Chapter 1

COVERED CALIFORNIA MUST CONTINUE TO MONITOR ITS FINANCIAL SUSTAINABILITY AND ENROLLMENT PROJECTIONS TO ENSURE ITS SOLVENCY

Chapter Summary

Covered California has demonstrated progress in implementing key federal and state requirements that pertain to establishing a health insurance exchange (exchange), but some concerns remain. In our July 2013 report we recommended that Covered California conduct regular reviews of enrollment, costs, and revenue and make prompt adjustments to its financial sustainability plan as necessary. During this current audit we found that Covered California has conducted these reviews and made necessary adjustments as part of its annual budget process. Nevertheless, to better ensure its financial sustainability, Covered California should formally analyze whether its proposed reserve is adequate and determine the steps it would take to reduce its operating expenditures in the event that enrollment significantly decreases. For instance, it could identify the contracts it would eliminate to reduce its expenditures.

This audit found that Covered California has annually updated its enrollment projections. Using six key assumptions to determine its multiyear enrollment projections, Covered California has developed a range of enrollment estimates, from low to high, which show continued enrollment growth through fiscal year 2018–19.

To help ensure that Covered California meets its enrollment projections, the marketing division develops and executes marketing campaigns promoting the products and services offered through the State’s exchange. In addition, Covered California has established a network of certified enrollment representatives consisting of entities and individuals that educate consumers on, and enroll them in, qualified health plans (QHPs) and the California Medical Assistance Program (Medi Cal).

Although Covered California Has a Plan to Help Ensure Its Financial Sustainability, It Must Complete a Formal Analysis of Whether Its Reserve Is Adequate

State law requires Covered California’s board of directors (board) to ensure that the costs of establishing, operating, and administering the exchange do not exceed the combination of federal funds, private donations, and other available money. Covered California may not use money from the State’s General Fund to help support its operations. Its revenue is generated from plan assessments—charges on the QHPs that insurance issuers offer, as state law requires and as discussed in the Introduction. As a result, if Covered California falls short of achieving its enrollment goals, its financial condition will suffer.

In our July 2013 report we found that, given the limits of its information at the time, Covered California appeared to have engaged in a thoughtful planning process to ensure that it would remain solvent in the future. We also noted that Covered California’s financial plans greatly depend on patterns of enrollment in its QHPs by individuals and small business employers, which could only be projected at that time. Consequently, we concluded that financial sustainability would continue to be an area of risk that would need to be closely monitored, and we recommended that Covered California conduct regular reviews of enrollment, costs, and revenue and make prompt adjustments to its financial sustainability plan as necessary.

During our current audit we found that Covered California has conducted these reviews and made necessary adjustments as part of its annual budget process. According to Covered California’s Fiscal Year 2015–2016 Budget (2015–16 budget), this process was conducted over six to seven months, with particular attention paid to updating its enrollment forecast, which relies to a great extent on its actual enrollment experience in 2014 through the end of the second open enrollment period in February 2015. The goal of this process is for Covered California to ensure that its revenues will cover its expenditures for each fiscal year as state law requires. For fiscal year 2015–16 Covered California created a robust budget document that outlines the steps it needs to be financially sustainable. In that document Covered California explains that its fiscal year 2015–16 budget reflects a multiyear financial strategy of providing continuous fiscal integrity, transparency, and accountability. The budget includes low, medium, and high enrollment forecasts and corresponding revenue projections. In its budget Covered California states that, to the extent that enrollment varies from the medium forecasted amounts, it will be able to adjust its revenue by increasing or decreasing its plan assessments or by adjusting its budgeted expenditures.

Table 2 shows Covered California’s multiyear budget forecast through fiscal year 2018–19. As the table indicates, Covered California projects that expenditures will decrease while revenues increase so that both are balanced at approximately $300 million in fiscal year 2017–18—the first year in which Covered California estimates that its operations will break even. Covered California plans to begin fiscal year 2016–17 with approximately $197 million in reserve funding to address any unforeseen economic uncertainties and to facilitate the transition to supporting its operations solely on plan assessments. The table also shows that in the beginning of fiscal year 2015–16, Covered California estimated that $100 million in federal establishment funds were remaining. As of November 2015, documentation provided by Covered California indicated that it had roughly $107 million in federal funds remaining, which it can spend on a variety of purposes, including consulting with stakeholders and developing information technology (IT). As described in the Introduction, the federal government has extended the deadline by which Covered California must spend these funds to September 30, 2016, and Covered California intends to ensure that it will exhaust these funds by that deadline. Table 3 summarizes Covered California’s progress in complying with certain federal and state requirements for funding its operations.

| Fiscal Year | ||||

|---|---|---|---|---|

| 2015–16 | 2016–17 | 2017–18 | 2018–19 | |

| Effectuated enrollment* | 1,476,342 | 1,666,617 | 1,809,095 | 1,977,792 |

| Beginning balance of unrestricted funds | $197.9 | $197.2 | $156.4 | $160.0 |

| Balance of federal establishment funds | 100.0† | - | - | - |

| Opening balance | ||||

| Plan assessments—cash basis | $234.4 | $269.2 | $303.6 | $329.2 |

| Total funds | ||||

| Expenditures | ($335.0) | ($310.0) | ($300.0) | ($300.0) |

| Year-end operating reserve | ||||

| Estimated number of months the operating reserve will cover expenditures | 7.1 | 5.6 | 5.4 | 6.1 |

Sources: Adapted from Covered California’s Fiscal Year 2015-2016 Budget (2015–16 budget), dated June 30, 2015, and documentation provided by Covered California’s financial management division.

* Effectuated enrollment is the number of enrollees who complete an application, select a qualified health plan, and pay at least their first month’s premium.

† Although Covered California estimated in its 2015–16 budget that it would have $100 million in federal funds for this fiscal year, as of November 25, 2015, Covered California reported that it had roughly $107 million of these funds remaining that it plans to spend by September 30, 2016.

Covered California’s 2015–16 budget indicates that if it falls short of meeting its enrollment goals, it will consider increasing plan assessments, reducing costs, or using its reserves to maintain its solvency. Covered California’s interim chief actuary stated that a large body of work from different health economists shows that if health insurance premiums were to increase by 1 percent, with all other factors held constant, the resulting reduction in enrollment would not be significant—between 0.2 and 0.6 percent. Therefore, Covered California believes that if it needs to moderately increase its plan assessments, the small increases that insurance issuers would distribute across all of their California members would have little effect in causing current enrollees in the exchange to cancel their coverage or in deterring individuals from enrolling in the future.

| Requirements For Covered California | Progress Toward Completion | Steps That Covered California Has Taken |

|---|---|---|

| Federal | ||

| Have sufficient funding to support its ongoing operations beginning January 1, 2015.* | ↑ | Created a financial sustainability plan (financial plan), which it submitted to the federal government in November 2012 as a part of its grant application. Through its annual budget process, Covered California conducts reviews of enrollment, costs, and revenues; develops multiyear budget forecasts to help ensure its financial sustainability going forward; and makes necessary adjustments. |

| State | ||

| Assess a fee on the qualified health plans (QHPs) offered by health insurance issuers through the health insurance exchange (exchange) that is reasonable and necessary to support the operations of the exchange. | ↑ | Established an initial fee of $13.95 assessed on a per-member, per-month basis for individual QHPs sold through the exchange and created a similar fee structure for QHPs offered to small businesses. In its Fiscal Year 2015–2016 Budget, Covered California indicated that it will consider adjusting the fees, or plan assessments, based on enrollment. |

| Maintain enrollment and expenditures to ensure that expenditures do not exceed revenue, and institute appropriate measures to ensure fiscal solvency. | ↑ | Through its annual budget process, Covered California develops a budget to help ensure that it covers operating costs under a range of enrollment scenarios. Beginning in fiscal year 2013–14, its goal has been to maintain a three- to six-month reserve. |

Sources: 42 United States Code, section 18031; 45 Code of Federal Regulations, part 155.160; California Government Code, section 100503; Covered California’s 2012 Financial Sustainability Plan; and Covered California’s Fiscal Year 2015–2016 Budget.

* Covered California must spend its remaining federal establishment grant funds by September 30, 2016. These funds can be used for establishment costs but cannot be used to support ongoing operations.

↑ = Progressing as expected.

According to Covered California’s 2015–16 budget, an increase in its plan assessments would require between nine and 18 months to have an impact on revenue. As explained by its chief financial officer, this delay would be necessary because an increase in the plan assessments must be approved by Covered California’s board and then presented during Covered California’s next round of negotiations with insurance issuers for the following plan year. Consequently, a plan assessment increase can take effect only on January 1 of the year following the next contract negotiation. According to Covered California’s Health Insurance Companies and Plan Rates for 2016, QHP premiums increased by an average of approximately 4 percent in 2015 and 2016; however, Covered California has not increased its plan assessments. For the projections it includes in its 2015–16 budget, Covered California used its monthly plan assessments for the individual and small business markets of $13.95 and $18.60, respectively, as the basis for its projections through fiscal year 2018–19.

Covered California projects that its expenditures will decrease and level out over the next several years and that it will achieve a balance between its revenues and expenditures in fiscal year 2017–18. Specifically, its costs for the California Healthcare Eligibility, Enrollment, and Retention System (CalHEERS) and for outreach, sales, and marketing represented 70 percent of Covered California’s expenditures in its fiscal year 2013–14 budget. In subsequent fiscal years expenditures for CalHEERS have decreased, and Covered California projects that expenditures for outreach, sales, and marketing will decrease for the current fiscal year. In its 2015–16 budget Covered California projects that these expenditures will continue to decrease through at least fiscal year 2016–17 as it becomes more established. Table 4 presents a breakdown of Covered California’s budgeted and actual expenditures for the last two fiscal years and its budgeted expenditures for fiscal year 2015–16.

| Fiscal Year 2013–14 | Fiscal Year 2014–15 | Fiscal Year 2015–16 | |||||

|---|---|---|---|---|---|---|---|

| Budget | Actual* | Budget | Actual* | Budget | |||

| Service centers† | $64,732,239 | $79,031,302 | $97,022,224 | $96,836,382 | $100,103,078 | ||

| California Healthcare Eligibility, Enrollment, and Retention System (CalHEERS) | 181,042,718 | 114,714,737 | 88,177,616 | 93,607,718 | 42,410,485 | ||

| Outreach & sales, marketing‡ | 134,218,916 | 131,718,285 | 189,831,459 | 153,558,948 | 121,512,473 | ||

| Plan management and evaluation | 22,788,018 | 4,939,390 | 17,334,578 | 11,286,694 | 17,300,582 | ||

| Administration | 36,556,839 | 32,571,736 | 37,796,386 | 36,460,965 | 46,159,372 | ||

| Other expenditures# | 9,504,885 | 151,547 | 12,589,363 | 1,543,057 | 13,493,138 | ||

| Total expendituresll | $448,843,615 | $363,126,997 | $442,751,626 | $393,293,764 | $340,979,127 | ||

Sources: California State Auditor’s analysis of data obtained from Covered California’s data as maintained in the California Department of Finance’s California State Accounting and Reporting System; Covered California Policy and Action Items, dated June 19, 2014; Covered California’s Fiscal Year 2015–2016 Budget, dated June 30, 2015; and budget reconciliation documents provided by Covered California.

* These amounts exclude prior year expenditures for each fiscal year and any pass-through payments to issuers of qualified health plans (QHPs) and insurance agents.

†Covered California’s service centers are staffed by representatives who assist both consumers and certified enrollment representatives with understanding health plan options, determining eligibility for subsidies and tax credits, and enrolling consumers in QHPs.

‡ For fiscal year 2013–14 this expenditure was listed as “Enrollment Activities,” whereas for fiscal years 2014–15 and 2015–16, it was listed as “Outreach & sales, marketing.”

# For fiscal year 2013–14 these budgeted amounts are for Covered California for Small Business (CCSB). For fiscal years 2014–15 and 2015–16 these budgeted amounts are for statewide general administrative costs and strategic initiatives. However, according to Covered California the actual expenditures for these categories are reported in different categories. Specifically, the actual expenditures for CCSB are included in the “Outreach & sales, marketing” actual column. In addition, Covered California stated while the actual expenditures for statewide general administrative costs remain in this category, the actual expenditures for the strategic initiatives are reported within the appropriate organizational category.

ll These totals do not include reimbursements or CalHEERS cost-sharing.

State law requires Covered California to establish and maintain a prudent reserve and as of January 1, 2016, it requires Covered California to reduce plan assessments during a subsequent fiscal year if, at the end of any fiscal year, the reserve is equal to or more than Covered California’s operating budget for the subsequent fiscal year. As shown earlier in Table 2, Covered California projects that it will end fiscal year 2015–16 with approximately seven months of operating funds in its reserve, and it will have nearly six months in its reserve as of the end of fiscal year 2016–17. As expressed in its 2015–16 budget, one of Covered California’s guiding financial principles is to maintain a reserve that is sufficient to cover its financial obligations and allow for time to adjust revenue and expenditures in the event of an unanticipated event. The chief financial officer stated that Covered California’s board has established a target reserve of three to six months of operating expenditures rather than a one year reserve—the maximum state law allows. He explained that building a larger reserve would be possible but at the expense of increasing the plan assessments, which would increase the premiums paid by enrollees in QHPs.

The chief financial officer also stated that the targeted reserve of three to six months would allow Covered California sufficient time to make adjustments to revenue or expenditures in order to maintain solvency. For example, most, if not all, of Covered California’s contracts allow it the flexibility to cancel them with 30 days’ notice and according to its 2015–16 budget, over $200 million of its expenditures are for contracts. However, he acknowledged that a thorough review of the contracts would be necessary to determine which ones could be canceled. In addition, he stated that if a significant revenue change were to surface, Covered California would evaluate the magnitude of that change and develop plans to resolve the resulting issues. These plans might include initiating adjustments to the plan assessments charged to QHP issuers, reducing discretionary expenditures, and reducing contract expenditures. Further, he said that Covered California would consider a hiring freeze, terminating temporary employees, or reducing vacant positions.

Were Covered California to undertake such a large reduction in expenditures in such a brief period of time, it might not be adequately prepared to respond effectively to the market conditions that necessitated those expenditure reductions. For example, Covered California could find that it is without the funds necessary to undertake additional marketing efforts that might be necessary to increase enrollment and, in turn, to increase revenues. Despite these risks and the fact that it is now nearing completion of its third open enrollment period, Covered California has not completed a formal analysis of the adequacy of its reserve level. Nonetheless, Covered California has conducted some work in this area, such as a review of a reduction in enrollment countered with adjustments to plan assessments and expenditures. When we inquired about this, the chief financial officer stated that as Covered California gathers more data over time on expenditure trends and revenues, it will continue to fine tune its reserve requirement estimates. Specifically, he explained that the data from 2014 and 2015 would not be indicative of typical business cycles and reserve requirements; thus, using these data would likely lead to overestimating the reserve. He stated that although 2016 data should be more reflective of future years’ business cycles, it would be premature to establish the reserve using only one year of data. Covered California would like to use data for 2016 and 2017 to prepare a formal reserve analysis soon after December 2017.

However, we believe that Covered California can conduct a meaningful, formal analysis to determine an adequate reserve level with the data available following this third open enrollment period, which was scheduled to end on January 31, 2016. In addition, to ensure that the most recent data are incorporated into its analysis, Covered California should update the analysis periodically. Covered California’s financial plans are highly dependent upon its enrollment projections, which in turn largely rely on its limited experience from its first two open enrollment periods. If Covered California does not enroll as many consumers as its fiscal year 2015–16 budget projects, its revenues will suffer. Further, increasing its revenues by adjusting its plan assessments could take nine to 18 months, as described earlier. To better position itself to ensure its financial sustainability in this scenario, Covered California could formally analyze the steps it would take to ensure that its reserve is adequate to cover its operating expenditures. For instance, as part of this analysis, it could identify the contracts it would eliminate to reduce its expenditures. Although Covered California has done some work in this area, we believe it could benefit from a formal analysis related to its reserve level to ensure it maintains its financial solvency if enrollment significantly decreases. Consequently, financial sustainability continues to be an area of risk that will need to be closely monitored.

It Is Too Early To Tell Whether Enrollment Projections Accurately Reflect the Market

To ensure Covered California’s financial sustainability, our July 2013 report recommended that it conduct regular reviews of enrollment, as well as other factors, and make prompt adjustments to its financial sustainability plan as necessary. During our current audit, we found that Covered California has annually updated its enrollment projections. For its fiscal year 2015–16 budget, Covered California primarily based these enrollment projections on prior year or other recent data, as well as the California Simulation of Insurance Markets.3 However, as Covered California has acknowledged, a number of potential developments could lead to more or less enrollment and revenue than anticipated. In fact, Covered California stated that the biggest uncertainty in its forecasts is the pace at which the population eligible for federal subsidies on health insurance (subsidy eligible population) enrolls in QHPs through Covered California. Thus, future enrollment is uncertain, and Covered California’s limited operational history suggests that its enrollment projections are an area of risk that it will need to carefully monitor in order to ensure its financial sustainability.

Summary of Covered California’s Six Key Assumptions Used to Forecast Enrollment

Enrollment of the subsidy-eligible population: Proportion of the population eligible for federal subsidies that has enrolled in the exchange.

Effectuation rate: Proportion of enrollees who completed an application, selected a qualified health plan, and paid at least their first month’s premium.

Monthly enrollment rate during special enrollment: Average number of new monthly enrollments in Covered California for qualifying events, such as loss of coverage from loss of employer-provided insurance or loss of coverage under the California Medical Assistance Program.

Monthly disenrollment rate: Proportion of current effectuated enrollees terminated each month.

Nonrenewal rate: Proportion of enrollees who did not renew or were found ineligible for renewal.

Subsidized and unsubsidized enrollments: Ratio of subsidy-eligible enrollees to enrollees not eligible for subsidies.

Source: Covered California’s Fiscal Year 2015-2016 Budget, as of June 30, 2015.

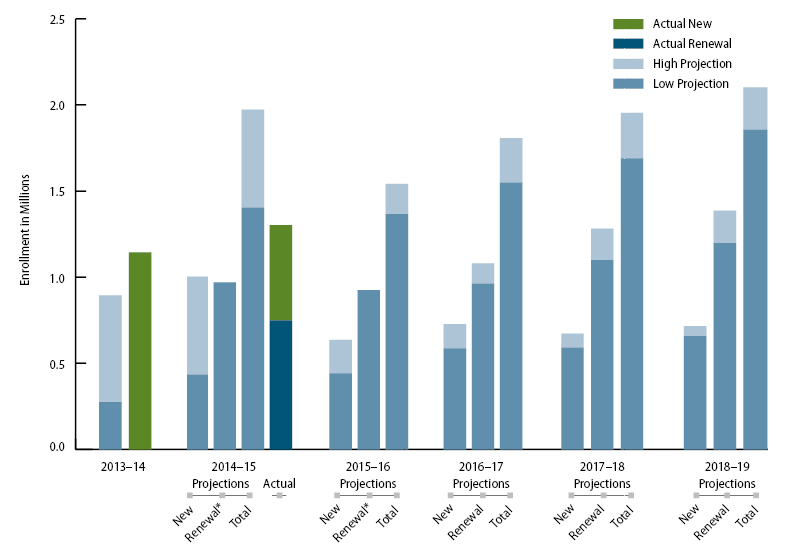

Covered California used six key assumptions to determine its multiyear enrollment projections. Using these assumptions, Covered California developed a range of enrollment estimates—from low to high, which show continued enrollment growth through fiscal year 2018–19. The text box describes Covered California’s six key forecasting assumptions.

One of Covered California’s key assumptions is the proportion of the subsidy eligible population that has enrolled in health insurance through the exchange. Covered California used external estimates and participation in similar programs, such as the Healthy Families program, to arrive at low, medium, and high alternatives for this assumption in its forecast. Covered California forecasts that by 2018 it will enroll 75 percent—the medium alternative—of those who are eligible for subsidies and do not already have coverage. According to Covered California’s 2015–16 budget, the California Simulation of Insurance Markets model estimates the subsidy eligible population in California to be approximately 2.5 million, increasing to 2.7 million by 2017.

Another of Covered California’s key assumptions is the monthly enrollment rate during special enrollment, which consists of individuals who enroll outside of the open enrollment period because of qualifying events, such as the loss of employer provided insurance or the loss of Medi Cal coverage.4 Although an average of 31,000 special enrollments occurred each month from June 2014 through November 2014, Covered California used a conservative assumption of 25,000 new monthly special enrollments for its projection, in part because the actual month to month pace slowed noticeably after July 2014.

A third assumption that Covered California used is its effectuation rate, which is the proportion of enrollees who completed an application, selected a QHP, and paid at least their first month’s premium. Covered California based its effectuation rate for subsequent years on the actual effectuation rate of those who enrolled in 2014, which was approximately 80 percent for those enrolled during open enrollment and approximately 75 percent for those enrolled outside of the open enrollment period. Using this data, Covered California projected an 80 percent effectuation rate during open enrollment and a 75 percent effectuation rate during special enrollment.

Covered California bases its budgets on its medium enrollment projections. According to its 2015-16 budget, individuals from the subsidy-eligible population made up 83 percent of its 2014 enrollment; therefore, Covered California’s revenues are primarily dependent on the number of individuals it enrolls from this subpopulation of Californians. As shown in Figure 1, in fiscal year 2013–14, the year of its first open enrollment period, Covered California exceeded its high projection of roughly 894,000 by enrolling more than 1.1 million consumers. For its second open enrollment period, Covered California’s enrollment, including renewals, was nearly 1.3 million, falling slightly short of its low projection of 1.4 million and well below its high projection of nearly 2 million. As of September 30, 2015, Covered California had roughly 1.3 million consumers enrolled in the exchange. Its third open enrollment period began on November 1, 2015, and continued through January 31, 2016.

Figure 1

Covered California’s Projected and Actual Enrollment

Fiscal Years 2013–14 to 2018–19

Sources: Covered California’s Request for Approval of Proposed FY 2013–14 Budget; Covered California Policy and Action Items, June 19, 2014; Fiscal Year 2015–2016 Budget; and data provided by Covered California.

Note: Data for actual enrollment consist of consumers who effectuated, which means they completed an application, selected a qualified health plan, and paid at least their first month’s premium

* Covered California did not include distinct renewal data in its projections. Therefore, we arrived at its renewal data by subtracting nonrenewals and disenrollments from its beginning effectuated enrollment. The fact that its high projections for these fiscal years contained much larger numbers of disenrollments than its low projections was primarily responsible for reducing the high renewal projections that we calculated for these fiscal years to below the level of its low renewal projections.

Covered California Evaluates and Modifies Its Marketing Approach to More Effectively Reach Eligible Program Participants

Covered California’s marketing division develops and executes marketing campaigns promoting the products and services offered through the State’s exchange. Under state law Covered California is required to market and publicize the availability of health care coverage and federal subsidies through the exchange. To satisfy this requirement and to target key populations and ensure a positive effect on enrollment, the marketing division has adjusted its marketing strategy for each open enrollment period to reach consumers eligible for health insurance. Table 5 summarizes how Covered California’s key marketing strategies have evolved for each of the three enrollment periods based on its evaluations of enrollment and survey data.

| Enrollment Period One | Enrollment Period Two | Enrollment Period Three | |

|---|---|---|---|

| Marketing expenditures (Dollars in millions) |

$74 | $67.5 | $60.8* |

| Selected marketing strategies |

|

|

|

| Total enrollment by period† | 1,395,929 | 1,408,362 | Not available as of December 2015 |

Sources: Various documents, including those related to its marketing campaigns and expenditures, provided by Covered California and selected executive director reports to Covered California’s board of directors.

Note: The enrollment periods include designated open enrollment periods, during which all eligible consumers may apply for health coverage, and special enrollment periods, during which consumers with certain qualifying life events, such as loss of health insurance or marriage, may apply.

* Enrollment periods one and two include actual marketing expenditures according to Covered California’s financial documents. For enrollment period three we present its marketing budget because, as of December 2015, all expenditures had not yet occurred.

† Enrollment figures include those consumers who selected a plan and enrolled during open enrollment periods, but who may or may not have made a payment to maintain insurance. These amounts do not include enrollees who signed up during special enrollment periods. These amounts are distinguishable from those in Figure 1, which include only those consumers who enrolled during open and special enrollment periods and paid their first month’s premium.

For the first open enrollment period, the marketing division focused on educating consumers throughout the State about the exchange. According to documentation regarding its marketing campaign, Covered California’s objective was to establish a media presence to generate awareness about the exchange and reach the subsidy eligible population. To accomplish this objective, its marketing campaign included television advertisements that promoted the benefits of enrolling in a health plan through Covered California and newspaper advertisements regarding sources of more information about available plans and services such as a toll free phone number and website. The advertisements emphasized that Covered California provides financial assistance for those who need help with their monthly insurance bills and that nobody can be denied coverage because of a preexisting condition.

According to documents related to its marketing campaign for the first open enrollment period, Covered California designated roughly half of its marketing budget to the Los Angeles market, which includes San Bernardino and Orange counties. Covered California designated the remainder of the marketing budget across the additional 11 marketing areas in the State, including San Francisco–Oakland–San Jose, Sacramento–Stockton–Modesto, San Diego, and Fresno–Visalia, with an emphasis on the type of media it determined to be most effective to reach the target populations it identified.

To determine the effectiveness of the strategies it used to inform consumers about its products and services, and to increase enrollment following the first open enrollment period, Covered California evaluated data, such as demographic data, regarding the consumers enrolled in QHPs. Further, it analyzed survey data regarding public awareness of Covered California and consumers’ overall experience with the exchange. According to the director of marketing, Covered California relied on these data to determine whether its marketing efforts were effective in enrolling consumers in QHPs.

Covered California used consumer enrollment data during and after the first open enrollment period to develop future targeted marketing campaigns. It determined that enrollment among Hispanic and African American consumers during the first three months of the first open enrollment period was significantly lower than its projections for that period. Although enrollment figures for these consumers eventually increased by the end of the first open enrollment period, Covered California focused its efforts for the second open enrollment period in part, toward underrepresented segments of the population, including the Hispanic and African American populations, to better ensure that they were aware of the opportunities to acquire health insurance. For example, Covered California used local platforms such as community newspapers and television advertisements specific to those communities to reach the underinsured in these target populations. According to Covered California’s available enrollment data, the percentage of new Hispanic and African American enrollees increased in 2015 from the previous year.

In addition, during and following the first open enrollment period, Covered California surveyed or interviewed enrolled consumers; members of its outreach community, such as its service center representatives and enrollment counselors; and uninsured consumers to identify barriers to enrollment and to adjust its marketing strategy. For example, it conducted interviews to gauge consumer attitudes toward health insurance, awareness of Covered California, and barriers to obtaining health insurance through Covered California. The results indicated that, although consumers were generally aware of Covered California, many indicated that they would not enroll because they were confused about how Covered California works and were concerned about not being able to afford insurance. Further, based on interviews with enrollment counselors, Covered California learned that the biggest barriers to enrollment of Hispanic consumers were confusion surrounding the program, technological barriers, and cost.

Covered California’s second open enrollment marketing campaign included an advertising approach aimed at addressing the results of these surveys and interviews. Specifically, this campaign included advertisements containing testimonials from actual enrollees discussing positive experiences, such as cost savings and peace of mind, from enrolling in QHPs. In addition, Covered California encouraged consumers to seek free, in person enrollment assistance or to visit its multilanguage website to obtain additional information. In March 2015, after the close of the second open enrollment period, one of Covered California’s consultants conducted focus groups of uninsured consumers in select areas to understand key barriers and motivators for enrolling in a health insurance plan, among other factors. The results the consultant reported indicated that, although nearly all participants had heard of Covered California, those who had looked into it had not found what they considered an affordable plan. In addition, some had negative experiences with the website and, as a result, had not returned. The consultant also reported that almost all focus group participants wanted health insurance but were resigned to the idea that they could not currently afford to enroll in a plan.

Following the second open enrollment period, Covered California used survey data to inform its marketing strategies moving forward. In particular, it contracted with the National Opinion Research Center (NORC) at the University of Chicago to conduct market research and evaluation. NORC surveyed approximately 2,200 California residents during March through May of 2015. The purpose of the survey was to assess recent changes in public knowledge, attitudes, and behaviors related to purchasing health insurance and the effectiveness of Covered California’s marketing and outreach campaigns. The resulting report, released in October 2015, reached two important conclusions that affected Covered California’s marketing strategy. It indicated that overall consumer awareness of Covered California rose from 12 percent in 2013 to 85 percent in 2015. The report also stated that 72 percent of respondents who purchased a health plan through Covered California indicated that financial assistance was an extremely important motivator in obtaining insurance. Further, the survey closely examined respondents’ knowledge of the availability of financial assistance for lower income groups and the tax penalty for not having minimum essential coverage. According to the report the results showed that 64 percent of the uninsured population were aware of the subsidy in 2015. As a result of this moderate level of awareness of the subsidy, Covered California runs the risk that some uninsured individuals may decline health care coverage because of the cost, even though they may qualify for financial assistance.

Covered California has taken steps to address the report’s findings in its marketing campaign for the third open enrollment period. According to its director of marketing, in addition to facilitating retention and renewal of existing members, Covered California’s goals include attracting new enrollees who are unsure about how to enroll or are unaware of the available federal subsidies. To accomplish these goals Covered California is promoting radio and television advertisements to inform general and Hispanic audiences that most uninsured Californians can receive financial assistance to pay for insurance, and that four out of five consumers who receive their insurance through Covered California have received financial assistance. In addition, Covered California’s English and non English language advertisements include notice of a deadline to enroll to avoid a tax penalty. Although it anticipates that this effort will increase awareness of the subsidy and tax penalties, according to the director of marketing, Covered California plans to reevaluate both enrollment and awareness data following the third open enrollment period to determine whether its efforts were effective.

Covered California Has Established a Network of Entities to Help Strengthen Its Outreach Efforts

Covered California’s outreach and sales division reviews the performance of certified enrollment representatives (enrollment representatives) and provides numerous resources and service center support to the entities that educate and enroll program participants. Under federal requirements the exchange must conduct outreach and education activities that meet specified standards to inform consumers about the exchange and insurance affordability programs to encourage participation. Similarly, state law requires Covered California to conduct public education actions to raise awareness of the availability of QHPs and to conduct outreach activities to assist enrollees. In our July 2013 report we concluded that Covered California’s planned outreach efforts were extensive and appeared to satisfy federal and state requirements. Covered California has established a network of enrollment representatives, consisting of entities and individuals that educate consumers on, and enroll them in, QHPs and Medi Cal. As shown in Table 6 enrollment representatives include certified application entities and counselors as well as certified insurance agents.

| Type of Certified Enrollment Representative (Enrollment Representative) | Number of Enrollment Representatives as of November 2015 | Responsibility | Fiscal Year Enrollment Representatives Began Work |

|---|---|---|---|

| Certified application entity or certified application counselor | 340 certified application entities, 1,797 certified application counselors |

A public or private entity designated by Covered California to certify its staff members or volunteers as certified application counselors that provide information to consumers about the full range of qualified health plans (QHP) options and insurance affordability programs for which they are eligible, assist them in applying for coverage, and facilitate enrollment of eligible individuals in QHPs and insurance affordability programs. | 2015–16 |

| Certified insurance agent | 14,037 | Agents, certified by Covered California to transact in the individual and Small Business Health Options Program exchanges, now called Covered California for Small Business. | 2013–14 |

| In-person assister (certified enrollment entity and certified enrollment counselors) | Program discontinued | Staff at entities, such as nonprofit community organizations, faith-based organizations, or local government agencies, whose responsibilities include maintaining expertise in eligibility, enrollment, and program specifications; providing information and services in a fair, accurate, and impartial manner; and facilitating consumers’ selection of a QHP. | 2013–14* |

| Navigator | 68 contractors and an additional 64 subcontractors | Entities, receiving grant funding to perform services for consumers, that demonstrate an existing relationship or could readily establish relationships with employers and employees, consumers, or self-employed individuals likely to be eligible for enrollment. These groups include community and consumer-focused nonprofit groups, trade and professional associations, and state or local human services agencies. The navigator’s responsibilities include maintaining expertise in eligibility, enrollment, and program specifications and facilitating consumers’ selection of a QHP. | 2014–15 |

| Plan-based enroller | 11 QHP issuers, and 1,602 plan-based enrollers | Staff employed or contracted by a QHP issuer to provide enrollment assistance to consumers. The enrollers’ responsibilities include maintaining an expertise in eligibility enrollment and program specifications, providing information and services to consumers, informing consumers of the availability of other QHP products offered through the exchange, and facilitating enrollment in QHPs. | 2013–14 |

Sources: Documentation and information provided by Covered California; 45 Code of Federal Regulations, parts 155.205(d), 155.210, 155.215, 155.220, and 155.225; 10 California Code of Regulations, sections 6652, 6654, 6664, 6702, 6710, 6800, and 6802.

* Covered California used the in-person assister program, which compensated enrollment representatives for each person enrolled in the program, to help enroll as many consumers as possible during the first two enrollment periods. The certified application entity and certified application counselor program took over the role of the in-person assister program beginning in fiscal year 2015–16. This role is administered by local entities whose mission it is to provide services to people without being paid an incentive for their efforts.

The outreach and sales division generates reports from CalHEERS to review the performance of enrollment representatives. It uses this information to determine gaps in services and to identify new outreach opportunities to increase enrollment during future enrollment periods. For example, the outreach and sales division generates certain detailed reports to better inform local enrollment representatives during their planning processes. Using these reports, enrollment representatives can quickly identify consumers who began working with a team member but who never enrolled. The enrollment representatives can use this information to contact those consumers and continue to discuss enrollment options.

The outreach and sales division uses other reports to better assess overall program performance and make necessary changes that can help enrollment representatives in better serving consumers. For example, Covered California modified the structure of its navigator program, described in Table 6, from an incentive based grant program during fiscal year 2014–15 to a block grant program for fiscal year 2015–16, after evaluating the program’s milestones and enrollment data. Covered California began the navigator grant program shortly before the beginning of the second open enrollment period, using its operational funds and not federal establishment funds, in accordance with the Patient Protection and Affordable Care Act. We reviewed data Covered California collected that specifies each grant recipient’s target goals for new effectuated enrollments (enrollment goals) and whether those goals were reached during the grant award period, which included the second open enrollment period. According to these data, many navigators fell short of reaching the enrollment goals outlined in their grant agreements.

Specifically, according to the grant agreements for the first award period of October 1, 2014, through June 30, 2015, each navigator received an initial payment, or 25 percent of its total grant award, for achieving the milestone of submitting a strategic work plan and campaign strategy to Covered California. The grant agreements further specify that the navigators would receive subsequent payments whenever they achieved 25, 75, or 100 percent of their enrollment goals and satisfied certain reporting requirements. However, many navigators failed to reach their enrollment goals. Of the 65 entities awarded navigator grants, only 10 met or exceeded 100 percent of their enrollment goals, and seven achieved only 75 percent of their goals. Of the remaining 48 navigators that fell short of achieving 75 percent of their enrollment goals, 20 did not even attain 25 percent of the goals. As a result, many navigators were in jeopardy of not receiving additional grant payments since they were not achieving the enrollment goals specified in their grant agreements.

In January 2015 Covered California’s executive director indicated during a presentation to the board that navigators were spending much of their time helping consumers renew and enroll in health plans. The former acting deputy director of Covered California’s outreach and sales division told us that the support many navigators were providing to consumers was more extensive than anticipated, particularly for non native English speakers. As a result, in January 2015 Covered California’s board approved a one time payment modification of the grant agreements to base payments on the number of consumers who enroll in a plan while assisted by a navigator rather than on effectuated enrollment, the number of consumers who enroll in a plan and make their first monthly payment. The former acting deputy director of the outreach and sales division stated that this change alone would allow navigators to attain the next payment. She also explained that those who still fell short of the revised enrollment goals could demonstrate progress and achievement of goals through a narrative report to receive grant funding.

After the second open enrollment period, Covered California evaluated the results of the navigator program and modified its approach to funding navigators. Specifically, at an April 2015 board meeting, the former acting deputy director of the outreach and sales division asserted that these entities are key contributors to the effort to provide outreach, education, enrollment and renewal assistance, and post-enrollment support, implying that the navigators’ compensation should reflect this effort. Subsequently, the board approved changes to the navigator grant program for the third open enrollment period so that it operates in a manner similar to a traditional block grant program by paying navigators in equal installments on an established schedule. Navigator grantee payments are now not based solely on achieving actual enrollment and renewal goals but are also based on the work they perform related to consumer outreach, education, enrollment, renewal assistance, and post-enrollment support on behalf of Covered California. As a result, navigators can earn the full installment amount without reaching their enrollment goals, provided their work in these other areas has been satisfactorily documented in their progress reports and approved by Covered California.

As a result of these changes, Covered California’s new navigator agreements, which have a duration that includes the third open enrollment period, require additional accountability measures. In addition to the monthly performance reporting previously required, the new grant agreements require information pertaining to performance and quality assurance. This added information includes the number of consumers assisted or enrolled by demographic category, successful educational and enrollment strategies, and any barriers or technical difficulties preventing navigators from meeting their enrollment or renewal goals. According to a manager in the navigator grant program, Covered California will finalize its evaluation of the success of the navigator program under the new funding format at the conclusion of the third open enrollment period, and it will make necessary modifications to help grant recipients better deliver services to consumers. This evaluation should help inform any necessary changes to the navigator program.

The outreach and sales division also routinely informs the enrollment representatives of new developments and strategies to help generate additional enrollments or renewals. To assist in this effort, the outreach and sales division provides numerous webinars to keep enrollment representatives informed of ways to promote their business and provide effective service to consumers. Covered California also provides its enrollment representatives, which include certified insurance agents, with online access to webinars and information about the open enrollment and renewal process as well as electronic agent briefings that describe pertinent information, such as reminders, and available resources. Moreover, Covered California established service centers to help ensure that all enrollment representatives have their enrollment questions answered.

Finally, the outreach and sales division is using geographic information software (GIS) to further inform Covered California’s outreach efforts. As of November 2015 using GIS technology, the outreach and sales division had created and allowed regional sales staff and community partners to access a map book displaying the estimated remaining subsidy eligible population. The map book hones in on certain regions within the State’s eight sales areas and provides overlaid, color coded information about estimated subsidy eligible populations and the location of enrollment representatives in the region. The map book enables regional sales staff and local enrollment representatives to identify underserved areas with high levels of uninsured consumers who qualify for the federal subsidy. A manager within the outreach and sales division stated that, by tracking the enrollments made by enrollment representatives before and after they began using this tool, Covered California intends to evaluate the effectiveness of the map book and establish best practices for enrollment representatives.

Recommendations

Covered California should continue to monitor its plan for financial sustainability and revise the plan accordingly as factors change. Further, it should complete a formal analysis of the adequacy of its reserve level by December 31, 2016, and update this analysis as needed, so that it is prepared if it does not meet its revenue projections and needs to increase its funding or decrease its expenditures to maintain financial solvency. This formal analysis should identify those contracts it could quickly eliminate, among other actions it would take, in the event of a shortfall in revenues.

Covered California should continue to regularly review its enrollment projections and update the projections as needed to help ensure its financial sustainability.

Footnotes

3 The California Simulation of Insurance Markets model, a joint project of the University of California, Los Angeles, Center for Health Policy Research and the University of California, Berkeley, Center for Labor Research and Education, is designed to estimate the impacts of elements of the Patient Protection and Affordable Care Act on employer decisions to offer insurance coverage and individual decisions to obtain coverage in California. Go back to text.

4 Open enrollment is a designated period during which all eligible consumers may apply for health coverage. Go back to text.