City of Anaheim

It Has Not Properly Managed Tourism-Related Contracts and Millions of Dollars in Related Funds

January 30, 2024

2023-133

The Governor of California

President pro Tempore of the Senate

Speaker of the Assembly

State Capitol

Sacramento, California 95814

Dear Governor and Legislative Leaders:

As directed by the Joint Legislative Audit Committee, my office conducted an urgent audit of the public funds that the city of Anaheim disbursed to two private nonprofit entities—the Anaheim Chamber of Commerce (Chamber) and the Anaheim and Orange County Visitor and Convention Bureau (Visit Anaheim). The city entered into contracts with and disbursed more than $100 million to Visit Anaheim, and the Chamber received from both the city and Visit Anaheim more than $6 million in public funds from fiscal years 2012–13 through 2021–22. In general, we determined that the city lacked a meaningful contract monitoring process and did not properly manage the contracts it entered into with these entities, resulting in unallowable spending and unmet deliverables.

In one case, Visit Anaheim subcontracted with the Chamber to provide work related to promoting Anaheim’s tourism and convention industries. Visit Anaheim did this without the required written permission from the city and absent appropriate oversight from the city. The Chamber then used some of these funds for unallowable services, including advocating for or against proposed federal, state, and local legislation and supporting resort-friendly candidates through its political action committee. Furthermore, the Chamber could not demonstrate that it provided Visit Anaheim with three of the 10 agreed-upon services we reviewed from 2018 through 2022, such as holding meetings with local businesses.

In another circumstance, Anaheim awarded a $6.5 million contract to Visit Anaheim to perform economic recovery activities during the pandemic when Visit Anaheim already had millions in estimated unspent public funds intended to fund similar services. Among the recommendations we have made for the city to improve its contract monitoring policies and procedures is for it to seek to renegotiate its largest contract with Visit Anaheim to allow for more effective oversight.

Respectfully submitted,

GRANT PARKS

California State Auditor

Summary

Key Findings & Recommendations

The Legislature requested an urgent audit of the public funds that the city of Anaheim disbursed to two private nonprofit entities—the Anaheim Chamber of Commerce (Chamber) and Anaheim and Orange County Visitor and Convention Bureau (Visit Anaheim). The city entered into contracts with and disbursed more than $100 million to Visit Anaheim, and the Chamber received more than $6 million in public funds from fiscal years 2012–13 through 2021–22.

Our review of these contracts found the following:

- Visit Anaheim improperly subcontracted with the Chamber to provide work related to its tourism district assessment contract with the city—generally intended to promote Anaheim’s tourism and convention industries—without written permission from the city as required. The Chamber then used tourism district assessment funds for unallowable services, including advocating for or against proposed federal, state, and local legislation, meeting with elected officials and policymakers, and supporting resort-friendly candidates through the Chamber’s political action committee. Notably, Visit Anaheim’s subcontract did not require the chamber to track its costs or provide invoices substantiating its expenditures.

- The Chamber could not demonstrate that it provided Visit Anaheim with three of the 10 agreed-upon services we selected for review from 2018 through 2022, such as holding meetings with local businesses.

- Because the city did not have a meaningful process for contract monitoring, Visit Anaheim was able to pay the Chamber for unallowable services that involved political advocacy and influence, and the Chamber failed to deliver certain services without the knowledge of the city. We also found that the city did not conduct substantive monitoring or oversight of these and other contracts, including a $6.5 million payment to Visit Anaheim for an economic recovery contract during the COVID-19 pandemic even though Visit Anaheim already had millions in estimated unspent tourism district assessment funds intended for similar services.

Therefore, we have made recommendations for the city to improve its contract monitoring policies and procedures and to seek to renegotiate its largest contract with Visit Anaheim to provide for more effective oversight. We also recommend that the city establish an advisory board—partially comprised of business owners in the tourism district—to make recommendations on how tourism district assessment funds are to be spent.

Agency Comments

The city stated that it welcomes our recommendations and explained the steps it will begin to take to implement them. Although we did not make recommendations to the Chamber or Visit Anaheim, they disagreed with or mischaracterized some of our findings and conclusions.

Audit Findings

The City of Anaheim Contracted With Two Nonprofit Entities to Promote Tourism and Related Business Development Opportunities

Figure 1

Source: City contracts entered into with Visit Anaheim and the Chamber, a subcontract between Visit Anaheim and the Chamber, and bylaws for Visit Anaheim and the Chamber.

Figure 1 description:

Figure 1 is a triangulation of three entities--the city of Anaheim, Visit Anaheim, and the Anaheim Chamber of Commerce--with arrows indicating the contracted services between each of the entities. The city of Anaheim contracted with Visit Anaheim to operate the Anaheim Tourism Improvement District and other tourism-related services. Visit Anaheim is a nonprofit mutual benefit corporation that, among other things, works to enhance the economy of Anaheim by marketing the city as a destination for conventions, meetings, events, and leisure travel. The city of Anaheim also contracted with the Chamber to promote and market the city to Anaheim businesses. The Chamber is a nonprofit mutual benefit corporation that works to provide community solutions that create economic prosperity for the greater Anaheim area. Visit Anaheim subcontracted with the Chamber to provide work related to its tourism district assessment contract with the city.

Anaheim intended that its tourism district assessment funds would be

used for various purposes that include the following:

- Providing marketing efforts to attract new conventions to the Anaheim Convention Center.

- Promoting activities that would attract new visitors to benefit the tourism district’s hotels.

Source: Anaheim’s tourism improvement district resolution of formation.

The city of Anaheim, a popular tourist destination, contracted with two nonprofit entities—Visit Anaheim and the Chamber—for services that included promoting its tourism and convention industries and local businesses, as Figure 1 shows. The Anaheim area draws as many as 19 million visitors a year to the Disneyland Resort, and the city reports that the convention center receives more than 1 million visitors per year. To better attract tourists and conventions, the city established the Anaheim Tourism Improvement District (tourism district) in 2010 and determined it would be funded, with limited exceptions, by imposing an assessment of 2 percent of hotel room rates at Anaheim resorts, hotels, and motels within a designated geographic area. The tourism district is set to last for a period of 30 years, and the text box describes the intended use of tourism district assessment funds.

On the same day that it established the tourism district, the city contracted with Visit Anaheim to carry out the tourism district’s day-to-day operations and certain activities related to the district (tourism district assessment contract). Visit Anaheim receives the majority of its funding—roughly 70 percent each year—from Anaheim’s tourism district assessments (assessments). The city collects these assessments and transfers 75 percent of these funds to Visit Anaheim—approximately $5 to $15 million a year from 2012 through 2021. The tourism district assessment contract currently extends automatically each year, unless terminated.

The Chamber received a combined total of more than $6.2 million from various contracts with either the city or Visit Anaheim from fiscal years 2012–13 through 2021–22. For example, the city entered into contracts with the Chamber and paid it with public funds to promote and market the city to businesses and to recognize it as the key sponsor of certain events, such as economic development conferences and job fairs. Separately, as part of a subcontract under Visit Anaheim’s tourism district assessment contract with the city, Visit Anaheim paid the Chamber with tourism district assessment funds to provide programs, activities, and services for the promotion and benefit of the assessed hotels and resorts in Anaheim and the tourism and convention industry. For example, the Chamber committed to placing tourism-related content on various social media platforms, conducting tourism-related presentations to community groups, and having a tourism webpage on its website. Table 1 summarizes each of the contracts among the city, Visit Anaheim, and the Chamber and the amounts of public funds disbursed for each.

Table 1

Contracts Among the City of Anaheim, Visit Anaheim, and the Chamber

Fiscal Years 2012–13 Through 2021–22

| Contract | Contract Description | Contract Term (Calendar Year) |

Source of Funds |

Amount Disbursed |

|---|---|---|---|---|

| Contracts the city of Anaheim entered into with Visit Anaheim | Anaheim tourism district assessment contract City pays 75 percent of the tourism district assessment funds (less the city’s administrative costs) to Visit Anaheim for providing convention services and promoting tourism, among other activities. |

Entered into in 2010 and currently extends automatically each year, unless terminated | Tourism district assessment | $111,220,000 |

| Economic recovery services contract City contracted with Visit Anaheim to expedite the city’s economic recovery, including restoration of hotel occupancy rates and convention center bookings back to pre-COVID-19 pandemic levels. |

2020–indefinite | City convention, sports, and entertainment venue fund | 6,500,000 | |

| Volleyball retention contract City contracted with Visit Anaheim to secure Anaheim as the host city for various volleyball events and to recognize Anaheim as a sponsor of USA Volleyball. |

2017–2020 | City general fund |

980,000 | |

| Other | 190,000 | |||

| Subcontract that Visit Anaheim entered into with the Chamber | Anaheim tourism district assessment subcontract Visit Anaheim transfers 3.5 percent of the tourism district assessment funds it receives from the city to the Chamber. The Chamber is to fund programs, activities, and services benefitting the assessed hotels and resorts in Anaheim as well as the tourism and convention industry. |

2010–2023* | Tourism district assessment funds | $4,430,000† |

| Contracts the city of Anaheim entered into with the Chamber | Sponsorship agreements City sponsorships of various Chamber events including job fairs, economic conferences, and a golf tournament. |

2015–2016, 2019–2020 | City economic reinvestment fund and economic development fund | 650,000 |

| Shop-and-dine-local contract Implementation of an online platform to promote local businesses during the pandemic. |

2020–2021 | City general fund |

500,000 | |

| Anaheim Enterprise Zone City funds paid to the Chamber to perform certain services related to the administration of the Anaheim Enterprise Zone Program |

2012–2013 | City general fund |

550,000 | |

| Other | 90,000 | |||

Source: Auditor analyses of city contracts, a related subcontract, and financial records from the city and Visit Anaheim.

* Visit Anaheim canceled the contract with the Chamber, effective September 2023.

† Amount includes funds Visit Anaheim disbursed to the Chamber under the tourism district assessment subcontract from calendar years 2012 through 2022. Because Visit Anaheim’s 2022 audited financial statements were not available, the expenditure of $660,000 for that fiscal year is unaudited.

Corruption Investigations Involving Some of Anaheim’s Local Leaders Led to This Urgent Audit

In response to an investigation by the Federal Bureau of Investigation and the city of Anaheim’s issuance of the results of a city-commissioned corruption investigation, the Joint Legislative Audit Committee (Audit Committee) requested this urgent audit to review those public funds that the city has disbursed to Visit Anaheim and the Chamber and to ensure that the nonprofits fulfilled their contractual obligations to the city. In August 2023, the former Anaheim Mayor—who was elected in 2018 and resigned in May 2022—pled guilty to obstruction of justice and to providing false statements to a federal agent involving the sale of the Los Angeles Angel Stadium in Anaheim. The former mayor was involved with the city’s negotiations, beginning in 2020, to sell the stadium. In his capacity as a member of the negotiating team for the city, the former mayor provided confidential information so that the Angels baseball team could buy the stadium on beneficial terms. Federal law enforcement recorded the former mayor saying, after he had provided the confidential information, that he expected a $1 million campaign contribution from the Angels after the team succeeded in buying Angel Stadium from the city.

In May 2022, the Anaheim city council directed the city attorney to void the purchase and sale agreement for Angel Stadium. Also in 2022, the former president and CEO of the Chamber (former Chamber president) pled guilty to various charges including wire fraud, filing false tax returns, and making a false statement to a financial institution. Based on the investigative report the city released that discussed these individuals, the Audit Committee requested that the State Auditor review the city of Anaheim’s disbursement of public funds to the Chamber and to Visit Anaheim.

Public Funds Paid for Some Unallowable and Undelivered Services

Figure 2

Source: Auditor analyses of city contracts, a related subcontract, and financial records from the city and Visit Anaheim.

Figure 2 description:

Figure 2 consists of three icons with red X's describing unallowable services, services the Chamber could not demonstrate it provided, and a contract between the city and Visit Anaheim that may not have been necessary. Specifically, the first icon with a red X relates to political activities and describes that Visit Anaheim paid the Chamber for unallowable services with tourism district assessment funds. The second icon and red X relates to contracts, and describes that the Chamber did not provide, or could not demonstrate that it delivered agreed upon services for contracts we reviewed. The third icon and red X relates to financial tracking, and describes that the city of Anaheim paid Visit Anaheim $6.5 million for an economic recovery contract during the COVID-19 pandemic even though Visit Anaheim already had more than an estimated $6 million in unspent tourism district assessment funds.

Tourism Assessment District Subcontract

Parties: Visit Anaheim and the Chamber

Total amount from 2012 through 2022:

$4.4 million

Key provisions:

- The contract required the parties to agree annually on a written program of work.

- The contract did not require the Chamber to track costs or provide invoices.

Summary of key deliverables:

- Event sponsorships

- Advertisements and articles in the Chamber’s publications

- Promotion of the Anaheim resort through social media

Source: Subcontract between Visit Anaheim and the Chamber, and Visit Anaheim’s financial records.

As Figure 2 shows, we found that the Chamber used tourism district assessment funds for unallowable services and that the Chamber could not demonstrate that it provided some services for multiple city contracts. We also found that the city may have paid Visit Anaheim for unnecessary services given Visit Anaheim’s estimated tourism district assessment reserves. In 2010 Visit Anaheim entered into a subcontract with the Chamber for the Chamber to provide work related to the tourism district assessment contract, as the text box describes. Visit Anaheim asserted that its former president and the former Chamber president agreed to the contracted work that the Chamber would perform each year, which generally included event sponsorships, community outreach, and legislative tracking and advocacy. A Letter of Intent signed by both Visit Anaheim and the Chamber indicates that Visit Anaheim paid for this contract using a portion of the tourism district assessment funds that it receives from the city of Anaheim. In total, Visit Anaheim paid the Chamber $4.4 million from 2012 through 2022 for services pertaining to the city’s tourism district assessment contract with Visit Anaheim. This tourism district assessment contract allows Visit Anaheim to subcontract for services related to the tourism district. However, it requires Visit Anaheim to monitor and supervise those subcontractors, and it requires Visit Anaheim to obtain prior written approval from the city before subcontracting for convention and tourism marketing services. Visit Anaheim could not provide documentation to demonstrate that it obtained written approval from the city to subcontract with the Chamber, as we discuss later.

The Chamber Used Tourism District Assessment Funds for Unallowable Services

We also found that the Chamber reported using tourism district assessment funds it received pursuant to its subcontract with Visit Anaheim to pay for unallowable services each year since at least 2012. The tourism district assessment contract between the city and Visit Anaheim states that Visit Anaheim and, by extension, any entity that subcontracts with Visit Anaheim is generally prohibited from using tourism district assessment funds for purposes unrelated to specified tourism‑related programs, improvements, and related activities. In addition, the tourism district assessment contract specifically prohibited Visit Anaheim and, by extension, its subcontractors from using these funds for other unrelated purposes such as political donations, contributions, or other activities. Although the subcontract did not include these prohibitions, the subcontract is required to comply with the tourism district assessment contract between the city and Visit Anaheim, which does have these prohibitions. Visit Anaheim’s subcontract with the Chamber also requires both parties to agree annually on the work that the Chamber performs with the funds and requires the two nonprofits to meet semi-annually to assess the Chamber’s performance. The Chamber generally provided Visit Anaheim with deliverable reports detailing the services that the Chamber provided under the contract, and the contract did not require the Chamber to track costs or provide invoices.

However, the Chamber’s subcontract work plans and deliverable reports indicate that the Chamber used these funds for numerous services that involved political advocacy and influence, none of which fall within the allowable services described above. Unallowable services listed in these work plans included advocating for or against proposed federal, state, and local legislation; meeting with elected officials; and supporting resort-friendly candidates through the Chamber’s political action committee. Our review of the Chamber’s deliverable reports to Visit Anaheim from 2012 through 2022 reveals a variety of political activities each year that the Chamber provided under the subcontract, as Table 2 shows. Although we recognize that some of the unallowable services could have a direct and positive impact on the tourism district, using tourism district assessment funds for such services violates the city’s tourism district assessment contract and the authorizing ordinance of the tourism district.

Table 2

Examples of Unallowable Services That the Chamber Reported It Engaged in Using Tourism District Assessment Funds

2012 Through 2022

| Year | Selected Unallowable Services |

|---|---|

| 2012 | Developed Resort Legislative Plan and used the plan to shape conversations with current and potential legislators. Designed campaign interviews, questionnaires, and strategies based on the plan. |

| 2013 | Produced list of current bills and their impact on resort businesses. Developed a voter guide and campaign and communication pieces based on the Resort Legislative Plan. |

| 2014* | Presented regular bill updates and analysis at the Chamber’s Legislative Committee meetings. Included legislative articles in its magazine and newsletters. |

| 2015 | Advocated on behalf of resort businesses to support or oppose various proposed local, state, and federal policies. Held four Chamber Legislative Committee meetings, which included attendance by elected officials. |

| 2016 | Took key positions and action on legislation and other policies, including writing letters of support or opposition of tourism or resort-related policies. |

| 2017 | Hosted nine Chamber Government Affairs Committee meetings to discuss and set policy related to critical legislation impacting the Anaheim business community and Anaheim Resort. Traveled to California State Capitol and met with 11 legislators to discuss Anaheim and the Anaheim Resort. |

| 2018 | Hosted five Chamber Government Affairs Committee meetings including policymakers, such as a county supervisor, a city councilmember, a district attorney, and the registrar of voters. Tracked 17 tourism-related bills. |

| 2019 | Coordinated 21 people to speak at Anaheim city council meetings to share news and updates from the Anaheim resort and entertainment industry. Held one-on-one meetings with five city councilmembers, one county supervisor, and a district attorney. Provided eight reports regarding government affairs to the business community. |

| 2020 | Met individually with seven councilmembers, a congressmember, a state senator, an assemblymember, a county supervisor, and a district attorney. |

| 2021 | Met individually with six councilmembers, a congressmember, an assemblymember, a county supervisor, and a district attorney. Held three Chamber Government Affairs Committee meetings with two congressmembers and a district attorney. |

| 2022 | Advocated for a tourism-business friendly climate by supporting or opposing 13 local, state, or federally proposed pieces of legislation. |

Source: Auditor’s analysis of the Chamber’s annual reports to Visit Anaheim.

* The Chamber’s 2014 annual report references many activities that occurred in 2011 and 2012. Therefore, based on this annual report, it is unclear whether some of these activities also occurred in 2014.

The city did not review or monitor the services that the Chamber provided to Visit Anaheim with money originating from the tourism district assessment funds. The city’s executive director of convention, sports, and entertainment (tourism director), who was primarily responsible for overseeing the tourism district assessment contract, has been aware since 2018 that the Chamber was a subcontractor. However, he explained that he did not question whether the city had approved the subcontract and that he did not monitor the Chamber’s activities, because he believed those activities to be Visit Anaheim’s responsibility. Given the significant amount of tourism district assessment funds involved, we would have expected the city to periodically monitor the Chamber’s activities as part of the city’s oversight of the tourism district assessment contract. Following the 2022 guilty plea of the former Chamber president, Visit Anaheim notified the Chamber that it had canceled the subcontract, effective September 2023.

The Chamber Did Not Demonstrate That It Delivered Some Agreed-Upon Services for Multiple Contracts

The Chamber could not demonstrate that it delivered some of the contracted services it agreed to provide to the city or to Visit Anaheim. We found that the Chamber could not document that it delivered most services between 2012 through 2017, stating that many of the documents we requested were beyond its record retention period. From 2018 through 2022, the Chamber could not substantiate three out of 10 of the tourism-related activities we selected for review under the tourism district assessment subcontract, as Table 3 shows. Similarly, neither Visit Anaheim nor the Chamber could demonstrate that they agreed on deliverables for 2021 for the tourism district assessment subcontract. Nonetheless, Visit Anaheim’s accounting records show that it still provided the Chamber with roughly $275,000 in tourism district assessment funds that year pursuant to this subcontract.

Table 3

The Chamber Could Not Demonstrate That It Delivered Some Services for Which It Was Paid

| Contract | Unsubstantiated Deliverables | |

|---|---|---|

| Tourism district assessment subcontract with Visit Anaheim | 2018 | Host monthly economic development meetings with Visit Anaheim, the Chamber, the city’s director of community and economic development, and two city councilmembers. The Chamber provided evidence of calendared meetings from 2018, but did not clearly indicate the purposes of those meetings or how they aligned with this deliverable. |

| 2020 | Include Visit Anaheim and tourism-related organizations in six visits to businesses to discuss potential relationships to tourism, sports, or national associations. Chamber provided evidence of five calendared meetings from 2020, but they did not clearly indicate the purposes of those meetings or how they aligned with this deliverable. | |

| 2021 | No work plan containing agreed-upon deliverables. | |

| Sponsorship agreement with the city of Anaheim | 2019–2020 | Develop a program to encourage Anaheim businesses to purchase locally. The Chamber provided some research it had conducted and other documentation indicating that it had not developed a purchasing program for local businesses. |

| Shop‑and‑dine-local contract with the city of Anaheim | Deliverables Not Provided | |

| 2020–2021 |

|

Source: Auditor’s analyses of city contracts and a related subcontract.

Neither the city’s tourism director nor current Visit Anaheim staff believed that the tourism district assessment subcontract with the Chamber was necessary. Specifically, the city’s tourism director stated that he believed Visit Anaheim would have been able to perform any, if not all, of the work that the Chamber provided for the tourism district assessment funds. Similarly, Visit Anaheim’s senior vice president of operations, who indicated that she was aware of the purpose of the agreement but was not aware of the deliverables expected in exchange for those funds, stated that Visit Anaheim paid the Chamber for activities that would have been undertaken by the Chamber without those additional funds and that the subcontract could be considered unnecessary. Regardless, Visit Anaheim entered into an unauthorized subcontract with the Chamber that may not have been cost-effective nor an efficient use of money originating from tourism district assessment funds.

2019 Sponsorship Agreement

Parties: City of Anaheim and the Chamber

Total amount: $425,000

Key provisions:

- The contract term was from June 2019 to June 2020.

- The Chamber had to invoice the city for half of the contracted amount upon the contract’s approval, with the remaining amount to be paid at the conclusion of six months.

- The contract did not require the Chamber to track the costs of the services it provided.

Summary of key deliverables:

- Develop and distribute resource materials to new businesses and top tax-generating businesses.

- Host special events and individual meetings aimed at attracting new businesses to Anaheim and recognize the city as a lead sponsor at specified special events.

- Place advertisements in specified Chamber magazines, newsletters, and website.

- Develop a shop-and-dine-local program to promote local industry and business-to-business purchasing.

Source: 2019 sponsorship agreement between the city and the Chamber.

Our review of deliverables due under the 2019 sponsorship agreement between the city of Anaheim and the Chamber also found that the Chamber did not deliver some of those agreed‑upon services. The initial agreement included clear deliverables, such as sponsorships for an economic conference, a job fair, a business luncheon, and other events, as the text box describes. However, after the onset of pandemic restrictions in early 2020, the Chamber proposed to the city to shift the emphasis of the contract to business retention and recovery. As a result, the city and the Chamber mutually agreed to contract modifications, allowing the Chamber to develop a web-based shop-and-dine-local program to spur consumerism during the pandemic, and they agreed to provide local businesses with information and resources to assist with business sustainability and recovery. Although the Chamber ultimately developed the shop-and-dine-local website for consumers, it could not show that it developed a program to encourage Anaheim businesses to purchase locally.

2020 Shop-and-Dine-Local Contract

Parties: City of Anaheim and the Chamber

Total amount: $500,000

Key provisions:

- The contract term was from October 2020 to October 2021.

- The Chamber had to invoice the city for one-third of the contracted amount upon the contract’s approval, with the remaining amount to be paid on specified dates within approximately the first two months of the contract.

- The contract did not require the Chamber to track the costs of the services it provided.

Summary of key deliverables:

- Promote and provide incentives to residents to shop and dine at Anaheim businesses.

- Create local incentives and education for local business‑to‑business purchasing.

- Engage Anaheim employers, aggregate resources and incentives for local hiring, and promote local job opportunities.

- Coordinate, host, and provide staffing for a local job fair.

Source: 2020 shop and dine local contract between the city and the Chamber.

In 2020 the city engaged in another contract with the Chamber regarding the shop-and-dine-local program. In addition to promoting local businesses to the community using this web-based program during the pandemic, the Chamber agreed to engage Anaheim business-to-business-focused companies and to create the deliverables that the text box describes. However, we did not find in the shop-and-dine-local program any materials or other information for business-to-business companies, employers, or job listings.

According to the Chamber, continued implementation of the business-to-business purchasing and local hiring components of the program would have required additional funding. The Chamber asserted that through July 2021, it spent roughly $500,000 on the shop-and-dine-local program. However, that contract did not require the Chamber to track costs or provide invoices. Therefore, without tracking these costs, the Chamber cannot demonstrate that a lack of funding was the reason it failed to provide these contracted services to the city.

Visit Anaheim Engaged in a Questionable Transfer of Funds

2020 Economic Recovery Contract

Parties: City of Anaheim and Visit Anaheim

Total amount: $6.5 million

Key provisions:

- Contract term is indefinite. The contract will terminate when Visit Anaheim performs all services to the satisfaction of the city.

- Contract term is indefinite. The contract will terminate when Visit Anaheim performs all services to the satisfaction of the city.

- Visit Anaheim must provide invoices or other documentation to the city, including a detailed description of the services performed.

Summary of key deliverables:

- The City Council intended that the funds be budgeted as follows:

- Advertising (30%)

- Marketing (30%)

- Sales and paid advertising (20%)

- Content development (10%)

- Communications and miscellaneous (10%)

- The goals for marketing included:

- Conduct marketing analysis and work to return hotel occupancy rates to pre-pandemic levels.

- Restore meetings and convention bookings to pre‑pandemic levels.

- Market to local Anaheim and Orange County residents to promote local dining, retail, entertainment, and sports venues.

Source: 2020 economic recovery contract between the city and Visit Anaheim and the city’s financial records.

At the onset of the pandemic in 2020, the city of Anaheim awarded Visit Anaheim an economic recovery contract for up to $6.5 million. The city paid for this contract from its Convention, Sports, and Entertainment Venue Fund (economic recovery contract funds).The Convention, Sports, and Entertainment Venue Fund accounts for the operations of the city’s convention center and Angel Stadium in Anaheim. The economic recovery contract required Visit Anaheim to promote and market the city’s tourism industry and to expedite economic recovery after the State lifted stay-at-home restrictions, as the text box shows. The contract required Visit Anaheim to provide invoices or other documentation to the city that detailed the services it would provide. We reviewed 20 of Visit Anaheim’s transactions related to this agreement and found that the transactions were generally related to the contract’s marketing, promotion, or advertising provisions. The economic recovery contract required—and Visit Anaheim produced—various marketing assessments and strategies related to pandemic recovery. Visit Anaheim also tracked the costs associated with the contract and accounted for its expenditures.

Beginning in April 2020, Visit Anaheim also provided a total of $1.5 million, including a portion of economic recovery contract funds, to another entity—the Anaheim Economic Development Corporation (AEDC)—to, among other things, build an exhibitor roster for future events and provide recovery assistance to businesses. AEDC was formed as the Anaheim Chamber of Commerce Foundation in 2007, and the two most recent Chamber presidents have been listed as the AEDC’s principal officers. According to public federal tax filings, the $1.5 million that AEDC received from Visit Anaheim represents most of AEDC’s income in 2020 and 2021. AEDC invoices show that it used the funds it received from Visit Anaheim to provide services related to the development of the shop-and-dine-local program; to identify local, state, and federal resources for business relief; and to coordinate virtual town hall seminars. Current staff at Visit Anaheim stated that this transaction was a result of a verbal agreement between its former president and the former president of the Chamber. Visit Anaheim and Chamber staff indicated that the former presidents did not execute a formal written contract.

Visit Anaheim accounting records initially showed that it made the $1.5 million in payments to the AEDC using $1 million in economic recovery contract funds and $500,000 from its other accounts. However, Visit Anaheim now accounts for the entire $1.5 million in payments as originating from Visit Anaheim’s other operational funds. Visit Anaheim’s finance director stated that the former president of Visit Anaheim, who resigned in November 2023, instructed her to change the funding source. According to Visit Anaheim’s senior vice president of operations and its finance director, the former president requested the reallocation of transfers from its economic recovery contract accounts to other operating accounts because he stated that the transfer could not show on the record as being from economic recovery contract funds.

Visit Anaheim’s re-accounting of its payments to AEDC raises additional questions regarding the use of other public funds that Visit Anaheim has received from the city, such as the tourism district assessment funds. Visit Anaheim could not demonstrate how much of the $1.5 million it paid to AEDC might have included surplus tourism district assessment funds. Specifically, it indicated that its tourism district assessment contract with the city did not require it to independently verify how much of its reserves were derived from those funds. However, a city ordinance, the terms of which the tourism district assessment contract incorporates by reference, requires Visit Anaheim to submit an annual report that describes surplus revenues it carried over from a previous fiscal year. This lack of accountability highlights the need for the city to require Visit Anaheim to separately account for its tourism district assessment fund expenditures to ensure that these funds are spent appropriately and in compliance with the tourism district assessment contract.

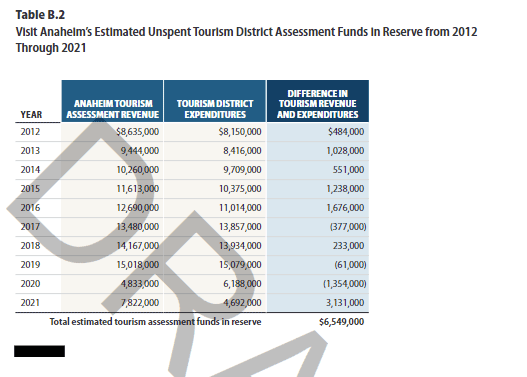

In addition, the city might not have needed to provide Visit Anaheim with the $6.5 million for the economic recovery contract if the city had performed proper oversight of the tourism district assessment contract, as we discuss later. As Table B.2 in Appendix B shows, from 2012 through 2020, we estimate that Visit Anaheim had accumulated $3.4 million in unspent surplus tourism district assessment funds that remained in its reserves and had surpluses in most preceding years. By December 2021, this number grew to more than $6 million. This surplus amount and the fact that Visit Anaheim had $1.5 million of additional funds to award to other entities call into question whether the city needed to award Visit Anaheim $6.5 million in economic recovery contract funds.

Please refer to the Recommendations section to find the recommendations that we have made as a result of these audit findings.

The City of Anaheim Performed No Meaningful Oversight of Its Contracts With Visit Anaheim or the Anaheim Chamber of Commerce

Table 4

| State Contracting Manual management practices for contract oversight | Do the city’s policies and procedures for professional services contracts include these practices? | Does the city consistently engage in these policies or practices for professional services contracts we reviewed? |

|---|---|---|

| Identify the deliverables and ensure satisfactory delivery | No | No |

| Monitor progress, especially for quality and performance deadlines | No | No |

| Conduct audits, especially for critical compliance issues | No | No |

| Review invoices for contract compliance, accuracy, and prompt payment | No | No |

| Track deadlines and use of funds | No | No |

| Identify contract and contractor problems and communicate these to the contractor | No | No |

Source: State Contracting Manual and auditor’s analysis of the city’s monitoring practices for the contracts we reviewed.

Because the city did not have a meaningful process for contract monitoring, Visit Anaheim was able to pay the Chamber for unallowable services for political purposes, and the Chamber failed to deliver certain services without the knowledge of the city. As Table 4 shows, the city lacks formal, comprehensive contract management policies and practices for professional services contracts. The State Contracting Manual provides the policies, procedures, and guidelines to promote sound business decisions and practices in securing necessary services for the State, and these constitute best practices for local governments in the State.

2010 Tourism

District Assessment Contract

Parties: City of Anaheim and Visit Anaheim

Total amount between fiscal years 2012–13 and 2021–22: $111,220,000

Key provisions:

- The city must pay Visit Anaheim 75 percent of the net collected tourism district assessments 30 calendar days after the end of each month in which the funds are collected.

- Visit Anaheim must submit an annual report that complies with the city ordinance and outlines its improvements, activities, and their estimated costs for that fiscal year, and any surplus revenues carried over from a previous fiscal year.

- Visit Anaheim must maintain financial and performance records in sufficient detail to allow an audit of the expenditure of city funds it receives.

Summary of key deliverables:

Visit Anaheim must do the following:

- Maintain records of associations, convention groups, trade show sponsors, and other such organizations for continued promotion and sales efforts.

- Maintain sales staff to contact trade show executives, submit detailed proposals, and coordinate onsite inspections of convention, exhibition, and housing facilities.

- Prepare and disseminate promotional materials and advertising for convention, trade show, and housing facilities and services, including through association memberships, tours, and print and online media.

- Provide customary convention services, including a labor pool of registrars, cashiers, and secretaries for use by conventions and trade shows, and maintain open lines of communications with convention center management and staff.

Source: Tourism district assessment contract between the city and Visit Anaheim and the city’s financial records.

In lieu of monitoring policies and procedures that would have ensured that Visit Anaheim met its contractual requirements for the 2010 tourism district assessment contract, as the text box outlines, city officials stated that they relied on two city employees to attend Visit Anaheim board meetings as the primary method of overseeing Visit Anaheim’s use of tourism district assessment funds. The services that Visit Anaheim indicated it delivered in its annual reports generally complied with the contract requirements, but the city’s oversight of the contract was limited.

According to the city’s tourism director, he and another city staff member, as Visit Anaheim board members, review information presented at the board meetings and monitor the use of tourism district assessment funds. For example, according to the tourism director, the board members discuss sales goals, marketing and advertising plans, and annual goals and budgets. He provided us with board meeting minutes that reference these items, but he was unable to provide supporting documentation, such as sales presentations and budgets referenced in those minutes. He said that he relied on Visit Anaheim to maintain records of board meetings in accordance with its contractual agreements, including the documents it distributed for review and discussion. Because it was his understanding that the tourism district assessment funds were not public funds, he relied on Visit Anaheim’s annual externally audited financial statements and did not request that the city conduct an audit of Visit Anaheim or its subcontractors, even though the tourism district assessment contract allows the city to audit Visit Anaheim’s compliance with the contract. He also stated that he was unaware of the city ever asking Visit Anaheim to provide financial records, such as invoices, to verify its contract-related expenditures since entering into the contract in 2010. Notwithstanding these documentation issues, the city should not have relied only on two city employees acting as Visit Anaheim board members to monitor the contract.

The city acknowledged that it could strengthen its contract monitoring practices. The city’s tourism director noted that the city does not have specific guidance or expectations for overseeing and monitoring the tourism district assessment contract, and the assistant city manager confirmed that the city does not have monitoring policies and procedures to guide staff in their oversight of professional services contracts. Although the city has policies related to capital improvement project contracts, the assistant city manager did not know why the city had not established similar guidance for monitoring and oversight of its professional services contracts. Because of a multitude of issues raised in this audit, the assistant city manager stated that Anaheim welcomes the opportunity and plans to develop such policies and procedures to prevent similar occurrences.

In addition to establishing monitoring policies and procedures, the city has the authority through city ordinance to strengthen its oversight of how Visit Anaheim uses tourism district assessments funds. That ordinance allows it to designate an advisory board to make recommendations to the city council regarding the expenditures of revenues derived from the tourism district assessments. The city’s 2010 management plan—a description of how the city plans to manage the tourism district—states that while the city did not intend to appoint an advisory board at that time, it may elect to do so in the future to provide representation and oversight on behalf of the assessed entities.

Given the significant funding that Visit Anaheim receives under the tourism district assessment contract, the appointment of an advisory board would serve as a critical control on behalf of the city to ensure that Visit Anaheim meets its contractual obligations—legally, financially, and practically. We found that tourism districts throughout the State have advisory boards, including Morro Bay, Palm Springs, Santa Rosa, and San Luis Obispo. For example, the advisory board in San Luis Obispo advises the city council on the administration and use of assessment funds and recommends projects to promote tourism that directly benefit area hotels. To ensure an appropriate level of knowledge and expertise, an advisory board in Anaheim should include representatives of the assessed entities within the district and—given the issues we uncovered during this audit—legal counsel and a person knowledgeable of government finance.

A Lack of Clearly Defined Deliverables in the Tourism District Assessment Contract Further Limited the City’s Oversight

We also found that the tourism district assessment contract’s lack of specific deliverables inhibited the city’s ability to effectively monitor the contract, which provided Visit Anaheim with approximately $5 million to $15 million annually from 2012 through 2021. According to the State Contracting Manual, which cities can use as contracting best practices, a contracting state agency must build contract management into the contract to facilitate measurement of achievement and contractor performance, and it must conduct specific contract oversight activities, as Table 4 outlines. The State Contracting Manual also states that contracts must include clear and concise language to describe the scope of work and deliverables. However, the tourism district assessment contract included only vague high-level expectations for the services that Visit Anaheim was to perform in its day-to-day operations of the tourism district.

For example, the contract requires Visit Anaheim to contact convention and trade show executives, to disseminate related promotional materials, and to conduct tours for industry representatives. However, the contract does not include clear performance benchmarks, such as the number of contacts Visit Anaheim should make, the number of people to whom it should disseminate promotional materials, or the number of tours it should conduct for industry representatives. It also does not provide other possible benchmarks, such as goals for occupancy rates or convention center bookings. The city’s tourism director acknowledged that the city could better specify the contract deliverables by clearly defining what elements the city expects Visit Anaheim to include in its annual reports, such as consistent prospective and retrospective financials, key performance indicators, and detailed descriptions of promotional activities. Without clearly defining the contract’s deliverables, the city is limited in its ability to measure whether Visit Anaheim is effectively spending the millions of dollars it receives each year and its ability to ensure accountability to the entities in the tourism district.

The City Did Not Require Visit Anaheim to Provide the Necessary Information for the City to Effectively Monitor the Use of Public Funds

Although our review found that from fiscal years 2017–18 through 2021–2022, Visit Anaheim submitted annual reports to the city as its contract with the city required, the city has not required Visit Anaheim to comply with all of the annual reporting requirements. Such compliance would have allowed the city to better measure whether Visit Anaheim was using tourism district assessment funds effectively. A city ordinance, which the tourism district assessment contract incorporates by reference, requires Visit Anaheim to submit an annual report that describes, among other things, the activities it will provide that fiscal year, an estimate of the cost of providing those activities, and the amount of any surplus revenues it has carried over from the previous fiscal year. If Visit Anaheim had reported the activities it planned to provide and the estimated costs of those activities, it would have provided the city with another mechanism to verify the deliverables and the amount of surplus revenues. Such reporting would have also allowed the city to establish ongoing monitoring to ensure that Visit Anaheim delivered the services and that those services were commensurate with the cost. However, the annual reports that Visit Anaheim submitted to the city from fiscal years 2017–18 through 2021–22 did not include its surplus revenues, the activities it planned to provide in that fiscal year, or the estimated cost for providing those services.

In our review of Visit Anaheim’s annual reports, we found that Visit Anaheim included selective information on the activities it had conducted during the previous year and that the reports were not consistent enough to compare Visit Anaheim’s year-to-year performance. Figure 3 shows an example of this inconsistency. In fiscal year 2017–18, Visit Anaheim reported that it ran a sweepstakes advertisement to 8 million people to obtain emails for its electronic newsletter, and the sweepstakes generated more than 5,000 entries. In fiscal year 2018–19, Visit Anaheim reported distributing the same sweepstakes to approximately 11 million people, but it did not report how many entries it received. In fiscal year 2019–20, Visit Anaheim only reported that it ran the sweepstakes, but it did not report the distribution numbers or the results. Visit Anaheim believed that the reports it had provided were acceptable, because the city never provided it with guidance or feedback to the contrary. However, by not requiring Visit Anaheim to report consistent information from year to year, the city limited its ability to assess the progress of Visit Anaheim’s activities and to evaluate whether it was effectively using public funds.

Figure 3

Visit Anaheim’s Reporting of an Annual Sweepstakes Promotion Was Inconsistent From Year to Year

Source: Auditor’s analysis of Visit Anaheim’s annual reports to the city.

Figure 3 description:

Figure 3 is a side-by-side comparison of Visit Anaheim's reporting of a sweepstakes it promoted, including the number of people reached and the number of sweepstakes entries, each fiscal year from 2017-18 to 2019-20. The x axis is organized by fiscal year, and the y axis includes the number of people reached and the number of sweepstakes entries. Visit Anaheim reported that it reached 8 million people in fiscal year 2017-18, 11 million people in fiscal year 2018-19, and the figure show a question mark for the number of people reached it reached in fiscal year 2019-20, indicating that Visit Anaheim did not report the number of people it reached that year. Visit Anaheim reported that it obtained 5,000 sweepstakes entries in fiscal year 2017-18. However, the figure has question marks for fiscal years 2018-19 and 2019-20, indicating that Visit Anaheim did not report the number of sweepstakes entries it obtained in those years.

The city’s tourism director, who indicated that he was responsible for reviewing and submitting Visit Anaheim’s report to the city council for consideration each year, explained that he did not realize that Visit Anaheim’s annual reports did not comply with the requirements set forth in the city ordinance. He did not question the report’s lack of compliance with the ordinance and did not request additional information or provide additional guidance to Visit Anaheim to clarify expectations. Upon his subsequent review of the city ordinance, he acknowledged that the annual reports did not meet the requirements and that the reports should have addressed Visit Anaheim’s plan for using tourism district assessment funds in that fiscal year. However, because the city did not ensure that Visit Anaheim’s reports included the required information, the city’s ability to assess the effectiveness of Visit Anaheim’s activities was limited. As we discussed previously, had Visit Anaheim reported the surplus tourism district assessment revenue each year, the city might not have felt compelled to award it an additional $6.5 million to assist with economic recovery.

Visit Anaheim’s senior vice president of operations indicated that the city requested that Visit Anaheim include additional information in its fiscal year 2022–23 annual report, such as its 2024 work plans, projections, and a statement of income and expenses. In our review of this report, we found that Visit Anaheim included the additional information that the city requested, including planned activities for 2024, visitor projections, and revenue and expense information. However, although it included information on its remaining unspent revenue for fiscal year 2022–23, Visit Anaheim still did not report cumulative surplus revenue from the tourism district assessment funds as required.

The City’s Lack of Monitoring Also Led to Limited Oversight for the Other Visit Anaheim and Chamber Contracts We Reviewed

Aside from the 2010 tourism district assessment contract discussed previously, the city was also unable to demonstrate that it performed regular monitoring of three other contracts we reviewed. For example, the 2020 economic recovery contract with Visit Anaheim that we discussed previously states that one of its goals was to restore meetings and convention bookings to pre-pandemic levels and that Visit Anaheim should complete the related services in a timely and expeditious manner. However, until we prompted its leadership to do so, the city had not compared pre-pandemic meetings and convention bookings to the bookings at the time of Visit Anaheim’s final report in April 2021 or anytime thereafter, and was unaware of whether Visit Anaheim had accomplished its goals. Further, the city council intended the funds to be allocated for services—according to certain percentages—for advertising, co-op marketing, sales and paid advertising, content development, communications, and other services. The contract also required Visit Anaheim to submit invoices or other documentation providing a detailed description of the services it had performed. However, the city never asked it to provide invoices or detailed documentation to ensure that Visit Anaheim spent the funds as intended. According to the assistant city manager, the city did not oversee the spending of these funds because, at the time, the pandemic was an evolving situation and no one expected it to continue as long as it did.

The city was also unable to demonstrate that it provided any meaningful oversight of its 2019 sponsorship agreement or its 2020 shop-and-dine-local program contract with the Chamber. According to the assistant city manager, the city did not monitor these contracts on a day-to-day basis because of staff turnover. In each contract, however, we found unmet and unsubstantiated deliverables that the city would likely have identified with adequate monitoring and oversight. As a result, the city paid for some services it did not receive, which may constitute a waste of public funds.

Please refer to the Recommendations section to find the recommendations that we have made as a result of these audit findings.

Other Areas Reviewed

To address audit objectives approved by the Joint Legislative Audit Committee (Audit Committee), we include in this section additional information related to the city of Anaheim.

Compensation of Executives at Visit Anaheim and the Chamber

Examples of Reportable Compensation:

- Salary or wages

- Bonuses or incentives

- Sick pay

- Sick or vacation leave cashed out

- Retirement contributions

- Health benefits

Source: 2022 instructions for Form 990 Return of Organization Exempt From Income Tax.

We reviewed publicly available federal tax filings from 2017 through 2021 for Visit Anaheim and the Chamber to determine the extent to which these organizations increased staff compensation during the pandemic. Our review was limited to the executive staff included in those filings. Reportable compensation includes various types of compensation, some of which the text box shows. We found that the reported executive compensation at Visit Anaheim generally decreased in 2020 and 2021 during pandemic. For example, Visit Anaheim’s former president’s reportable compensation was nearly $500,000 in 2019, but it decreased to roughly $400,000 in 2020 and then decreased to just more than $300,000 in 2021. The Chamber’s former president’s reportable compensation was $248,000 in 2018, $241,000 in 2019, and $295,000 in 2020. Current Chamber staff stated that its publicly available 2019 tax filing was incorrect, and it provided us with an amended filing that the Chamber said it filed in December 2023. The 2019 compensation reported above reflects this amended amount and is higher than the amount originally reported for the Chamber’s former president of $168,000. Chamber staff indicated that the former Chamber president resigned from his position in October 2021 and was reported to have received $230,021 in year-to-date reportable compensation.

Current Chamber staff also asserted that they were unaware of how the Chamber determined the former president’s salary each year and that they were not privy to that information. Based on our review of publicly available and amended information, we found no indication that the Chamber used public funds to increase the Chamber’s former president’s salary during the pandemic.

Conflicts of Interest

We also reviewed whether certain conflicts of interest existed between the city of Anaheim and the Chamber or Visit Anaheim from 2012 through 2022. Our review did not uncover any evidence that a sitting member of the Anaheim city council or another city official had a personal financial interest in any contract entered into with the Chamber or Visit Anaheim that would give rise to a violation of the conflict-of-interest laws under Government Code section 1090 or the Political Reform Act of 1974. We note, however, that due to limited resources and time constraints, we did not conduct a review of whether an immediate family member of a sitting councilmember or other city official had a financial interest in the Chamber or Visit Anaheim that would give rise to a violation of those conflict-of-interest laws.

Recommendations

To ensure better oversight of tourism district assessment funds, the Anaheim city council should by July 2024 designate an advisory board to make recommendations regarding how such funds should be spent. The advisory board should include, at a minimum, some of the owners of the assessed entities within the tourism district, legal counsel, and a person knowledgeable in government finance.

To ensure better stewardship of public funds, Anaheim should by January 2025 develop a contract management, monitoring, and oversight process that aligns with the practices set forth in the corresponding provisions of the State Contracting Manual. Specifically, the city should implement policies and procedures for its professional services contracts that require it to track contract deadlines, deliverables, and contractors’ use of funds, and it should perform periodic compliance audits and reviews of contractors’ financial records.

To improve Anaheim’s oversight of the tourism district assessment contract with Visit Anaheim, the city should by January 2025 seek to renegotiate with Visit Anaheim to revise the contract to ensure that the contract does the following:

- Includes key performance indicators to allow the city to better gauge how effectively Visit Anaheim is using tourism district assessment funds. These benchmarks should include, at a minimum, hotel occupancy rates, convention center bookings, and the number of presentations made to convention center executives.

- Requires that Visit Anaheim separately track all expenditures related to the contract and prohibits Visits Anaheim from comingling tourism district assessment funds with other revenue sources.

- Requires Visit Anaheim to annually report to the city the amount of any unspent tourism district assessment funds and tourism district assessment fund reserve balances.

- Prohibits Visit Anaheim from transferring tourism district assessment funds to another entity without the city’s prior approval and full compliance with the subcontracting provisions of the tourism district assessment contract.

- Requires Visit Anaheim to develop a plan for oversight of any subcontractor and provide documentation of this oversight annually to the city.

To ensure that the city of Anaheim receives adequate consideration for all of its professional services contracts, the city should implement contract monitoring practices sufficient to ensure that it receives all of the deliverables agreed to in any contract’s scope of work. Further, the city should assess whether it received adequate consideration for the 2019 economic development contract or the 2020 shop-and-dine-local contract; if the city finds that it did not receive adequate consideration, then the city should explore its restitution mechanisms under contract law to obtain a return of those funds.

We conducted this performance audit in accordance with generally accepted government auditing standards and under the authority vested in the California State Auditor by Government Code section 8543 et seq. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on the audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Respectfully submitted,

GRANT PARKS

California State Auditor

January 30, 2024

Staff:

Nicholas Kolitsos, CPA, Audit Principal

Aaron Fellner

Logan Blower

Karen Wells

Legal Counsel:

Heather Kendrick

JudyAnne Alanis

Appendices

Appendix A—Scope and Methodology

Appendix B—Visit Anaheim's Expenditures

Appendix A

Scope and Methodology

The Audit Committee directed the State Auditor to conduct an urgent audit of the city of Anaheim to review the public funds it disbursed to Visit Anaheim and the Chamber. This urgent audit was conducted pursuant to rule 18 of the Audit Committee that states that the cost of urgent audit requests must not exceed $290,000, and the approved audit request allows the State Auditor to modify or decrease the scope of this audit to remain within the monetary limit. Table A lists the objectives that the Audit Committee approved and the methods we used to address them. Unless otherwise stated in the table or elsewhere in the report, all statements and conclusions about items selected for review cannot be projected to the population.

Table A

Audit Objectives and the Methods Used to Address Them

| AUDIT OBJECTIVE | METHOD | |

|---|---|---|

| 1 | Examine all sources of public funds that the city disbursed to the Anaheim Chamber of Commerce and Visit Anaheim or their affiliates over the past 10 years and how those funds were used. |

|

| 2 | For each contract, initiative, project, etc., approved by the city in which the Anaheim Chamber of Commerce or Visit Anaheim were recipients of public funds, identify the source of the money, the parameters on those funds, and how each dollar was ultimately spent. This should include a review of all contracts approved by the Anaheim city council, city manager, and city director in the past 10 years. |

|

| 3 | Examine the city’s policies regarding projects, grants, contracts, etc., and identify what went into their decision-making process for awarding funds to the Anaheim Chamber of Commerce and Visit Anaheim and their affiliates. Additionally, review the city’s process for monitoring its projects, grants, contracts, etc. with the Anaheim Chamber of Commerce and Visit Anaheim to ensure compliance and recommend ways it can improve its oversight. |

|

| 4 | Identify COVID-19 funds, such as the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), awarded to the city and then given to the Anaheim Chamber of Commerce and Visit Anaheim. For any COVID-19 funds allocated to these entities by the city, identify the amount of money given, the parameters of those funds, and how the dollars were ultimately spent. | Determined the sources of funds the city used to pay Visit Anaheim and the Chamber from fiscal years 2012–13 through 2021–22 and did not identify any COVID-19 funds, such as CARES Act funds awarded to the city of Anaheim, used to pay those contracts. Table 1 shows the sources of funds for those contracts. |

| 5 | Identify the number of no-bid contracts the city awarded to the Anaheim Chamber of Commerce and Visit Anaheim, and determine whether the lack of competitively bid contracts were justified and/or complied with the city’s policies and practices. | Reviewed five no-bid contracts that the city of Anaheim entered into with Visit Anaheim and the Chamber. We found that the city complied with its policies and procedures when awarding no-bid contracts to Visit Anaheim for the tourism assessment district contract in 2010, the volleyball retention contract in 2017, and the economic recovery contract in 2020. Similarly, we found that the city complied with its policies and procedures when awarding no-bid contracts to the Chamber for a sponsorship agreement in 2019 and the shop-and-dine-local contract in 2020. We did not review how the city awarded two other contracts it had with the Chamber, because these contracts were outside of our review authority. |

| 6 | Determine whether any public dollars allocated to the Anaheim Chamber of Commerce or Visit Anaheim by the city of Anaheim were used for increases in staff salaries or compensation for professional services (consultants, lobbyists, contractors, etc.) during the COVID-19 shutdown. | Determined whether executive reportable compensation at Visit Anaheim and the Chamber increased during the pandemic by reviewing executive reportable compensation information disclosed annually in publicly available tax documents. Because this was an urgent audit, our budget and expedited timeframe did not allow us to conduct work on whether Visit Anaheim or the Chamber used public funds to increase salaries for consultants, lobbyists, or contractors. |

| 7 | Identify the public funds the city has spent on negotiations surrounding the sale of the Angel Stadium and resolving the Surplus Land Act issue. | Because this was an urgent audit, our budget and expedited reporting timeframe did not allow for us to conduct work on this objective. |

| 8 | So long as it does not interfere with litigation or criminal indictment, identify and report any corruption that took place. | Because this was an urgent audit, our budget and expedited audit release timeframe did not allow us to conduct work on this objective. Additionally, had we attempted to conduct the work, we might not have been able to proceed or report under audit standards, as we are not to interfere with ongoing litigation or investigations. |

| 9 | For the last 10 years, identify any conflicts of interest among the City of Anaheim, Anaheim Chamber of Commerce, and Visit Anaheim. | Analyzed whether any sitting member of the Anaheim city council or other city official, in the prior 10 years, had a personal financial interest in any contract entered into by the city with the Chamber or Visit Anaheim. However, because this was an urgent audit, our budget and expedited reporting timeframe did not allow us to review whether an immediate family member of a sitting member of the Anaheim city council or other city official had a financial interest that would give rise to a violation of conflicts-of-interests laws. |

| 10 | Determine whether the City has adequate practices and policies in place to ensure that staff, councilmembers, Anaheim Chamber of Commerce, and Visit Anaheim comply with the Brown Act. Identify any violations of the Brown Act. | Because this was an urgent audit, our budget and expedited reporting timeframe did not allow us to conduct work on this objective. |

Source: Audit workpapers.

Assessment of Data Reliability

The U.S. Government Accountability Office, whose standards we are statutorily obligated to follow, requires us to assess the sufficiency and appropriateness of computer‑processed information that we use to support our findings, conclusions, or recommendations. In performing this audit, we relied on financial records from the city of Anaheim and on the records of Visit Anaheim. To evaluate the completeness of the city’s financial reports, we searched its accounting records by vendor for Visit Anaheim and the Chamber and the transactions for those entities from fiscal years 2012–13 through 2021–22. We also compared the total amounts the city disbursed to Visit Anaheim and the Chamber from fiscal years 2012–13 through 2021–22 to the amounts in the related contracts, and we found that the totals materially matched. Thus, we were able to gain some assurance that we captured the complete population of payments made by the city to Visit Anaheim and the Chamber. We also relied upon records obtained from Visit Anaheim during calendar years 2012 through 2021. To gain assurance that we obtained all expenditures from Visit Anaheim to the Chamber related to the tourism district assessment contract, we compared the total expenditures in its records to its audited financial statements. We found that the total expenditure amounts materially matched. In both instances, we found the data to be sufficiently reliable for our audit purposes.

Appendix B

Visit Anaheim's Expenditures

The tourism district assessment contract between Anaheim and Visit Anaheim requires that Visit Anaheim maintain financial and performance records sufficient to conform with generally accepted accounting principles to allow for an audit of the expenditure of tourism district assessment funds. However, Visit Anaheim did not discretely account for expenditures related to the tourism district assessment funds that it received. To present an estimate of Visit Anaheim’s expenditures and unspent tourism district assessment funds, we used the revenue and expenditures that Visit Anaheim reported in its annual audited financial statements and applied the percentage of total revenue that Visit Anaheim received from tourism district assessment funds to its total annual expenditures by category, as Tables B.1 and B.2 show. This methodology is similar to the one proposed by the city in 2011 for estimating tourism district assessment reserves.

Table B.1

Estimated Tourism District Assessment Expenditures by Category

2012 Through 2021 (nearest thousand)

| Category | Expenditures |

|---|---|

| Salaries and wages | $40,174,000 |

| Convention advertising, promotion, research | 10,252,000 |

| Solicitation—travel and promotion | 7,482,000 |

| Insurance | 7,055,000 |

| Tourism travel and promotion | 6,120,000 |

| Anaheim Chamber of Commerce | 2,738,000 |

| Payroll taxes | 2,859,000 |

| Rent | 2,774,000 |

| Computer contingency | 2,662,000 |

| Miscellaneous | 2,605,000 |

| Enterprise Anaheim, LLC | 2,178,000 |

| Client assistant commitments | 2,080,000 |

| Convention associations, meetings, exhibitions | 1,840,000 |

| Media and community relations | 1,373,000 |

| Employer’s pension contribution | 1,303,000 |

| TID reimbursable expenses | 954,000 |

| Professional services and public relations | 946,000 |

| Membership expense | 922,000 |

| Industry events | 576,000 |

| Client materials, services, and housing | 509,000 |

| Passkey user fees | 414,000 |

| Community assistance | 403,000 |

| Supplies and other office expenses | 383,000 |

| Legal fees | 346,000 |

| Telephone | 318,000 |

| Equipment rental | 297,000 |

| Pension administration fees | 261,000 |

| Partnership development | 251,000 |

| Payroll administrative fees | 221,000 |

| General travel and promotion | 206,000 |

| Mailing cost | 171,000 |

| Events—sports development | 171,000 |

| Depreciation | 146,000 |

| Employee—auto and mileage expenses | 115,000 |

| Other | 309,000 |

Source: Auditor’s analysis of Visit Anaheim’s annual financial statements.

Table B.2

Visit Anaheim’s Estimated Unspent Tourism District Assessment Funds in Reserve

2012 Through 2021 (nearest thousand)

| Year | Anaheim tourism assessment revenue | Tourism district expenditures | Difference in Tourism Revenue and Expenditures |

|---|---|---|---|

| 2012 | $8,635,000 | $8,150,000 | $485,000 |

| 2013 | 9,444,000 | 8,416,000 | 1,028,000 |

| 2014 | 10,260,000 | 9,709,000 | 551,000 |

| 2015 | 11,613,000 | 10,375,000 | 1,238,000 |

| 2016 | 12,690,000 | 11,014,000 | 1,676,000 |

| 2017 | 13,480,000 | 13,857,000 | (377,000) |

| 2018 | 14,167,000 | 13,934,000 | 233,000 |

| 2019 | 15,018,000 | 15,079,000 | (61,000) |

| 2020* | 4,833,000 | 6,188,000 | (1,355,000) |

| 2021 | 7,822,000 | 4,690,000 | 3,132,000 |

Source: Auditor’s analysis of Visit Anaheim’s annual financial statements.

Note: Total tourism district expenditures differ slightly from total expenditures in Table B.1 due to rounding.

* From 2012 through 2020, Visit Anaheim had accumulated an estimated $3.4 million in unspent surplus tourism district assessment funds.

Responses

Anaheim of Chamber of Commerce

Larson LLP on behalf of Visit Anaheim

Anaheim Chamber of Commerce

January 11, 2024

Mr. Grant Parks

California State Auditor

621 Capitol Mall, Suite 1200

Sacramento, California 95814

Dear Mr. Parks:

The Anaheim Chamber of Commerce would like to express its gratitude to the State Auditor for affording us the opportunity to respond to the audit report, despite the absence of specific recommendations directed towards the Chamber.

①We understand that in accordance with State law, the State Auditor’s office could not provide an unredacted copy of the entire report as other aspects of the audit pertain to the City of Anaheim and Visit Anaheim. Consequently, our response is based on approximately 1/3 of the audit report that we were able to review, with about 2/3 of the report remaining redacted. It is essential to note that all recommendations within the audit report were redacted, given that none were specifically directed towards the Chamber. The redactions varied in scope, ranging from entire pages, paragraphs, sentences to individual words within sentences.

②The examination conducted by the State Auditor’s office included a scrutiny of several Chamber contracts. For the majority of those contracts the Chamber was able to provide evidence to the audit staff demonstrating the numerous activities that the Chamber engaged in for the benefit of Anaheim.

In the tourism improvement district (TID) agreement workplans with Visit Anaheim, of the 10 activities selected for review, the State Auditor’s office found the Chamber able to substantiate 7. While 3 items were singled out, it is crucial to understand that an unsubstantiated deliverable does not imply the work did not occur. It is not a statement by the Auditor’s office suggesting the absence of the work.

Furthermore, we believe it is imperative for readers of the audit report to have proper context regarding the items shown in Table 3:

③For the first two items in Table 3, the State Auditor’s table acknowledges that the Chamber provided evidence of calendared meetings where deliverables were meetings or visits but indicated that the Chamber could not provide documentation showing the purpose of the meetings and actual discussions held, which in our view is unreasonable, given that the meetings occurred three to five years ago.

④The third item in Table 3 from the TID agreement with Visit Anaheim was the 2021 workplan. The 2021 workplan was supposed to be adopted in late 2020; however, this was during the height of the COVID-19 pandemic when the Governor imposed the strictest lockdown of the entire pandemic with the regional stay-at-home orders. Consequently, as described in the mid-year update for 2021, the Chamber continued to operate under the 2020 workplan.

⑤Since 2015, the Chamber has engaged in various activities, including advocacy and policy work impacting the tourism industry, such as tracking, supporting, or opposing legislation, meetings with policymakers, and discussions on government affairs.

⑥We concur with the State Auditor’s acknowledgment that there was nothing in the Chamber’s agreement with Visit Anaheim that prohibited these activities.

⑥Nevertheless, the State Auditor’s office contends that these were deemed unallowable activities under the City’s agreement with Visit Anaheim because they should be considered political activity. We respectfully disagree with this assessment, as these services and activities have demonstrably benefited the tourism and convention industries in Anaheim.