City of Compton

Financial Mismanagement and a Lack of Leadership Have Threatened Compton's Ability to Serve the Public

October 13, 2022

2021-802

The Governor of California

President pro Tempore of the Senate

Speaker of the Assembly

State Capitol

Sacramento, California 95814

Dear Governor and Legislative Leaders:

The city of Compton (Compton) has struggled for several years to adequately perform many core functions of city government:

- Many of its streets are in poor condition, and its water wells and related infrastructure are decaying.

- For more than a decade, it has faced a persistent deficit in its general fund and has failed to produce timely, complete audited financial statements.

- It has suffered high turnover and ongoing vacancies in key positions for many years.

Since October 2019, our local high-risk dashboard has ranked Compton as the most financially at-risk city in California, and our audit of the city found that financial mismanagement and a lack of leadership have threatened Compton's ability to serve the public.

Compton's deteriorating infrastructure presents health and safety risks to the public and is emblematic of the city's overall troubles. One reason for its infrastructure's state of disrepair is that the city has not updated its plan for prioritizing and funding infrastructure projects since 2014. Compton's financial mismanagement and problematic budgeting practices have also allowed millions of dollars in certain funds to sit idle while the city could have used them for street repairs and water system improvements.

The overarching cause of Compton's challenges has been its inability to hire and retain qualified leaders and staff. In the past six fiscal years, Compton has had six city managers—a position that is critical to a city's effective operation. One likely cause for such turnover is that the city has not consistently used an open and competitive hiring process when selecting individuals to serve in important roles. Compton has also suffered chronic understaffing, and issues related to the city's human resources department have compromised its ability to recruit and retain staff.

The recommendations we present in this report serve as a roadmap for Compton to achieve stability and ensure that the city's leadership can provide essential services to its residents.

Respectfully submitted,

MICHAEL S. TILDEN, CPA

Acting California State Auditor

HIGH-RISK ISSUES

| ISSUE | |

|---|---|

| Compton's Deteriorating Infrastructure Presents Significant Health and Safety Risks | |

| Compton Has Not Developed an Updated Plan for Prioritizing Its Capital Improvements | |

| Half of Compton's Streets Are in Poor Condition | |

| Compton's Aging Water Infrastructure Threatens the Reliability of Its Water Supply | |

| Despite Numerous Sewage Overflows, the City Has Not Completed Needed Sewer Infrastructure Projects | |

| Financial Mismanagement Has Hampered Compton's Ability to Address Its Infrastructure Needs | |

| Rather Than Address Its Financial Instability, Compton Has Used Funds Dedicated for Specific Purposes to Support Its General Fund | |

| The City Lacks an Adequate Plan for Addressing Its Financial Challenges | |

| The City's Problematic Budgeting Practices Have Prevented Transparency and Left Funds Unspent | |

| By Not Updating Charges for City Services, Compton Has Forgone Potential Revenue | |

| Compton's Inadequate Purchasing Safeguards Increase the Risk of Fraud, Waste, and Abuse | |

| The City Has Struggled to Retain Leadership and Staff | |

| High Turnover and Vacancies in Key Management Positions Have Led to a Lack of Continuity in Compton's Leadership | |

| Compton's Weak Hiring Process Has Not Ensured That Key Staff Are Qualified to Perform Their Duties | |

| Weaknesses in Its Human Resources Department Have Prevented Compton From Filling Vacancies and Retaining Staff | |

| The City Does Not Provide Recurring Training to the City Council on Its Financial and Operational Oversight Responsibilities | |

| Appendices | |

| Appendix A—The State Auditor's Local High-Risk Program | |

| Appendix B—Scope and Methodology | |

| Agency Response | |

| City of Compton | |

Risks the City of Compton Faces

The city of Compton (Compton) has struggled for several years to adequately perform many core functions of city government. Compton's past overspending and questionable budgeting have contributed to a debilitating, persistent deficit in its general fund. The city has also failed to produce timely and complete audited financial statements for more than a decade, and it did not issue financial statements at all for several of those years. As a result, since October 2019, we have ranked Compton on our local high-risk dashboard as the most financially at-risk city in California. In the midst of this financial instability, the State Controller's Office reported in 2018 that the city's controls over its finances were virtually nonexistent. In fact, Compton's lack of controls allowed a former deputy treasurer to embezzle $3.7 million from 2010 through 2016. Compton has received hundreds of audit findings from several previous reviews but has yet to resolve many of those issues. For all of these reasons, Compton continues to be at high risk of fraud, waste, and abuse.

Compton's deteriorating infrastructure—which has presented health and safety risks to the public—is emblematic of its struggles. Half of Compton's streets are in poor condition, its water wells and related infrastructure are decaying, and it has not yet completed overdue sewer system upgrades, despite numerous overflows of sewage that have threatened public health and the environment. One reason for Compton's infrastructure disrepair is that it has not updated its citywide capital improvement plan—which should prioritize the city's infrastructure projects and identify their funding sources—since 2014. In part because Compton has left many of its infrastructure needs unaddressed, repairs to its streets, water systems, and sewer systems will likely end up costing the city well over $100 million.

Financial mismanagement has played a significant role in Compton's inability to maintain its infrastructure and perform other key functions. After depleting its general fund reserve balance in fiscal year 2008–09, Compton supported its general fund by borrowing heavily from other funds, such as its water and sewer funds—nearly $29 million of which the general fund has yet to repay. This borrowing has limited the resources available for needed infrastructure projects. Moreover, the city's problematic budgeting practices have allowed millions of dollars in certain funds to sit idle while Compton's infrastructure deteriorates. For example, because it has not appropriately monitored its unspent revenue, Compton has accumulated balances of about $41 million in unspent financial resources, some of which could have been used for street repairs and water system improvements. Compton also has not regularly assessed its charges for city services to ensure that they cover the costs of providing those services, thereby potentially forgoing much-needed revenue. Further, the city's inadequate purchasing and contracting practices have increased the risk of unauthorized or inappropriate spending.

The overarching cause of Compton's numerous challenges, however, has been its struggle to hire and retain qualified leaders and staff. Compton has been plagued by high turnover and ongoing vacancies in key positions for many years. For example, in the past six fiscal years, Compton has had six city managers—a position that is critical to the city's effective operation. Compton's high turnover is likely in part the result of not consistently using an open and competitive hiring process, and it has at times faced consequences for selecting existing city staff members to serve in important roles without considering external candidates. Further, chronic understaffing and inadequately documented processes in the city's human resources department have compromised that department's ability to adequately perform some of its basic functions for recruiting and retaining staff, such as regularly reviewing salaries to ensure that they are competitive and developing effective strategies for advertising open positions. Finally, Compton has not provided its city council—which is ultimately responsible for the city's governance—with recurring training on important topics such as approving budgets and monitoring the city's financial status, even though the council has also experienced significant recent turnover.

Because our audit and previous reviews of Compton have determined that the city's many deficiencies point toward deep structural problems, we have prioritized our recommendations in an effort to ensure that the city addresses core issues first. For example, we believe that prioritizing an open and competitive hiring process, overhauling and fully staffing the city's human resources department, and developing plans for fiscal sustainability and needed infrastructure projects are initial priorities that will significantly improve Compton's operations and financial stability. Our recommendations present a roadmap for the city to achieve stability and ensure that it can provide essential services to its residents. However, if in the next three years Compton still cannot adequately address its long‑standing challenges, we believe it may be necessary for the Legislature to consider implementing ongoing external oversight of the city's finances and operations.

Recommendations

The following are the recommendations we made as a result of our audit. Descriptions of the findings and conclusions that led to these recommendations can be found in the sections of this report. Given the magnitude and quantity of risks facing Compton, we have presented our recommendations for the city by priority level to help it address the issues of greatest concern first.

Legislature

Based on deficiencies with city council oversight that we discuss in this report as well as in several previous audits of other cities, to improve the governance of cities throughout California, the Legislature should consider requiring all individuals who serve on a city council to participate in recurring training related to municipal finance, budgeting, and the council's role in overseeing city operations.

Compton

Priority 1 Recommendations

To ensure that Compton has consistent, qualified management and fundamental plans in place to address the challenges it is currently facing, its city council should prioritize taking the following actions:

- By April 2023, propose city charter amendments to be voted on in the next statewide general election—and amend all related guidelines, such as the personnel rules and regulations, to the extent permissible under the existing charter—to prioritize an open, competitive hiring process for all positions. The city council's proposed charter amendments should also explicitly require that Compton use an open, competitive hiring process whenever it makes permanent appointments for key leadership positions that include but are not limited to the following: city manager, city controller, human resources director, and budget officer. As part of this process, the city council should develop detailed job qualifications for the city manager position.

- By April 2023, formalize the key responsibilities of the human resources department and its director by amending the municipal code or personnel rules and regulations or by proposing charter amendments, and ensure that the department begins making efforts to meet these responsibilities. The responsibilities should include at a minimum the following tasks in the area of recruiting and hiring:

- Perform a salary survey for all positions that compares the city's compensation to that of other cities or employers and update it at least once every three years to ensure that the city is positioned to provide competitive pay. Upon completion of the initial survey, the human resources director should work with the city manager to develop a process for using the survey results to increase compensation where feasible, such as by prioritizing increases for the positions that have the lowest salaries compared to the survey results.

- Develop a process for maintaining and proactively reviewing job specifications for all positions to ensure that they are reasonably up to date.

- Document and implement a plan for recruiting, including the websites on which the city will advertise its open positions, to ensure that it attracts qualified applicants for each recruitment.

- Take ownership of key aspects of the recruiting and hiring process, such as managing labor negotiations and setting and meeting clear goals for filling positions in a timely manner.

- Formally assess each recruitment effort to determine how the recruiting and hiring process could be improved.

- Develop and maintain a succession plan for key positions.

- Document specific procedures for accomplishing the above objectives, such as by updating the recruitment and examination manual, and disseminate the procedures to appropriate staff.

- In addition, the city council should require that the city manager submit a report to the council at least annually that describes the human resources department's status in meeting these objectives and minimizing ongoing staff vacancies.

- By July 2023, direct the city manager to make efforts to fully staff the human resources department and the city controller's office with qualified individuals to ensure that these departments can address Compton's broader, chronic issues related to staffing and finances. The level of staffing in the departments should be sufficient for the successful performance of key tasks, including those listed in our recommendations.

- To ensure accountability for Compton's fiscal recovery process, the city should develop and the city council should approve a fiscal sustainability plan by July 2023 that contains specific measures for increasing revenues, decreasing expenditures, and eliminating fund deficits. This plan should identify the individuals responsible for implementing these measures and those responsible for monitoring the city's progress in implementing each action, should include estimated dates of completion, and should describe the estimated fiscal impact of each measure. City management should also inform the city council every quarter of its progress in implementing the plan.

- By July 2023, the city should develop and the city council should approve an updated capital improvement plan. The city should then immediately begin implementing its updated capital improvement plan for needed infrastructure projects. The plan should set priorities for all projects, with an emphasis on those related to repairing and updating its streets, water system, and sewer system. The plan should include estimated costs and associated funding sources for each project and should take into consideration all prior unspent revenue and existing fund balances, such as Measure P and water fund resources. Compton should update its capital improvement plan at least once every three years.

Priority 2 Recommendations

After Compton has taken action to address its risk areas of greatest concern, it should do the following:

- By July 2023, city management should complete and the city council should approve an updated cost allocation plan. The council should also ensure that the fiscal year 2023–24 budget and subsequent budgets incorporate the results of this plan. For example, the budgets should include transfer amounts from the water fund to the general fund that accurately reflect the amounts the water fund owes for citywide services.

- By October 2023, the city council should adopt budgeting policies that follow Government Finance Officers Association (GFOA) best practices. For example, the policies should specify that city staff solicit input from the public about priorities before starting the budget process and that the city has a process for ensuring that the city budget document is clear and comprehensible.

- By October 2023, to ensure that its city council has the necessary knowledge and tools to make sound and responsible decisions on behalf of the public, Compton should implement a robust orientation and ongoing training program for council members, including training related to budgeting, finances, and the council's role in overseeing city operations.

Priority 3 Recommendations

After Compton has addressed the above recommendations, it should do the following:

- By January 2024, Compton should establish a central purchasing office and hire or formally designate a procurement officer to oversee the city's purchases and contracting, including maintaining all necessary documentation.

- By January 2024, Compton should create a comprehensive citywide purchasing manual with updated standards and policies regarding purchasing and contracting.

- By April 2024, the city should develop and the city council should approve an updated master sewer study that identifies infrastructure and maintenance needs.

- By July 2024, Compton should evaluate and the city council should approve updated charges for all city services in accordance with the substantive and procedural requirements of the state constitution. Compton should review its charges for services at least once every three years following this initial update.

- By July 2024, the city council should approve a realistic repayment plan for the amounts that the general fund has borrowed from other funds, with repayments beginning by at least fiscal year 2024–25.

- By July 2024, the city council should ensure that the city has issued its audited financial statements for fiscal years 2020–21, 2021–22, and 2022–23. The council should adopt a requirement that, for subsequent years, the city must issue complete audited financial statements by six months after the end of the fiscal year. To ensure that it has the ability to meet this requirement, the city should consider measures such as increasing staff in the city controller's office and training them on their responsibilities for preparing the financial statements.

- By July 2024, the city council should ensure that the city develops and begins implementing a plan for reducing Compton's pension and other postemployment benefits (OPEB) costs and liabilities. This plan may include placing retirement funds into a trust and negotiating changes to employees' contributions for pension and OPEB costs.

- By December 2024, Compton should resolve all of the audit findings it has received that predate its fiscal year 2020–21 audited financial statements and any findings from subsequent audit reports, including findings related to improving financial controls.

- By December 2024, Compton should develop a policy that describes how the city will determine the amount of fire department overtime it budgets each year and perform an analysis that compares the cost of this overtime to the cost of hiring additional firefighters to reduce the need for overtime.

Agency Comments

Compton did not state whether it agreed with our recommendations but indicated that the audit report can help the city identify and target corrective actions to improve the entire organization. We look forward to receiving Compton's corrective action plan by December 2022 to understand the specific actions it has undertaken, or plans to take, to address the conditions that led us to designate it as high risk.

Introduction

Background

Located south of the city of Los Angeles, Compton has a population of about 94,000. As a charter city, Compton has authority over its municipal affairs and may establish certain local ordinances over these affairs beyond those that state law allows for general law cities.Unlike general law cities, charter cities have the authority to adopt ordinances and regulations regarding municipal affairs that may be inconsistent with state law that is otherwise applicable to cities. A city council composed of five elected officials governs Compton. This city council appoints a city manager to serve as the chief executive officer, provide administrative leadership, and keep the council advised of Compton's financial condition. The services Compton provides for its community include public safety; public works; parks and recreation; community development, such as planning and zoning; and general administration.

Figure 1 presents Compton's general fund budgeted expenditures for fiscal year 2021–22. For that year, Compton budgeted for about 360 full-time city staff members. To obtain law enforcement services, Compton contracts with the Los Angeles County Sheriff's Department (LA County Sheriff).

Figure 1

Compton's General Fund Supports Many Key Services

Source: Compton's fiscal year 2021–22 budget.

Figure 1 description:

Figure 1 contains a pie chart demonstrating that Compton's general fund supports many key services. The graphic shows the different types of services supported by Compton's budgeted general fund expenditures for fiscal year 2021-22, totaling $70.5 million. The graphic includes $24.4 million budgeted for a law enforcement contract, representing 35 percent of the total; $14.1 million budgeted for non-departmental costs such as debt service and interest payments, representing 20 percent of the total; $11.7 million budgeted for the fire department, representing 16 percent of the total; $10.3 million budgeted for city administration, representing 14 percent of the total; $4.7 million budgeted for public works, representing 7 percent of the total; $3.3 million budgeted for community improvement, such as code enforcement and security officers, representing 5 percent of the total; $1.4 million budgeted for community development, such as land use zoning and building permits, representing 2 percent of the total; and $0.6 million budgeted for recreation services, representing 1 percent of the total.

Compton Has a Long History of Financial Challenges

Compton's Major Funds

General fund: Serves as the city's main operating fund. Includes Measure P revenues, which we describe below.

Housing capital projects fund: Accounts for housing assets and functions related to low and moderate income housing.

Retirement special revenue fund: Accounts for city contributions to its employees' retirement system.

Rubbish fund: Accounts for garbage collection services for residents and businesses.

Sewer fund: Accounts for the costs of replacing and upgrading portions of the city's sewer system and for related operational costs.

Water fund: Accounts for water services to city residents and businesses, including related functions such as billing, administration, and maintenance.

Source: Compton's fiscal year 2019-20 audited financial statements and fiscal year 2021-22 adopted budget.

Compton has faced financial challenges for many years. Although it had a positive general fund reserve balance of more than $22 million at the end of fiscal year 2006–07, overspending and questionable budgeting contributed to a deficit of more than $42 million just four years later, as Figure 2 shows. For example, Compton budgeted for a large increase in both revenues and expenditures in fiscal year 2008–09 to fund various projects and services, but the increased revenues did not materialize and the city subsequently overspent by about $13 million that year. The city's dire financial condition since fiscal year 2008–09 has had significant long-term consequences. For instance, it has borrowed millions of dollars from other funds, such as those we show in the text box, to support its general fund, and it has reduced staffing levels on multiple occasions.

Marketed Uses of Measure P Funds

- Repair local streets and sidewalks.

- Hire and retain firefighters and paramedics.

- Increase LA County Sheriff staffing to improve response times.

- Expand gang and drug prevention, economic development, and youth job training programs.

- Improve parks.

- Provide other general fund services.

Source: Los Angeles County's official sample ballot for the June 2016 primary election.

In recent years, Compton has received significant additional revenue through two major sources. In 2016 Compton's voters approved a 1 percent sales and use tax increase—known as Measure P—to increase general fund revenue for the marketed purposes listed in the text box. Measure P revenues have averaged more than $12 million annually and were nearly $15 million in fiscal year 2020–21. In addition, the federal government allocated Compton more than $34 million in funding as part of the American Rescue Plan Act of 2021 (American Rescue Plan Act). The city can use these one-time funds in certain specified ways to respond to the COVID-19 public health emergency and its economic impacts, such as by providing premium pay to eligible workers or by making necessary investments in water or sewer infrastructure.

Compton's Weak Controls Have Created Fraud Risks

In the midst of its financial challenges, Compton has not consistently maintained basic financial transparency and controls. As Figure 3 shows, Compton's audited financial statements for the past decade have been several months late, incomplete, or not completed at all, which has been a major factor in our local high-risk dashboard's classification of Compton as the highest-risk city in the State since October 2019. The city's lack of timely and complete financial statements has drawn criticism from several external entities, including the U.S. Department of Housing and Urban Development, Office of Inspector General, which indicated that Compton could potentially lose federal funding if it did not establish proper financial reporting. The lack of timely and complete financial statements has also prevented the public from being able to adequately understand the city's financial condition.

Figure 2

Compton Has Faced Significant Financial Challenges for More Than a Decade

Source: Audited financial statements, and unaudited financial information from the March 2018 State Controller's Office report and from Compton's city controller.

Note: Because Compton did not have audited financial statements for certain years, we present unaudited financial information provided by Compton's city controller and totals from the March 2018 State Controller's Office report.

* We present Compton's total general fund balance, rather than its unrestricted general fund reserves, because its audited financial statements have shown insignificant amounts of restricted financial resources in its general fund. Further, Compton's external auditor has found that the city was not reviewing fund balance classifications and that these classifications—such as whether certain amounts are restricted—could be materially misstated.

Figure 2 description:

Figure 2 contains a line graph depicting Compton's general fund balance, which illustrates that the city has faced significant financial challenges for more than a decade. The line graph covers fiscal years 2006-07 through 2020-21 on the x-axis, and a balance of negative $50 million up to positive $30 million on the y-axis. The values of the city's general fund reserve balance along the plotted line are as follows:

- FY 2006-07: positive $22.4 million

- FY 2007-08: positive $11.8 million

- FY 2008-09: negative $2.6 million

- FY 2009-10: negative $14.6 million

- FY 2010-11: negative $42.7 million

- FY 2011-12: negative $37.9 million

- FY 2012-13: negative $36.4 million

- FY 2013-14: negative $36.5 million

- FY 2014-15: negative $31.2 million

- FY 2015-16: negative $27.9 million

- FY 2016-17: negative $22.9 million

- FY 2017-18: negative $22.6 million

- FY 2018-19: negative $21.1 million

- FY 2019-20: negative $16.5 million

- FY 2020-21: negative $3.2 million

A text box on the graphic points to the decline between fiscal years 2007-08 and 2008-09 and states, "Compton overspent by about $13 million in fiscal year 2008-09, when it budgeted for a large increase in both revenues and expenditures, yet the increased revenues did not materialize." The figure also indicates that the values for fiscal years 2013-14 through 2016-17 and fiscal year 2020-21 were based on unaudited financial information.

Additionally, several past audits have identified significant concerns with the city's controls over its finances and operations. In 2018 a State Controller's Office review found Compton's administrative and accounting control deficiencies to be serious and pervasive, noting that controls were virtually nonexistent. In fact, the city's lack of financial safeguards allowed a former deputy treasurer to embezzle $3.7 million from 2010 through 2016 by stealing cash payments made to the city that should have been deposited in the bank. Compton's previous external auditor withdrew its independent auditor's report on the city's fiscal year 2013–14 audited financial statements after learning about the embezzlement, contributing to the financial reporting issues we detail in Figure 3. Through fiscal year 2019–20, the city's current external auditor identified more than 200 issues still outstanding from prior audits.

These numerous audit findings from past reviews of Compton have generally indicated that the city's struggles to hire and retain qualified staff have been at the heart of its challenges. We discuss this issue in more detail in later sections.

Figure 3

Compton Has Not Produced Timely and Complete Audited Financial Statements for Many Years

Source: Analysis of audited financial statements from external auditors, March 2018 State Controller's Office report, interviews with Compton's city controller, and criteria and best practices related to timeliness of financial reporting.

* Best practices suggest that cities should issue their audited financial statements within six months after the end of the fiscal year, so we have applied that standard here.

† Because of the effects of the pandemic, the federal government generally granted six-month extensions for certain fiscal years for entities' audits related to federal awards. We used the same extensions as our criterion for fiscal years 2019–20 and 2020–21.

Figure 3 description:

Figure 3 is a table describing Compton's audited financial statements with columns for fiscal year, content, and timeliness. For fiscal years 2007-08 through 2009-10, the content of the statements contained clean opinions and was generally complete; the statements were 3 months late, 4 months late, and 3 months late, respectively; and all three years are shaded with a light yellow color. There are no audited financial statements for fiscal year 2010-11, which is shaded with a dark red color. For fiscal years 2011-12 and 2012-13, the content of the statements lacked required financial analyses from city management, and the statements were 18 months late and 19 months late, respectively; these two years are shaded with a dark yellow color. There are no audited financial statements for fiscal years 2013-14 through 2016-17, all of which are shaded with a dark red color. For fiscal year 2017-18, the content of the statements was missing basic items and contained four areas that were found unreliable, and the statements were 11 months late; this year is shaded with a light red color. The fiscal year 2018-19 statements had four unreliable areas, lacked required financial analyses from city management, and were 10 months late; this year is shaded with a slightly lighter red color than the previous year's shading. The fiscal year 2019-20 statements contained two unreliable areas, lacked required financial analyses from city management, and were eight months late; this year is shaded with a slightly lighter red color than fiscal year 2018-19's shading. Finally, the statements for fiscal year 2020-21 were not yet issued as of September 2022; this year is shaded with a yellow color.

The graphic also contains three text descriptions referring to portions of the table. The first refers to fiscal years 2010-11 through 2016-17 and states, "A former Compton deputy treasurer embezzled $3.7 million from 2010 through 2016, causing the city's previous external auditor to withdraw its report for the city's fiscal year 2013 -14 audited financial statements." The second description refers to fiscal year 2017-18 and states, "In its March 2018 report, the State Controller's Office found Compton's administrative and accounting controls were virtually nonexistent." The third description refers to fiscal year 2019-20 and states, "Since October 2019, our office has ranked Compton as the most fiscally at-risk city in California, largely because of issues with its audited financial statements."

Compton's Deteriorating Infrastructure Presents Significant Health and Safety Risks

Compton Has Not Developed an Updated Plan for Prioritizing Its Capital Improvements

Providing basic infrastructure—such as safe streets, an adequate water supply, and a secure sewage system—is among Compton's chief responsibilities as a city. However, Compton's leadership has not properly planned, funded, and carried out critical repairs and upgrades to its infrastructure, as Figure 4 shows. In part because Compton has left many of its infrastructure needs unaddressed, city documents indicate that repairs to its streets, water systems, and sewer systems will likely end up costing the city well over $100 million.

Figure 4

Compton's Infrastructure Is in Disrepair

Source: March 2021 report updating Compton's pavement report, the city's 2008 and 2022 master water studies, and documents related to its sewer system.

Figure 4 description:

Figure 4 contains three illustrations demonstrating that Compton's streets and its water and sewer infrastructure are in disrepair. The first image depicts a street in need of repair under a headline that states, "A recent report found half of the city's streets were in poor or very poor condition." An arrow points from the image to text below that states, "Compton has received hundreds of legal claims related to its streets. The condition of these streets can cause pedestrian injuries and vehicle damage." The second image contains a faucet and a broken pipe under the headline, "Its water infrastructure is overdue for replacement." Below the image, an arrow points to text that reads, "Infrastructure at water well sites has been decaying, and the city needs to make significant changes - such as improving pipelines and constructing a new well - to ensure a quality water supply." The third image contains pipes and a red "x" indicating need for replacement, under a headline that reads, "Its sewer system requires repairs and upgrades." An arrow points from the image toward text below that states, "Numerous sewage overflows have posed public health and environmental risks and prompted legal action from the Los Angeles Regional Water Quality Control Board."

One reason for the disrepair of Compton's infrastructure is that it has not developed an effective plan for prioritizing and funding key projects. This type of plan is often referred to as a capital improvement plan. According to the Government Finance Officers Association (GFOA), capital planning is critical to water, sewer, transportation, and other public services—and a properly prepared plan is essential for the continued delivery of services to the community. Compton developed a basic, three-year capital improvement plan in May 2014 that included costs and funding sources for specific projects to improve its streets, bridges, traffic signals, and water and sewer piping. The city indicated in that plan that it would revise the plan every year to reevaluate priorities and reflect current needs and concerns. However, Compton has not updated the plan since it created the plan eight years ago.

A project manager in Compton's public works department—the only listed contributor to the May 2014 plan who is still with the city—confirmed that this plan is the most current available. He also stated that the public works department submits a list of projects for inclusion in the budget each year. However, these types of lists are not an adequate substitute for a comprehensive, multiyear plan that identifies and prioritizes funding sources for infrastructure needs across different departments. For example, as Compton's own 2014 plan states, a multiyear capital improvement plan creates a basis from which the city council can make financial decisions, encourages a broad overview of needs and avoids a piecemeal approach to improving infrastructure, and informs the public about the constraints and limitations of these improvements. Absent such an updated plan and adequate funding, Compton has been unable to effectively prioritize and address its backlog of projects and make critical improvements to its streets and its water and sewer infrastructure, as the following sections show. As a result, the city has subjected the public to unnecessary health and safety risks.

Half of Compton's Streets Are in Poor Condition

Perhaps the most visible of Compton's infrastructure issues is its deteriorating streets, which have led to unsafe conditions for motorists and pedestrians. In a 2021 update to the city's Pavement Management Program (pavement report), a consultant found that 50 percent of Compton's streets were in poor or very poor condition. These designations signify that the streets require major maintenance, such as reconstruction that involves removing the existing pavement and replacing it entirely. Only 30 percent of Compton's streets are in good or very good condition.

One obstacle to making necessary repairs has been identifying sufficient funding. The consultant estimated that simply maintaining Compton's streets in their current poor condition would require about $2.6 million per year. It estimated that to raise the overall condition of the streets to fair—which would then require only surface treatments and seals to maintain—would cost roughly $50 million over five years. A project manager in the public works department also provided its informal internal list of additional potential street improvement projects for pedestrian and bicycle accommodations, such as curb ramps, signage, and bike paths. The city entered into a $37 million bond agreement in 2021—at the expense of added debt and more than $28 million in interest the city will owe—to address some of its needed street repairs. Further, Compton could pay for additional projects using unspent Measure P funds, as we discuss later. However, even with this available funding, the magnitude of Compton's needed street repairs presents a significant ongoing financial challenge.

The more fundamental reason that the city is behind in repairing damaged streets, however, is that city management has not adequately planned for needed projects. Although public works personnel indicated that they use the recommendations in the pavement report to inform the city's annual priorities for street repairs, the city has not incorporated the pavement report's suggestions into a broader, multiyear plan—such as the missing citywide capital improvement plan we discuss earlier—to ensure that it completes all necessary projects. As a result, many streets remain unrepaired. For example, the city's internal documents show that it completed design or started construction on only six of the more than 50 streets that the pavement report suggested should be prioritized for major or minor street repairs in fiscal year 2021–22. Although Compton completed design or started construction on other roads, we question why it would not focus its efforts on the streets that the pavement report prioritized for repair in fiscal year 2021–22. The absence of a capital improvement plan also means it is unclear whether Compton lacked sufficient funding for the additional projects or whether other barriers, such as insufficient staffing, prevented their completion.

A staffing shortage in the public works department has also hampered its efforts to plan for street projects. For instance, one project manager stated that he has been mostly responsible for coordinating the functions of the public works department's engineering division, which includes street repairs. The project manager has taken on this responsibility in large part because the city engineer position—which is responsible for overseeing public works and the city's broader capital improvement program—was vacant for more than two years, until August 2022. We discuss these staffing challenges in detail later in the report.

Likely because the city has not kept up with street maintenance, it faces costly lawsuits every year. The poor condition of the pavement throughout the city causes injury to pedestrians, and the potholes cause damage to vehicles as well. In fact, Compton included in its fiscal year 2019–20 budget about $1 million to pay for legal claims related to potholes. More than a dozen additional cases are scheduled for litigation in 2023. To protect the health and safety of pedestrians and motorists, Compton needs to prioritize and complete critical street repairs.

Compton's Aging Water Infrastructure Threatens the Reliability of Its Water Supply

Like its streets, the city's water wells and other water infrastructure have been decaying and are in need of significant upgrades to ensure a sufficient supply of quality water. Two of the city's eight wells are not currently in use. One has been inactive for 10 years and needs infrastructure upgrades after failing to meet drinking water standards, and the other was removed from service by at least 2021 because of issues with sand entering the water supply. According to a recent study that we discuss in more detail later, Compton's priority is getting these two wells operating again. The study also recommends constructing a new well because many of the city's existing wells are declining in production and are approaching the end of their useful lives. For example, the plan indicates that three of the city's six active wells were drilled in the 1940s or 1950s and require significant infrastructure improvements such as new tanks.

A presentation by the former water department general manager to the city council in May 2022 highlighted the disrepair of infrastructure at Compton's water well sites. The presentation included photos of corroded pipes and valves; an aging water pump that is able to pump at only half its capacity; and facilities at the well sites with corroded doors, outdated electrical wiring, and improper ventilation systems. According to the presentation, the potential impacts of aging infrastructure include water quality issues, service interruptions, and an inability to provide needed water to properly fight larger fires.

In fact, failure to repair water well infrastructure may have already hindered the city's firefighting efforts in at least one instance. One of the city's water wells that has been out of service is located near the site of a February 2021 fire that reportedly burned school buses and caused evacuations from an apartment building. The fire department's incident report mentions issues with water supply and water pressure. The former water department general manager confirmed to us—and explained to the city council during his May 2022 presentation—that the water pressure was low because Compton had not repaired the well in question. He also stated that had the city repaired this well, the fire department might have been able to more easily extinguish the fire. His presentation noted that Compton had scheduled the well to be repaired in 2019 but that the city did not move forward with those repairs.

Similar to its issues with street repairs, one significant cause of Compton's decaying water infrastructure has been that city management has not evaluated its needs and planned accordingly. According to the GFOA, in order to provide a framework for the projects to include in the capital improvement plan we mention earlier, local governments generally develop long-range strategies—including for infrastructure development—that are often called master plans or master studies. The GFOA states that regular updates to these master studies are imperative to ascertain infrastructure needs as local conditions change. However, Compton completed its previous master water study in 2008—nearly 15 years ago. It did not complete an updated master water study until June 2022 and, as a result, the city has only recently begun to address many of its long‑standing water infrastructure needs.

Compton's 2008 study identified more than $100 million in needed pipeline replacements to alleviate problems with water quality and other issues as well as costs for additional infrastructure upgrades. According to Compton's audited financial statements, it issued $44 million in bonds in 2009 to finance part of the cost of overhauling the city's water system. Compton spent these bond funds to begin or complete several projects, such as pipeline replacements, although the former water department general manager could not locate sufficient documentation to describe these projects or their costs in detail, attributing the lack of documentation partially to frequent turnover in management. In part because it has fallen behind on completing other necessary projects, Compton's current water infrastructure needs will require significant ongoing investments. Its updated water study identifies more than $53 million in needed facility and pipeline improvement projects. The city council in May 2022 approved nearly $8 million in federal American Rescue Plan Act funding to be used for improving water infrastructure—such as infrastructure at well sites—but this funding will address only a small portion of Compton's needs. When it develops an updated capital improvement plan, the city will need to include and prioritize the projects from its new master water study and identify funding sources, such as the water fund balance we describe later.

Despite Numerous Sewage Overflows, the City Has Not Completed Needed Sewer Infrastructure Projects

Another critical area of infrastructure that the city has not adequately addressed is its aging sewer system. Over the past 15 years, Compton has reported to the State Water Resources Control Board more than 40 incidents in which the city's sewage has spilled or overflowed, posing risks to public health and the environment. State and federal agencies refer to overflows or spills of untreated or partially treated sewage as sanitary sewer overflows (sewage overflows). According to the U.S. Environmental Protection Agency, sewage overflows can pose health risks by causing diseases and can also damage property and the environment, such as by polluting bodies of water. For example, a sewage overflow in Compton reportedly discharged about 12,000 gallons of sewage into the Los Angeles River in January 2022, causing the city of Long Beach to temporarily close some of its beaches.

Because of its sewage overflows, Compton faced legal action in 2016 and agreed to undertake key infrastructure projects. The Los Angeles Regional Water Quality Control Board (regional water board) alleged that Compton failed to comply with statewide waste discharge requirements when it experienced eight sewage overflows from 2010 through 2013 that released untreated sewage into Compton Creek. Compton entered into a consent judgment with the regional water board in September 2016. As part of that settlement, Compton agreed to pay an initial civil penalty of about $161,000, along with additional penalties if it failed to make various improvements to its sewer system and oversight, such as performing ongoing inspections and maintenance. Most notably and among other projects and deadlines, Compton agreed to complete five capital improvement projects to restore or replace portions of its sewer pipelines by January 2020.

However, Compton has still not completed three of the five required infrastructure projects, increasing its risk of future sewage overflows and additional penalties. According to a project manager in the public works department—who previously served as interim director of public works—Compton had not started construction on any of the three projects as of June 2022. In fact, these projects have remained unfinished for more than a decade as Compton had begun initial planning for each of the three projects by 2012. Based on the cost estimates it performed at that time, the three overdue projects are likely to cost Compton at least $12 million to complete, which could present a challenge, given that the city's sewer fund had less than $3 million set aside for capital projects as of June 2020. In the meantime, Compton risks the possibility of additional sewage overflows, and it may also be required to pay penalties for failing to complete the projects on time.

Similar to Compton's issues with water infrastructure, its inability to complete needed sewer repairs appears to be the result of the city not adequately planning and budgeting for these projects. Compton has not updated its master sewer study—a document intended to comprehensively assess the existing condition and future needs of its sewer system, including related projects—since 2008. According to the public works department project manager, staffing shortages and limited funding are the two main reasons why the city has not updated key planning documents or completed needed projects. We discuss the city's challenges with both funding and staffing later in this report.

Please refer to the Recommendations section to find the recommendations that we have made to address these areas of risk to the city.

Financial Mismanagement Has Hampered Compton's Ability to Address Its Infrastructure Needs

Rather Than Address Its Financial Instability, Compton Has Used Funds Dedicated for Specific Purposes to Support Its General Fund

Because of Compton's financial instability, the city historically has had to rely on its other funds to support its general fund, which pays for core administrative and operational activities. However, this prolonged reliance has reduced the resources available in those other funds for critical infrastructure projects. Figure 5 highlights two main concerns we have about this practice. First, by June 2012, Compton had borrowed nearly $42 million from several other funds to compensate for cash shortfalls in its general fund. Compton took steps to repay these funds, but the general fund still had not repaid nearly $29 million as of June 2020.Compton had not issued audited financial statements more current than its fiscal year 2019–20 statements at the time of our review. However, unaudited and preliminary accounting information that the city controller provided to us in August 2022 indicated that the general fund had not yet repaid this nearly $29 million in the two years since then. Consequently, funds that are restricted in their uses, such as the water and sewer funds—which collectively lent more than $21 million to the general fund that it still owed as of June 2020—have had fewer resources available for needed infrastructure projects for at least a decade. This borrowing on behalf of the general fund has also put Compton in legal peril. For example, by continuing to owe millions of dollars to the water and sewer funds, the city risks violating legal requirements that generally prohibit such borrowing if it interferes with the purposes for which the restricted fund was created.

Although the city council in 2014 approved a 15-year repayment agreement for the $42 million in general fund borrowing, the city's external auditor stated in March 2022 that Compton has not continued making the required payments. Further, the amounts owed to the water and sewer funds have remained roughly the same since June 2012. The external auditor indicated that the general fund had insufficient cash available to comply with the repayment agreement, and it recommended that Compton develop a more realistic plan to repay the borrowed funds. In the city's response to that audit, it acknowledged needing to repay these funds—a position that the city controller reiterated to us. However, the city has also indicated that it is researching past general fund activity and performing other work that could change the amounts it needs to repay. Compton should complete this work, approve an updated repayment plan, and begin making payments as soon as possible.Figure 5

Compton's General Fund Has Relied on Borrowing and Questionable Transfers, Reducing the Resources Available for Infrastructure Projects

Source: Compton's budgets and audited financial statements.

Figure 5 description:

Figure 5 illustrates two ways in which Compton's general fund has relied on money from other funds. The top portion of the figure contains text that reads, "As of June 2020, Compton's general fund still owed nearly $29 million it had borrowed from other funds, and the city has not followed through on its agreement to repay these other funds." Below that text, the figure shows that $13.6 million from the water fund, $7.8 million from the sewer fund, and $7.2 million from other funds constitute this nearly $29 million in borrowed money. The figure includes bags of money beneath each of these three totals, and beneath the water and sewer fund totals there are images of water pipes and sewer pipes, respectively, that are in need of replacement. The bottom portion of the figure contains text that states, "Compton has also made annual transfers of at least $4.6 million from the water fund to the general fund without adequate justification." Below this text, the figure contains an image of a bag of money changing hands along with an arrow moving $4.6 million from the water fund to the general fund. At the very bottom of the figure, a caption reads, "These borrowings and transfers have limited the resources available for critical infrastructure projects."

In addition to the excessive borrowing, Compton has made annual transfers of at least $4.6 million from the water fund to the general fund without adequate justification that those amounts were appropriate. The purpose of the transfers appears to have been to reimburse the general fund for the water department's share of citywide administrative services, such as activities performed by the city manager's office and other central service departments. However, Compton has not updated its cost allocation plan—a study performed by governments to determine and justify each program's or fund's share of these centralized overhead costs—since 2013. That 2013 plan suggested that the water department's share of overhead costs was roughly similar to the amounts it has been transferring recently. Nevertheless, the GFOA has indicated that cost allocations should only be used for up to three years; thus, Compton's 2013 plan relies on information that is now significantly outdated, such as the water department's total budgeted expenditures from fiscal year 2011–12. In recent years, the water department's budget has decreased. Further, the city's budgets indicate that, since at least fiscal year 2017–18, other restricted funds similar to the water fund have not made the same size and types of transfers to the general fund. These factors raise questions about whether the water fund's transfer amounts are too high or are unjustified.

These annual transfers have indeed been sizable. In fiscal year 2021–22, for instance, the transfer of at least $4.6 million to the general fund represented about 20 percent of the water department's total budgeted expenditures. According to the former water department general manager, the transfers have reduced the department's ability to fund essential projects and services such as upgrading water wells. The city controller indicated that she was not aware of a detailed justification supporting the transfer amounts and stated that she previously raised the issue with city leadership and has been working on a new cost allocation plan that will resolve whether the transfer amounts are appropriate. In the meantime, Compton continues to make these transfers without adequate justification, raising concerns that it may be violating requirements in the state constitution that prohibit local governments from imposing property-related fees or charges and then using those funds for unrelated purposes or general government services.

The City Lacks an Adequate Plan for Addressing Its Financial Challenges

Because of these problematic practices and other issues, Compton will likely continue to face significant challenges in maintaining a positive balance in its general fund. Information from recent years—though complicated by a lack of timely, complete, and reliable audited financial statements—indicates that Compton's general fund revenues have exceeded its expenditures since at least fiscal year 2015–16. Unaudited and preliminary accounting information that the city controller provided to us in August 2022 also indicates that Compton's general fund balance may have improved to a deficit of about $3.2 million as of the end of fiscal year 2020–21. However, these promising trends are hampered by the fact that Compton has numerous staffing vacancies to fill and salaries it will likely need to increase, as we discuss later, as well as infrastructure projects it will need to pay for—which could further strain the financial resources of its general fund and other funds. In other words, although it appears that Compton could be on the verge of finally eliminating its general fund deficit, the city will still likely need to use millions of dollars in additional revenue to address staff vacancies and salary issues, meet its infrastructure needs, and repay borrowed money.

Compton will therefore need a sound plan for increasing revenues and achieving fiscal sustainability in the short and long term. Although the city council approved a resolution with 16 fiscal sustainability elements in March 2022, these elements are general in nature, and the resolution indicates that the elements were intended to serve as a basic framework to be followed by a more detailed fiscal sustainability plan that will be presented by June 2023. The city controller provided us with an informal list of several potential measures to promote fiscal sustainability that are more specific. Examples of these measures include bolstering public safety services to increase property values and encouraging individuals to spend money at city businesses. However, the list neither indicates the estimated fiscal impact of these potential measures nor provides detailed steps for implementing them. Formalizing and approving a long-term plan with specific, measurable actions for increasing revenues, decreasing expenditures, and eliminating fund deficits is a critical step Compton must take to achieve fiscal sustainability.

One example of a type of expenditure that the city should address are obligatory costs related to pensions and other postemployment benefits (OPEB), which is the cost for retiree health care benefits. Costs related to pensions and OPEB could place a significant financial burden on the city if it does not take action to reduce its liabilities, such as setting aside funds to cover future costs. For example, because Compton has used the pay-as-you-go method for OPEB—covering only the annual cost of the benefits for current retirees rather than proactively prefunding future costs—its liabilities are likely to continue to increase and could eventually require the city to make sizable payments that reduce its ability to fund other services such as street repairs or public safety.

The city controller stated that her primary recommendation for addressing pension and OPEB liabilities is for the city to place at least a portion of the revenues it collects to fund retirement costs into a trust to earn more interest and therefore decrease long‑term liabilities. The controller has also discussed other ideas for reducing costs with city leadership, such as negotiating changes to the city's pension and OPEB offerings for its employees. Similarly, we noted that Compton has chosen to pay both its share and employees' share of pension costs for employees hired before 2013—which has cost the city at least $1 million per year according to its recent audited financial statements—and it has not required any employees to make contributions toward the city's OPEB costs. As part of its long-term financial planning, Compton should formalize and execute a plan for reducing pension and OPEB liabilities and should consider negotiating with relevant labor unions about instituting employee contributions for those employees who are not currently contributing to their retirement plans.

The City's Problematic Budgeting Practices Have Prevented Transparency and Left Funds Unspent

The city's inadequate budgeting practices have allowed millions of dollars to sit idle while Compton's infrastructure deteriorates. The GFOA recommends that cities include their beginning fund balances when creating their annual budgets and evaluating their revenue and expenditure options. However, Compton has neglected to include all existing balances for certain funds when budgeting expenditures—instead, primarily budgeting to spend only as much as it expects to collect in revenue for that particular fiscal year. It did not use these available funds partly because it lacks a formal policy requiring it to include all available fund balances for consideration as part of its budgeting process. As a result, its water and Measure P funds have accumulated fund balances totaling about $41 million that the city has not spent, as Figure 6 shows. Although the water fund should maintain a certain level of reserves to cover operations in the event of an emergency, Compton could have used the remaining water fund balance as well as the Measure P balance for needed water and street infrastructure projects, respectively. Moreover, the city has not been transparent with the public about these high balances in the Measure P and water funds. The city did not report the full amount of the balances in these funds in the budget documents published on the city's website from at least fiscal years 2017–18 to 2021–22, preventing taxpayers from understanding the amount of financial resources the funds have available for the city to use.

Figure 6

Two of the City's Funds Continue to Accumulate Millions in Unspent Revenue

Source: Compton's unaudited financial information.

Figure 6 description:

Figure 6 is a stacked bar chart showing unspent water fund and Measure P fund revenues. The x-axis ranges from fiscal years 2017-18 through 2021-22, and the y-axis ranges from $0 to $50 million. The Measure P unspent revenues are shaded blue and represent the bottom portion of each bar, and the water fund unspent revenues are shaded orange and represent the top portion of each bar. The values of the five bars are:

- Fiscal Year 2017-18: $11.2 million for Measure P; $10.7 million for water fund; $21.9 million total

- Fiscal Year 2018-19: $14.0 million for Measure P; $11.3 million for water fund; $25.3 million total

- Fiscal Year 2019-20: $15.3 million for Measure P; $14.0 million for water fund; $29.3 million total

- Fiscal Year 2020-21: $19.7 million for Measure P; $17.1 million for water fund; $36.8 million total

- Fiscal Year 2021-22: $23.5 million for Measure P; $17.4 million for water fund; $41.0 million total

The figure contains a green arrow above the bars that slopes upward and indicates that the unspent revenues steadily increased from fiscal year 2017-18 through 2021-22. Above the final year in the figure - fiscal year 2021-22 - a caption that is shaded yellow reads, "$41 million in unspent revenue as of June 2022."

In addition, municipal law requires the city council to establish a citizen oversight committee to oversee the expenditure of Measure P revenues. However, the city has not consistently used this committee for its intended purpose. Specifically, as of August 2022, the five-member committee was lacking a member and has not convened since 2020, despite the requirement that it meet at least once a year. An active committee could have helped city management identify the more than $23 million in unspent Measure P revenues that the city's unaudited accounting records reported at the end of fiscal year 2021–22. It also might have raised questions about the use of some of these revenues to help pay for litigation. For instance, Compton included in its fiscal year 2019–20 budget about $1 million of Measure P revenues to pay for legal claims related to potholes. In its fiscal year 2022–23 budget, Compton included an additional $5.8 million in Measure P revenues to contribute to the city's liability fund. Measure P revenues were intended in part to repair the city's roads, as we describe in the Introduction. However, while not unlawful, the city is currently using a portion of these revenues to pay for litigation, which is partly driven by claims for damages resulting from the city's poor road conditions.

Another reason for Compton's unspent revenues is that the city has not adequately monitored budget-to-actual spending. The GFOA recommends that a government evaluate its financial performance relative to the adopted budget, including comparing budget-to-actual revenues, expenditures, and fund balances. Such monitoring can alert decision makers far enough in advance for them to take action if there are major deviations from the budget. However, Compton has not proactively identified instances where it spends less than expected and responded accordingly. For example, in fiscal year 2020–21, the city's accounting records showed that Measure P revenues were $1.4 million higher than projected, yet the city spent $5.3 million less than it budgeted to spend for Measure P, failing to use available revenues for additional projects, such as street repairs.

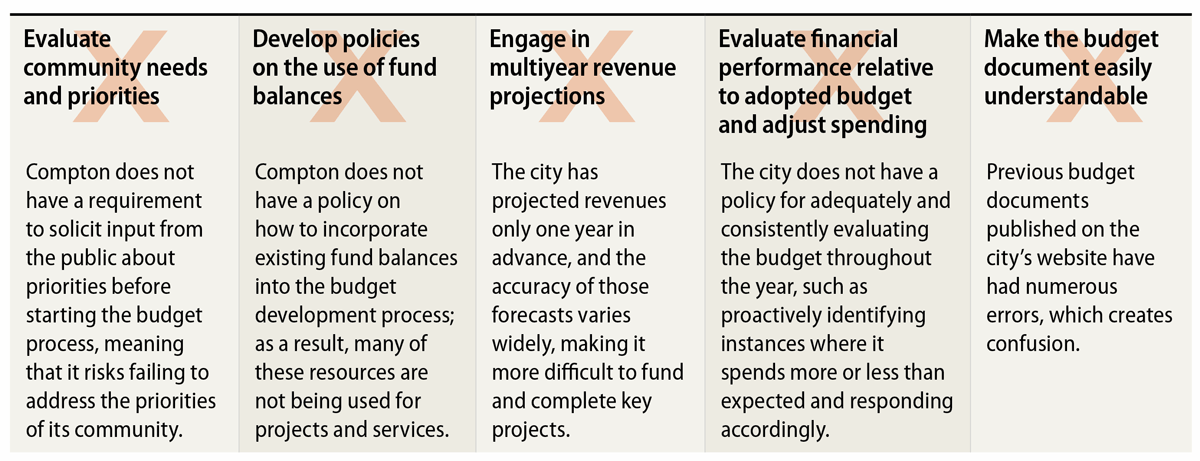

Compton has not followed other budgeting best practices as well, which has hampered its ability to effectively manage its resources. Figure 7 presents key budgeting best practices from the GFOA that the city has not implemented. One significant best practice is to employ multiyear revenue projections to take into account nonrecurring revenues and to evaluate how revenues may change over time. The city, however, has not employed such a practice and instead relies only on the use of a one-year projection, the accuracy of which varies from year to year. In fiscal year 2019–20, general fund revenues were only about $2.4 million below projections, while in fiscal year 2020–21, they were about $8.5 million above the projections, according to the city's accounting records. Significantly inaccurate projections like the latter can leave money unspent that could have been used for needed projects. The city has recently made some effort to follow that best practice by drafting a budget policy that requires five-year forecasting.

Figure 7

Compton Does Not Follow Many Budgeting Best Practices, Leading to Errors and a Lack of Transparency

Source: GFOA best practices and analysis of Compton's budgeting policies.

Figure 7 description:

Figure 7 lists five budgeting best practices, each of which contains a red "x" indicating that Compton has not followed the best practice. The first best practice reads, "Evaluate community needs and priorities." Below that, additional text states, "Compton does not have a requirement to solicit input from the public about priorities before starting the budget process, meaning that it risks failing to address the priorities of its community." The second best practice states, "Develop policies on the use of fund balances," and below that the additional text states, "Compton does not have a policy on how to incorporate existing fund balances into the budget development process; as a result, many of these resources are not being used for projects and services." The third best practice reads, "Engage in multiyear revenue projections," and below that the figure states, "The city has projected revenues only one year in advance, and the accuracy of those forecasts varies widely, making it more difficult to fund and complete key projects." The fourth best practice reads, "Evaluate financial performance relative to adopted budget and adjust spending," and the text below states, "The city does not have a policy for adequately and consistently evaluating the budget throughout the year, such as proactively identifying instances where it spends more or less than expected and responding accordingly." Finally, the fifth best practice reads, "Make the budget document easily understandable," and the text below states, "The previous budget documents published on the city's website have had numerous errors, which creates confusion."

One example of the city's poor budgeting has been its inability to accurately project and monitor overtime spending for its fire department. Compton has consistently spent more than it budgeted each year on these overtime costs. From fiscal year 2017–18 through March 2022, the city budgeted a total of $10.8 million for this overtime, yet it spent $16.3 million. This overspending suggests that the city needs to evaluate how much overtime is appropriate and whether the city needs to hire additional firefighters. The fire department chief indicated that overtime is necessary for the department to carry out its duties. However, the chief indicated that the city does not have a policy that describes how it determines the amount of fire department overtime it budgets each year, but he indicated that the department looks at prior year and upcoming expenditures to make a budget recommendation to city management. However, the fire department could not provide any analyses comparing the cost of this overtime to the cost of hiring additional firefighters to reduce the need for overtime. The absence of these practices raises questions about the appropriateness of the overtime costs.

Many of the problems with Compton's budget development process are likely the result of its lack of a formal budget policy that staff follow. Although an undated policy exists, key staff—such as the temporary budget officer—told us that they were not aware of it. Without using an official citywide budget policy, errors and misunderstandings are likely to occur. The city controller provided a new draft budget policy, which, when approved by the city council and implemented by city staff, will address some of our concerns. When we reviewed the draft policy, however, we found that it did not address some of the city's other shortcomings. For example, the draft policy does not have a requirement to solicit input from the public about priorities before starting the budget process. Before adopting this draft policy, Compton should ensure that it aligns with GFOA best practices.

Compton has also not consistently ensured that its budgets are easily understandable. Compton's budget document for fiscal year 2021–22 contains many errors, making some parts of the budget difficult to understand and creating confusion. In fact, the city council adopted a resolution in June 2022 acknowledging several errors in this budget and approving corrections to them. For example, some of the budgeted amounts listed in the summary of revenues and expenditures are different from the amounts listed in the detailed budgets for certain departments. The budget amount for the community development department in the citywide summary and the budget amount in the departmental section differ by about $10 million. We discovered similar inconsistencies in the city's past budget documents. Before finalizing and adopting its annual budget, the city should ensure that its budget documents contain no errors and are comprehensible in order to increase transparency to the public.

By Not Updating Charges for City Services, Compton Has Forgone Potential Revenue

In addition to collecting tax revenue, Compton charges the public for specific city services, such as conducting inspections of buildings. However, Compton has not assessed its service charges regularly, thereby potentially forgoing revenue to cover its costs. GFOA best practices suggest that cities should review and update charges for services periodically to ensure that those charges cover the costs of providing the services. Nevertheless, Compton most recently updated the charges for certain city services, such as building permits and business licenses, in October 2017.

Moreover, Compton has not updated water and sewer utility charges for many years, even though its infrastructure is deteriorating in these areas. According to its website, the city has not increased its water usage charges since 2014. Further, the city was unable to provide us with documentation showing when it last updated its sewer assessment charges. However, a longtime staff member in the engineering division of the public works department stated that he is not aware of any increases in sewer charges since at least 2009.

Compton had also not regularly assessed its garbage service charges, which contributed to a recent dispute with its garbage vendor. According to the city's July 2019 vendor agreement, the vendor asserted that Compton owed it $1.6 million because the city had undercharged customers and did not compensate the vendor for missing payments from customers with delinquent accounts, among other problems. To settle this dispute, the city subsequently revised its agreement with the garbage vendor and agreed to make installment payments totaling $1.6 million over the next three years. To make the final payment of $1.2 million in 2022, the city had to borrow that amount from its equipment rental fund. However, when we requested information about the agreement between the city and the vendor, city staff were unable to provide a detailed breakdown of how the settlement amount was determined. This lack of documentation raises questions about the accuracy and appropriateness of the amount it paid the vendor in an effort to resolve this dispute.

Because it has not regularly updated service charges to ensure that it accounts for current costs, Compton may be undercharging for its services and thus may not be obtaining revenue that could help alleviate the general fund's deficit or complete needed infrastructure projects. Compton lacks a comprehensive study of its current charges to demonstrate that they are high enough to recover the costs of providing the associated services. Without such a study, we used the corresponding inflation rates for the years we reviewed to conservatively illustrate potential increases in charges for providing services. Using the city's accounting records, we estimated that if the city had updated some of its high-revenue charges for services such as business licenses and construction permits to keep pace with inflation, it might have collected more than $900,000 in additional revenues from fiscal year 2017–18 through December 2021 for the general fund. Similarly, over the same period it might have been able to collect at least an additional $1 million for its water fund that it could have used for needed infrastructure repairs. The city controller indicated that she was unaware of a process for routinely studying and updating rates and fees, although the city has developed a draft policy to do so. Regularly assessing its rates and fees could provide the city with the information it needs regarding charges for services and could help ensure its full recovery of costs.

Compton's Inadequate Purchasing Safeguards Increase the Risk of Fraud, Waste, and Abuse

Compton's weak controls over purchasing and contracting increase the risk that it is spending inappropriately or misusing city funds. One important control is having a centralized system for overseeing purchasing and contracting. Both the city charter and the city's standard operating manual (operating manual), which contains policies for city operations, require the city to have a centralized purchasing system that could ensure the enforcement of procurement rules. Further, the operating manual references the role of a procurement officer, whose responsibilities include purchasing and contracting for supplies and services that the city needs and procuring them at the highest quality and at the least cost. The centralized purchasing system, in conjunction with the procurement officer, is intended to operate as a central hub for obtaining and tracking procurements.

These controls are lacking in actual practice as Compton does not have a central purchasing system. According to the city controller, the controller's office acts as the centralized purchasing office. However, we found that the controller's office did not maintain basic contract-related documentation, which is an essential element of centralized purchasing. Specifically, for six of the 10 expenditures we reviewed from fiscal years 2019–20 through 2020–21, the controller's office could not provide supporting documentation demonstrating that the corresponding contracts were competitively bid. The deputy controller informed us that the supporting documents for procurement are kept by each individual department. By not having these records to demonstrate that the city followed purchasing policies, the controller's office is not acting in a manner expected of a centralized purchasing office. In addition, the controller's office could not provide supporting documentation, such as signed purchase orders, for four of these expenditures, totaling $130,000. Without these records, it was unable to demonstrate that these transactions were authorized appropriately.