As we describe here of our report, if the city continues to use its general fund reserves to finance its deficits, it will no longer be able to use those funds for their intended purposes, such as funding its $11.8 million outstanding liability for retiree health benefits.

We are confused as to why Irwindale would suggest that this information is in vast contrast to the information presented in our report. Specifically, the city’s general fund reserves, as shown in its response for fiscal years 2011–12 through 2014–15, mirror the amounts shown in Figure 5. In addition, here in our report, we include the finance director’s assertion that the city’s reserves will increase by $4 million in fiscal year 2015–16, which equates to approximately $18.9 million. We did not provide information in our report on the level of reserves for fiscal year 2016–17, because the year is far from complete, and the amount shown in the city’s response is a projection.

As we state here, Irwindale provides key management and all full‑time staff with pensions that are more generous than any of the other comparable cities.

Irwindale misconstrues our point. Table 4 shows that, while many of Irwindale’s salaries for its key management positions are in the middle to low range, the city is similarly in the middle to low range of comparable cities in terms of expenditures, population, and size. Thus, Irwindale’s salaries are competitive with comparable cities. We make no recommendations related to Irwindale’s salaries, but rather find that Irwindale’s pension benefits are high compared to other cities. In particular, as shown in Table 5, most of Irwindale’s full‑time employees are eligible to receive a pension of 3 percent for each year of service at age 55. This is the highest pension benefit among all the cities shown in Table 5.

Irwindale’s comment that our report contains misleading and dishonest comparisons is entirely unfounded. We discuss Irwindale’s “cash in‑lieu of health benefits” payment because the Audit Committee asked us to examine all employee benefits. Although we point out in our report that the city’s payment is higher than what the State offers its employees in similar circumstances, we did not make any recommendations that the city change this small benefit. Rather, we focused on the more significant benefits that the city offers its employees, such as the pension benefits that are the highest of those offered by comparable cities.

Irwindale’s assertion that it proactively eliminated the PARS benefit is inaccurate. As we explain here in our report, the city required employees hired before January 1, 2011 to contribute 0.4 percent of their salaries toward this benefit and those hired on or after January 1, 2011 and before January 1, 2013 to contribute 7.485 percent of their salaries (the full employee share of the total contribution). The Public Employees’ Pension Reform Act of 2013 prohibits employees hired after January 1, 2013 from participating in PARS. Finally, Irwindale fails to mention in its response that the majority of its employees—52 of 76— were hired before January 1, 2011 and thus continue to receive the generous PARS benefit while only contributing to a very small portion of the cost of this benefit.

Contrary to Irwindale’s assertion, in Table 5 in our report and in the text we acknowledge that as of July 2015 the city requires all employees to pay the entire employee portion of the CalPERS required contribution.

As we state here, as a sound financial practice, we would expect that voluntary leave cash‑outs would be contingent upon the city having available cash. Instead, from fiscal year 2011–12 through 2015–16, the city paid more than $1.5 million in leave cash‑outs while budgeting for deficits in each of those years that ranged from nearly $1 million to as high as $3.9 million.

This paragraph references the following areas in the response from the City of Irwindale: 21a 21b

Regardless of whether other cities provide this benefit, Irwindale has faced continued budget deficits, as Table 3 on page 20 shows. As a sound financial practice, we would expect Irwindale to make voluntary leave cash‑outs contingent upon the city having available cash.

Irwindale overstates its efforts to reduce costs. In fact, here we explain that the city has been reluctant to implement changes to its prescription drug benefit program. Specifically, we note that the city council rescinded increases it had previously made to the copayment requirement and rejected the consultant’s more significant recommendations to increase the copayment for all participants to $10 and to implement a coordination of benefits that would make Irwindale’s program a secondary payer to residents’ private health insurance.

This paragraph references the following areas in the response from the City of Irwindale: 23a 23b

We are puzzled by Irwindale’s vehement defense of its prescription drug program. It would be irresponsible for us not to call attention to a program for which the city spends nearly $1 million each year, and that disproportionately benefits a very small segment of its population, as we explain here. Additionally, as we state here, the city has neither adequately demonstrated the need for the program nor made sure it is cost‑effective. Finally, as we describe here, there is a cost‑free alternative program offered by the League of California Cities that Irwindale could put in place. Thus, we believe it is an issue appropriate to the objectives of the audit.

This paragraph references the following areas in the response from the City of Irwindale: 24a 24b

Irwindale mischaracterizes our conclusion. We do not criticize the city for not hiring more police officers. Instead, as we state here, the city has not performed an adequate analysis to determine whether the police overtime is cost‑effective or whether police department staffing levels are appropriate for addressing its policing needs. Further, Irwindale did not address our recommendation that it evaluate the possibility of contracting with the Los Angeles County Sheriff’s Department for police services, which would reduce costs by an estimated $1.8 million and increase sworn law enforcement personnel by 11 percent. Additionally, Irwindale did not provide us the cost analysis it refers to in its response; it only provided the analysis we describe on page 36.

This paragraph references the following areas in the response from the City of Irwindale: 25a 25b

As we state here in our report, the police department policy does not address the effect of consecutive weeks of overtime, and here we discuss how the city’s own police chief at the time expressed concern about the overtime being unsafe. It is surprising to us that the city would ignore the concerns of its police chief and instead continue to allow five individuals to perform the bulk of the overtime. Finally, Irwindale provided no evidence to support its assertion that the overtime hours worked do not exceed the amounts indicated in the Lexipol policy.

Irwindale could provide no evidence that it performed a price analysis to ensure it received fair and reasonable prices for the 11 contracts we refer to in the last paragraph here. Irwindale’s contention that the lack of evidence showing prices were not competitive somehow ensures they were competitive is illogical. Further, as we explain here of our report, the city did not perform a price analysis to ensure it obtained a fair price when it renewed this contract for geologic engineering services in 2013.

This paragraph references the following areas in the response from the City of Irwindale: 27a 27b

Irwindale misunderstands our critique. We do not criticize the Housing Authority’s decision to give a preference to residents over non‑residents; however, we do take issue with the Housing Authority giving preferences to residents based on how long they have lived in Irwindale. The durational residency preferences that the city has established are arbitrary and forbidden by the federal government under its programs. The city has not established a compelling reason for giving preferences to some residents over other residents and non‑residents based on three and fifteen‑year residency thresholds.

Irwindale misses our point. As we state here, the city spent nearly $1 million dollars in its Mayans program to provide forgivable housing loans to three individuals. Given its limited funding, we believe the Housing Authority should consider options to provide opportunities to more people. During our fieldwork, we reviewed housing programs in other cities and could find none that provided anything close to the amount of funds Irwindale does—many offer loans of less than $80,000 dollars per household.

Irwindale misinterprets our statement. We do not acknowledge that the Housing Authority has sufficient funding to continue its housing programs for 20 more years. Instead, as we state here, the Housing Authority’s fund balance will decrease 39 percent over the next 20 years as a result of it forgiving its housing loans, thereby limiting its ability to carry out future housing projects. Although the loans will not be completely forgiven until then, the Housing Authority has already loaned the funds and thus can no longer use them unless the homeowner breaches the agreement and Irwindale recovers the funds.

We are troubled by Irwindale’s assertion that the decisions of the Irwindale Housing Authority are somehow not subject to the audit’s objectives. On the contrary, we believe that the purposes for which the Housing Authority uses taxpayer funds require diligent scrutiny, which extends beyond just determining whether there were any violations of law. In fact, housing was of such concern to the Audit Committee that it directed us to address a specific audit objective— Objective 10 shown in Table 1 on page 16—that required us to examine Irwindale’s ownership of residential property, including rental practices and property sale practices.

Irwindale grossly mischaracterizes our report by asserting that somehow our recommendation that the city remove the long‑term residency priorities from any future housing programs suggests that state law is not a good practice for Irwindale to follow. Nor do we state or imply that Irwindale’s housing program is nefarious. On numerous occasions the U.S. Supreme Court has invalidated durational residency preferences or requirements in connection with public benefits on constitutional grounds. The California Supreme Court has cited these cases and incorporated their principles. Our recommendation that Irwindale remove the long‑term residency preferences from any future housing programs as a best practice is a means for the city to avoid the risk of litigation and help to ensure equal opportunity in its housing programs.

The antiquated cases and attorney general opinion that Irwindale cites in its response are simply not on point because they do not address durational residency preferences—where the preferences are based on how long a person has lived in the jurisdiction—which is what we questioned.

This paragraph references the following areas in the response from the City of Irwindale: 33a 33b

We are mystified by Irwindale’s argument. The city’s assertion that no claims of discrimination have been made in the past is not a justification for not taking steps to help ensure equal opportunity in its housing programs.